MoneyGram 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

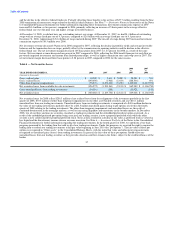

While the money remittance industry has generally been resilient during times of economic softness, the current global economic

deterioration has begun to adversely impact the demand for money remittances. The World Bank, a key source of industry analysis for

developing countries, projects a decline of approximately one percent to six percent in the face value of remittances in 2009. This is

consistent with our expectation that money transfer volumes in 2009 will be lower than those experienced in 2008. While we are unable

to predict when the global economy and the remittance industry will begin to improve, the World Bank is projecting remittance growth in

2010 of approximately one percent to six percent.

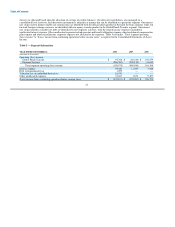

For our U.S.-based retail money order business, we expect the decline in overall paper-based transactions to continue in 2009. The

Company has $5.7 million of goodwill allocated to its retail money order business. In completing our assessment of goodwill during the

fourth quarter of 2008, we concluded that this goodwill is not impaired based on our estimates for 2009. If actual operating results in

2009 are worse than these estimates, we may need to recognize an impairment of the goodwill assigned to this business.

In our official check business, we expect our net investment margin to decline given the current interest rate environment. As described in

"Significant Actions and Developments — Interest Rate Environment," the effective federal funds rate dropped so low in late 2008 that

commissions to most of our financial institution customers were negative at the end of the year. Accordingly, we do not expect any

further benefit to commissions expense in 2009. The interest rates earned on our cash and cash equivalents are expected to decline further

in the current rate environment, which would cause our investment margin to decline in 2009. Any increase in interest rates in 2009 will

also negatively impact our margin due to the lagging impact of rising rates on our investment portfolio.

We continue to see a trend among state, federal and international regulators toward enhanced scrutiny of anti-money laundering

compliance. In addition, the European Union has adopted the European Commissions' 2007 Payment Services Directive, which creates a

new licensing and regulatory framework for our services in the European Union. As we continue to add staff resources and enhancements

to our technology systems to address the regulatory trend and the Payment Services Directive, our operating expenses related to

regulatory compliance will likely increase.

Acquisitions and Discontinued Operations

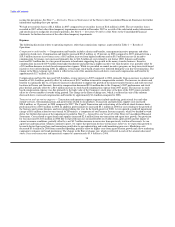

Raphael's Bank France — On February 2, 2009, MoneyGram acquired the French assets of R. Raphael's & Sons PLC ("Raphael's Bank")

for a purchase price of $3.2 million. The acquisition of Raphael's Bank provides us with five highly productive money transfer stores in

and around Paris, France that will be integrated into our French retail operations. We incurred $0.2 million of transaction costs related to

this acquisition in 2008 which are included in the "Transaction and operations" expense line in the Consolidated Income Statements.

MoneyCard World Express, S.A. and Cambios Sol S.A. — On July 10, 2008 and July 31, 2008, MoneyGram acquired two of its super-

agents in Spain, MoneyCard World Express, S.A. ("MoneyCard") and Cambios Sol S.A. ("Cambios Sol"), for purchase prices of

$3.4 million and $4.5 million, respectively, including cash acquired of $1.4 million and $4.1 million, respectively. The acquisition of

these two Spain-based money transfer entities provide us with a money transfer license in Spain, as well as the opportunity for further

network expansion and more control over marketing and promotional activities in the region. We incurred $0.5 million of transaction

costs in connection with these acquisitions.

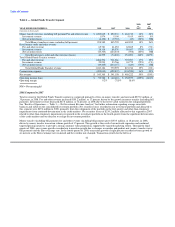

The final purchase price allocation as of December 31, 2008, includes $4.3 million of goodwill assigned to our Global Funds Transfer

segment and $1.4 million of intangible assets. The intangible assets consist primarily of agent rights, developed technology and licenses

and will be amortized over useful lives ranging from three to five years. In addition, there is an indefinite life intangible asset of

$0.6 million, which relates to a money transfer license. The operating results of MoneyCard and Cambios Sol subsequent to the

acquisition dates are included in the Company's Consolidated Statements of (Loss) Income. The financial impact of the acquisitions is not

material to the Consolidated Balance Sheets or Consolidated Statements of (Loss) Income.

PropertyBridge, Inc. — On October 1, 2007, we acquired PropertyBridge for $28.1 million. A potential earn-out payment of up to

$10.0 million contingent on PropertyBridge's performance during 2008 was not achieved. PropertyBridge is a provider of electronic

payment processing services for the real estate management industry. PropertyBridge offers a complete solution to the resident payment

cycle, including the ability to electronically

47