MoneyGram 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Other investing activity consisted of capital expenditures of $38.5 million, $70.5 million and $81.0 million for 2008, 2007 and 2006,

respectively, for agent equipment, signage and infrastructure to support the growth of the business and development of software related to

our continued investment in the money transfer platform and compliance activities. Additionally, in 2006, we acquired the remaining

50 percent interest in a corporate aircraft. Included in the Consolidated Balance Sheets under "Accounts payable and other liabilities" and

"Property and equipment" is $2.6 million of property and equipment received by the Company, but not paid as of December 31, 2008.

These amounts were paid in January 2009. In 2008, we acquired two of our super-agents in Spain, MoneyCard and Cambios Sol, for

$2.4 million (net of cash acquired of $5.5 million). In 2007, we acquired PropertyBridge for $28.1 million and also paid the remaining

$1.1 million of purchase price for ACH Commerce, which was to be paid upon the second anniversary of the acquisition. In 2006, we

acquired Money Express, our former super-agent in Italy.

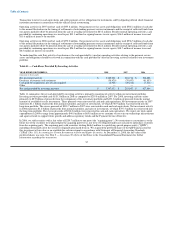

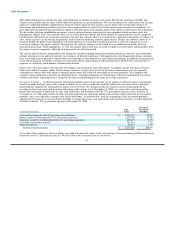

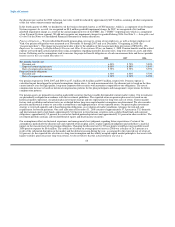

Table 12 — Cash Flows Provided By or Used in Financing Activities

YEAR ENDED DECEMBER 31, 2008 2007 2006

(Amounts in thousands)

Net proceeds from the issuance of debt $ 685,945 $ — $ —

Payment on debt (1,875) — —

Net change on credit facilities (100,000) 195,000 —

Net proceeds from the issuance of preferred stock 707,778 — —

Proceeds and tax benefit from exercise of share-based compensation — 7,674 24,643

Purchase of treasury stock — (45,992) (67,856)

Cash dividends paid — (16,625) (14,445)

Net cash provided by (used in) financing activities $ 1,291,848 $ 140,057 $ (57,658)

Table 12 summarizes the net cash flows provided by (used in) financing activities. In 2008, financing activities generated $1.4 billion of

cash from the Capital Transaction, net of $100.0 million of related transaction costs. From these proceeds, we paid $101.9 million toward

the Senior Facility; the remaining proceeds were invested in cash and cash equivalents as shown in Table 10 — Cash Flows Used in

Operating Activities. There were no proceeds received from the exercise of options or release of restricted stock, purchases of treasury

stock or payment of dividends in 2008. In 2007, we borrowed $195.0 million under our Senior Facility. We generated $7.7 million and

$24.6 million of proceeds in 2007 and 2006, respectively, from the exercise of stock options and release of restricted stock, including

related tax benefits of $1.1 million and $2.7 million, respectively. We purchased $46.0 million and $67.9 million of treasury stock during

2007 and 2006, respectively, and paid dividends on our common stock of $16.6 million and $14.4 million, respectively.

Mezzanine Equity and Stockholders' Deficit

Mezzanine Equity — See "Capital Transaction" and Note 12 — Mezzanine Equity of the Notes to the Consolidated Financial Statements

for information regarding the mezzanine equity.

Stockholders' Deficit — On May 9, 2007, our Board of Directors approved an increase of our current authorization to purchase shares of

common stock by an additional 5,000,000 shares to a total of 12,000,000 shares. In 2007, we repurchased 1,620,000 shares of our

common stock under this authorization at an average cost of $28.39 per share. We suspended the buyback program in the fourth quarter

of 2007. As of December 31, 2008, we had repurchased a total of 6,795,000 shares of our common stock under this authorization and

have remaining authorization to purchase up to 5,205,000 shares.

Under the terms of the equity instruments and debt issued in connection with the Capital Transaction, we are limited in our ability to pay

dividends on our common stock. No dividends were paid on our common stock in 2008 and we do not anticipate declaring any dividends

on our common stock during 2009.

58