MoneyGram 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

This underwriting process includes not only a determination of whether to accept a new agent, but also the remittance schedule and

volume of transactions that the agent will be allowed to perform in a given timeframe. We actively monitor the credit risk of our existing

agents by conducting periodic comprehensive financial reviews and cash flow analyses of our agents who average high volumes of

transactions and monitoring remittance patterns versus reported sales on a daily basis. In the current macroeconomic environment, we

have tightened our underwriting requirements and have initiated earlier action against agents with a pattern of delayed or late remittances.

We also utilize software embedded in our money transfer and retail money order point of sale equipment which provides credit risk

management abilities. First, this software allows us to control both the number and dollar amount of transactions that can be completed

by both agent and location in a particular timeframe. Second, this software allows us to monitor for suspicious transactions or volumes of

sales, which assists us in uncovering irregularities such as money laundering, fraud or agent self-use. Finally, the software allows us to

remotely disable the point of sale equipment to prevent agents from transacting if suspicious activity is noted or remittances are not

received according to the agent's contract. The point of sale software requires each location to be re-authorized on a daily basis for

transaction processing. Where appropriate, we will also require bank-issued lines of credit to support our receivables and guarantees from

the owners or parent companies, although such guarantees are often unsecured.

The risk for official check is mitigated by only selling these products through financial institution customers, who have never defaulted

on their remittances to us and have had only rare instances of delayed remittances. Substantially all of our financial institution customers

have a next-day remit requirement, which reduces the build-up of credit exposure at each financial institution. In addition, the termination

of our top 10 financial institution customers in connection with the restructuring of official check has resulted in less concentration of

exposure at a relatively small number of financial institutions.

Agents who sell money orders only typically have longer remit timeframes than other agents; in addition, the per transaction revenue

tends to be smaller for money orders than for money transfers. As part of our review of the money order business, we are currently

evaluating our money order only agents to identify agents where the credit risk outweighs the revenue potential. The Company will

consider various mitigation actions for the identified agents, including termination of relationships, reductions in permitted transaction

volumes and dollars, repricing the fees charged to the agent and prefunding by the agent of average remittances.

Investment Portfolio — Credit risk from the investment portfolio relates to the risk that we are unable to collect the interest or principal

owed to us under the legal terms of the various securities. Losses due to credit risk would be reflected as investment losses and other-

than-temporary impairments and negatively impact our net revenue. We manage credit risk related to our investment portfolio by

investing in short-term assets and in issuers with strong credit ratings. As of December 31, 2008, our conservative investment policy

permits the investment of funds only in cash, cash equivalents and securities issued by U.S. government agencies with a maturity of

13 months or less. This policy relates to both cash generated from our operations and the reinvestment of proceeds from the investment

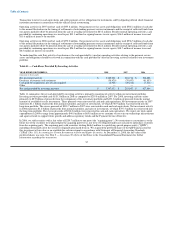

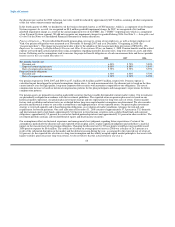

portfolio, and is not expected to change in the foreseeable future. As shown below, with the realignment of the investment portfolio,

approximately 99 percent of our investment portfolio is comprised of cash, cash equivalents and securities issued by, or collateralized by

securities issued by, U.S. government agencies at December 31, 2008:

Percent of

Fair Investment

(Amounts in thousands) Value Portfolio

Cash and time deposits held at large financial institutions $ 2,218,778 48.9%

Money markets collateralized by U.S. government agencies 1,626,788 35.9%

Securities issued by or collateralized by U.S. government agencies 409,247 9.0%

Cash held at international banks 231,814 5.1%

Other investments 51,013 1.1%

Total investment portfolio $ 4,537,640 100.0%

As a result of the realignment of the portfolio, our credit risk primarily relates to the concentration of our investment portfolio in financial

institutions and U.S. government agencies. We only hold assets at major financial institutions

61