MoneyGram 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

pay the Company par value plus accrued interest. The put options are non-transferable and the Company retains its rights under the put

options in the event the preferred put options in the auction rate securities are exercised. The Company has recognized an asset related to

the put options with a fair value of $26.5 million in the "Other assets" line on the Consolidated Balance Sheets, with a corresponding gain

in the "Net securities losses" line in the Consolidated Statements of (Loss) Income. The fair value of the put options will be remeasured

each period through earnings, and should significantly offset any further unrealized losses recognized in the Consolidated Financial

Statements related to the Company's trading investments.

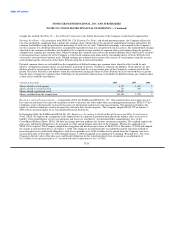

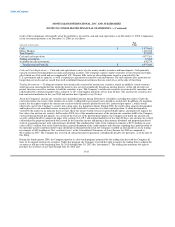

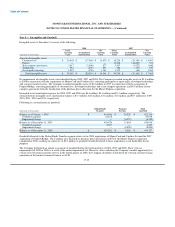

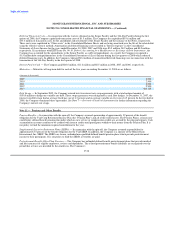

Available-for-sale Investments — Available-for-sale investments consist of mortgage-backed securities, asset-backed securities and

agency debenture securities. After other-than-temporary impairment charges, the amortized cost and fair value of available-for-sale

investments are as follows at December 31, 2008:

Gross Gross Net

Amortized Unrealized Unrealized Fair Average

(Amounts in thousands) Cost Gains Losses Value Price

Residential mortgage-backed securities — agencies $ 385,276 $ 6,523 $ (2) $ 391,797 $ 102.37

Other asset-backed securities 27,703 1,825 — 29,528 4.43

U.S. government agencies 16,463 986 — 17,449 91.84

Total $ 429,442 $ 9,334 $ (2) $ 438,774 $ 41.05

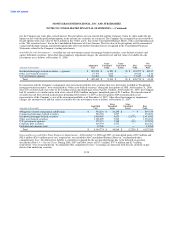

In connection with the Company's realignment of its investment portfolio, five securities that were previously included in "Residential

mortgage-backed securities" were reclassified to "Other asset-backed securities" during the first quarter of 2008. At December 31, 2008,

these five securities had a fair value of $1.0 million and an unrealized gain of less than $0.1 million. At December 31, 2007, the Company

had 81 securities of a similar nature with a fair value of $598.0 million and gross unrealized gains of $1.2 million. The classification of

securities has not been revised in disclosures pertaining to December 31, 2007 as the first quarter 2008 reclassification is not

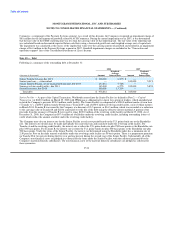

representative of the Company's view of the investment portfolio as of December 31, 2007. After other-than-temporary impairment

charges, the amortized cost and fair value of available-for-sale investments were as follows at December 31, 2007:

Gross Gross

Amortized Unrealized Unrealized Fair

(Amounts in thousands) Cost Gains Losses Value

Obligations of states and political subdivisions $ 574,124 $ 23,255 $ — $ 597,379

Commercial mortgage-backed securities 250,726 3,097 — 253,823

Residential mortgage-backed securities 1,409,489 4,633 (2,170) 1,411,952

Other asset-backed securities 1,308,699 9,543 — 1,318,242

U.S. government agencies 373,173 1,768 (88) 374,853

Corporate debt securities 215,795 2,572 — 218,367

Preferred and common stock 12,768 — — 12,768

Total $ 4,144,774 $ 44,868 $ (2,258) $ 4,187,384

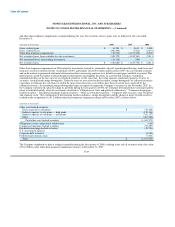

Gains and Losses and Other-Than-Temporary Impairments: At December 31, 2008 and 2007, net unrealized gains of $9.3 million and

$42.6 million ($26.4 million net of tax), respectively, are included in the Consolidated Balance Sheets in "Accumulated other

comprehensive loss." No deferred tax liability is currently recognized for the net unrealized gains due to the deferred tax position

described in Note 15 — Income Taxes. During 2008, 2007 and 2006, losses of $33.7 million, $737.6 million and $1.7 million,

respectively, were reclassified from "Accumulated other comprehensive loss" to earnings in connection with the sale, maturity or pay-

down of the underlying securities

F-28