MoneyGram 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

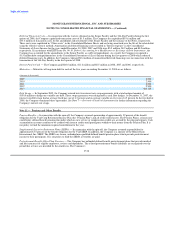

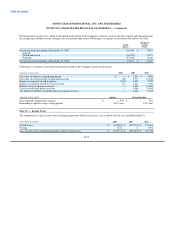

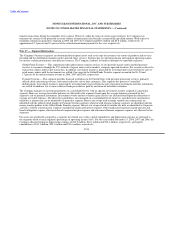

Restricted stock awards were valued at the quoted market price of the Company's common stock on the date of grant and expensed using

the straight-line method over the vesting or service period of the award. Following is a summary of restricted stock activity for 2008:

Weighted

Total Average

Shares Price

Restricted stock outstanding at December 31, 2007 234,354 $ 26.84

Granted — —

Vested and issued (55,233) 21.73

Forfeited (87,450) 28.60

Restricted stock outstanding at December 31, 2008 91,671 $ 28.25

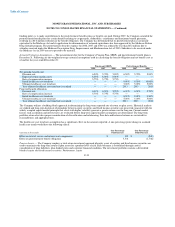

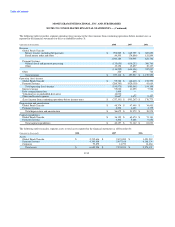

Following is a summary of pertinent information related to the Company's stock-based awards:

(Amounts in thousands) 2008 2007 2006

Fair value of options vesting during period $ — $ 2,591 $ 5,680

Fair value of restricted stock vesting during period 458 5,337 13,245

Expense recognized related to options 3,274 3,852 2,725

Expense recognized related to restricted stock 417 2,247 1,950

Intrinsic value of options exercised — 3,582 15,490

Cash received from option exercises — 6,606 21,899

Tax benefit realized for tax deductions from option exercises — 1,068 2,744

(Amounts in thousands) Options Restricted Stock

Unrecognized compensation expense $ 1,979 $ 424

Remaining weighted average vesting period 0.69 years 1.23 years

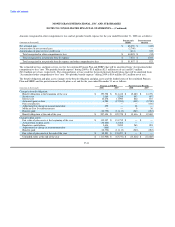

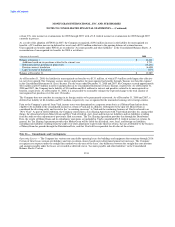

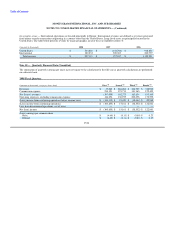

Note 15 — Income Taxes

The components of (loss) income from continuing operations before income taxes are as follows for the year ended December 31:

(Amounts in thousands) 2008 2007 2006

United States $ (345,063) $ (993,273) $ 171,681

Foreign 7,872 6 5,092

(Loss) income from continuing operations before income taxes $ (337,191) $ (993,267) $ 176,773

F-48