MoneyGram 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

On average, we pay approximately $1.0 billion a day to settle our payment instruments and make related settlements with our agents and

financial institutions. We generally receive a similar amount on a daily basis from our agents and financial institutions for the face

amount and related fees of our payment instruments sold. We use the in-coming funds from sales of new payment instruments to settle

previously sold payment instruments that are presented for payment. In simple terms, the face amount of an instrument sold today is used

to settle the face amount of an instrument sold yesterday and presented for payment today. This pattern of cash flows allows us to settle

our payment instruments without the need for short-term financing or routine divesting from our long-term portfolio. If sales of new

payment instruments declined faster than the settlement of outstanding instruments, we would need to utilize our short-term portfolio to

fund the settlement of payment instruments, and in a worst case scenario, would need to sell from our long-term portfolio. Our daily net

cash settlements tend to follow a pattern whereby certain days of the week are typically net cash inflow days, while other days are

typically net cash outflow days. On the days with a net cash outflow, we utilize our cash equivalents to fund the shortfall. On the net cash

inflow day, excess cash is reinvested in cash equivalents.

The timely remittance of funds by our agents and financial institution customers is an important component of our liquidity and allows

for the pattern of cash flows described above. If the timing of the remittance of funds to us deteriorated, it would alter our pattern of cash

flows and could require us to utilize our short-term portfolio for settlements with our agents more frequently. In the current economic

conditions, there is a higher risk that the timing of remittances to us could lengthen or that an agent or financial institution customer could

default on its remittance obligations. We are managing this risk by closely monitoring the remit patterns of our agents and financial

institution customers and acting quickly when we detect deterioration in remittance timing or an alteration in payment patterns. Options

available to us include the ability to deactivate an agent or financial institution customer's equipment at any time, thereby not allowing

them to initiate further money transfers or issue further instruments. See "Enterprise Risk Management — Credit Risk" for further

discussion of this risk and our actions to mitigate.

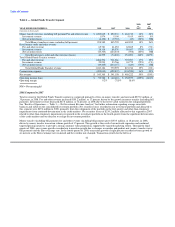

The in-coming cash flows related to fees paid by our consumers and income earned on our investment portfolio provide the funds for

commission payments to our agents and financial institutions, as well as our operating and capital expenditure cash needs. Substantially

all of our commission payments and a significant amount of our operating expenses are tied to transaction volumes. If transaction

volumes and the related fee revenue declined, our commission payment needs would decline approximately in tandem. Operating

expenses would also decline, but not at the same rate or in the same amount as fee revenue.

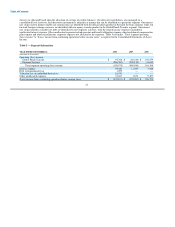

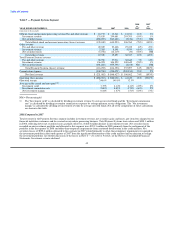

To ensure that we maintain adequate liquidity to meet our operating needs at all times, including during the current economic recession,

we keep a significant portion of our portfolio in cash and cash equivalents. As of December 31, 2008, 90 percent of our investment

portfolio is comprised of cash and cash equivalents. As shown in Table 8 — Unrestricted Assets below, we have unrestricted assets of

$391.0 million. These assets would be available to us for purposes of investment in the infrastructure and growth of our business;

however, we consider a portion of our unrestricted assets as additional assurance that regulatory and contractual requirements are

maintained through the normal fluctuations of our payment service assets and obligations. We believe that we have sufficient assets and

liquidity to operate and grow our business for the next 12 months. Should our liquidity needs exceed our operating cash flows, we believe

that our external financing sources, including availability under the Senior Facility, will be sufficient to meet any shortfalls. Depending

on market conditions and prices, our financial liquidity and other factors, and subject to limitations contained in our Credit Agreement

and Indenture, we may seek from time to time to repurchase our Notes and our common stock in open market purchases, privately

negotiated purchases or otherwise, and we may seek to repay all or part of our Senior Facility. The amounts involved in any such

transactions, individually or in the aggregate, may be material and may be funded from available cash or from additional borrowings.

We move and receive money through a network of clearing and cash management banks. The relationships with these clearing banks and

cash management banks are a critical component of our ability to move monies on a global and timely basis. We have agreements with 13

clearing banks that provide clearing and processing functions for official checks, money orders and share drafts, with two of these banks

expected to be consolidated in 2009 due to an acquisition. Due to concerns over the impact of the credit market disruption on our

business, we agreed with certain of our clearing banks to make funding changes, including providing additional intra-day funding, during

the

51