MoneyGram 2008 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

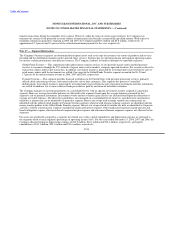

Stockholder Derivative Claims — The Company and its officers and directors were also parties to three stockholder lawsuits making

various state-law claims. Two of these lawsuits have been dismissed. The complaint filed in Hennepin County District Court by L.A.

Murphy and alleging breach fiduciary duty, abuse of control, mismanagement and corporate waste against various of the Company's

officers and directors was dismissed with prejudice on August 14, 2008. The complaint filed in the United States District Court for the

District of Minnesota by Evelyn York and alleging breach of fiduciary duties for insider selling, misappropriation of information and

disseminating false and misleading statements, waste of corporate assets and unjust enrichment against the Company and various current

and former officers and directors was dismissed by stipulation and with prejudice on September 17, 2008.

On January 22, 2008, Russell L. Berney filed a complaint in Los Angeles Superior Court against the Company and its officers and

directors, THL and PropertyBridge and one of its officers, Jason Gardner, alleging false and negligent misrepresentation, violations of

California securities laws and unfair business practices with regard to disclosure of the Company's investments. The complaint also

alleges derivative claims against the Company's Board of Directors relating to the Board's oversight of disclosure of the Company's

investments and with regard to the Company's negotiations with THL. and Euronet Worldwide, Inc. The complaint seeks monetary

damages, disgorgement, restitution or rescission of stock purchases, rescission of agreements with third parties, constructive trust,

declaratory and injunctive relief, as well as attorneys' fees and costs. In July 2008, an amended complaint was filed asserting an

additional claim for declaratory relief.

SEC Inquiry — By letter dated February 4, 2008, the Company received notice from the Securities and Exchange Commission ("SEC")

that it is conducting an informal, non-public inquiry relating to the Company's financial statements, reporting and disclosures related to

the Company's investment portfolio and offers and negotiations to sell the Company or its assets. The SEC's notice states that it has not

determined that any violations of the securities laws have occurred. On February 11, 2008 and November 5, 2008, the Company received

additional letters from the SEC requesting certain information. We are cooperating with the SEC on a voluntary basis.

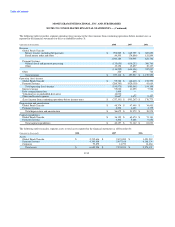

Credit Facilities — At December 31, 2008, the Company has overdraft facilities through its Senior Facility consisting of $7.6 million of

letters of credit to assist in the management of investments and the clearing of payment service obligations. All of these letters of credit

are outstanding as of December 31, 2008. These overdraft facilities reduce amounts available under the Senior Facility. Fees on the letters

of credit are paid in accordance with the terms of the Senior Facility described in Note 10 — Debt.

Other Commitments — The Company has agreements with certain co-investors to provide funds related to investments in limited

partnership interests. As of December 31, 2008, the total amount of unfunded commitments related to these agreements was $0.6 million.

The Company has entered into a debt guarantee for $1.7 million on behalf of a money order and transfer agent. This debt guarantee will

be reduced as the agent makes payments on its debt. The term of the debt guarantee is for indefinite period, but the agent is expected to

pay all outstanding amounts under its debt by March 2009. The Company accrued a liability of $0.3 million for the fair value of this debt

guarantee. A corresponding deferred asset was recorded and will be amortized on a straight line basis through March 2009. The

amortization expense is recognized as part of "Transaction and operations support" expense in the Consolidated Statements of (Loss)

Income.

Minimum Commission Guarantees — In limited circumstances as an incentive to new or renewing agents, the Company may grant

minimum commission guarantees for a specified period of time at a contractually specified amount. Under the guarantees, the Company

will pay to the agent the difference between the contractually specified minimum commission and the actual commissions earned by the

agent. Expense related to the guarantee is recognized in the "Fee commissions expense" line in the Consolidated Statements of (Loss)

Income.

As of December 31, 2008, the liability for minimum commission guarantees is $2.7 million and the maximum amount that could be paid

under the minimum commission guarantees is $16.3 million over a weighted average remaining term of 1.8 years. The maximum

payment is calculated as the contractually guaranteed minimum commission times the remaining term of the contract and, therefore,

assumes that the agent generates no money

F-53