MoneyGram 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

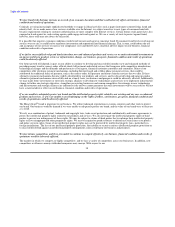

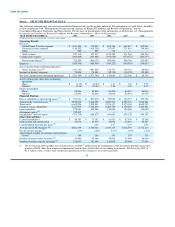

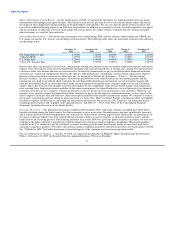

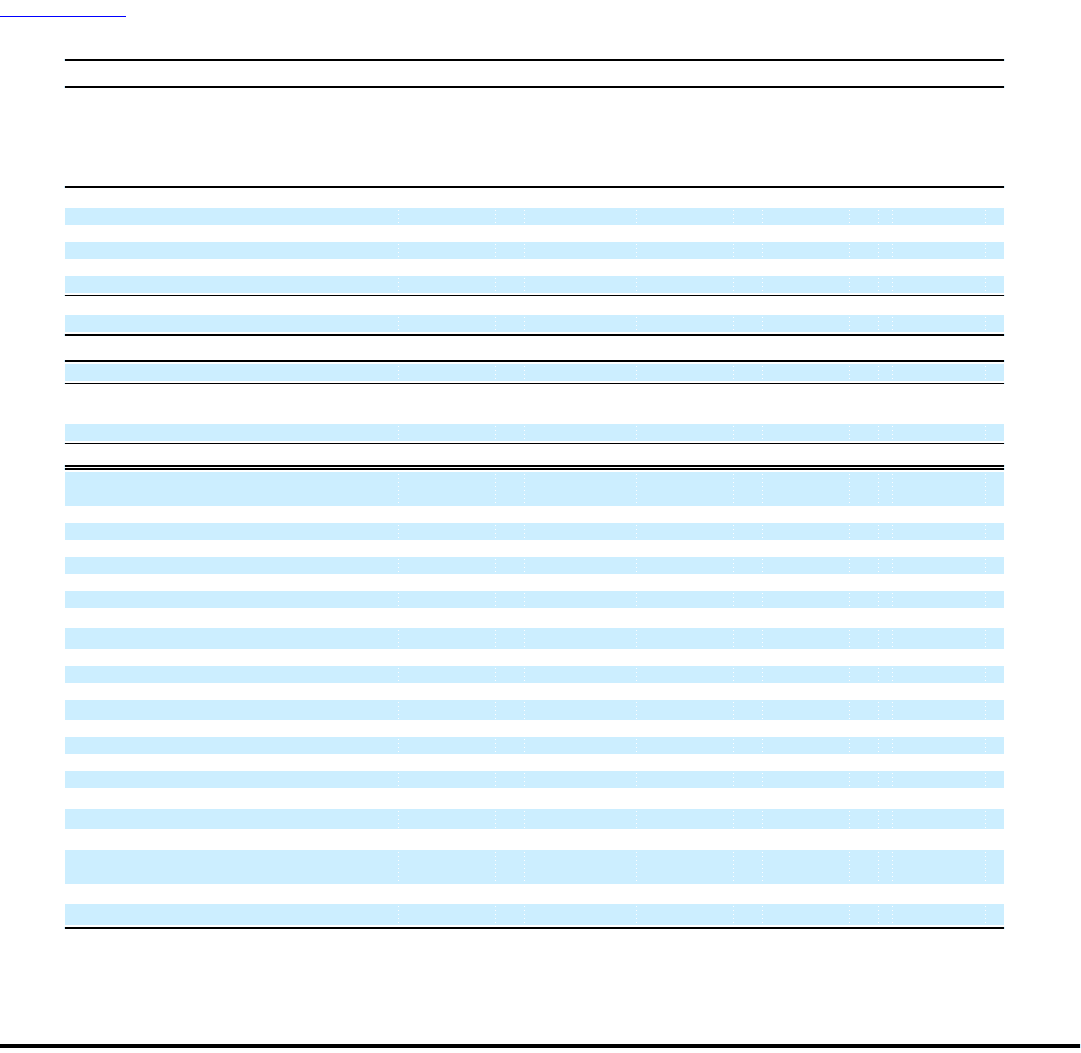

Item 6. SELECTED FINANCIAL DATA

The following table presents our selected consolidated financial data for the periods indicated. The information set forth below should be

read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our

Consolidated Financial Statements and Notes thereto. For the basis of presentation of the information set forth below, see "Management's

Discussion and Analysis of Financial Condition and Results of Operations — Basis of Presentation."

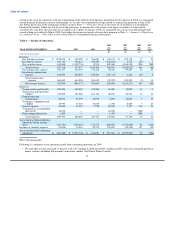

YEAR ENDED DECEMBER 31, 2008 2007 2006 2005 2004

(Dollars and shares in thousands, except per share data)

Operating Results

Revenue

Global Funds Transfer segment $ 1,043,184 $ 770,995 $ 821,746 $ 649,617 $ 532,064

Payment Systems segment (116,292) (614,356) 337,097 321,619 294,466

Other 226 898 716 — —

Total revenue 927,118 157,537 1,159,559 971,236 826,530

Commissions expense (604,609) (663,908) (563,659) (470,472) (403,473)

Net revenue (losses) (1) 322,509 (506,371) 595,900 500,764 423,057

Expenses (659,700) (486,896) (419,127) (354,388) (334,037)

(Loss) income from continuing operations

before income taxes (2) (337,191) (993,267) 176,773 146,376 89,020

Income tax benefit (expense) 75,806 (78,481) (52,719) (34,170) (23,891)

Net (loss) income from continuing operations $ (261,385) $ (1,071,748) $ 124,054 $ 112,206 $ 65,129

(Loss) earnings per share from continuing

operations:

Basic $ (4.19) $ (12.94) $ 1.47 $ 1.32 $ 0.75

Diluted (4.19) (12.94) 1.45 1.30 0.75

Shares outstanding

Basic 82,456 82,818 84,294 84,675 86,916

Diluted 82,456 82,818 85,818 85,970 87,330

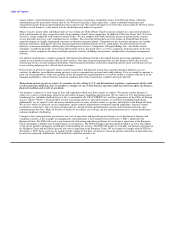

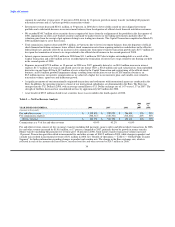

Financial Position

Excess (shortfall) in unrestricted assets (3) $ 391,031 $ (551,812) $ 358,924 $ 366,037 $ 393,920

Substantially restricted assets (3) 5,829,030 7,210,658 8,568,713 8,525,346 7,640,581

Total assets 6,642,296 7,935,011 9,276,137 9,175,164 8,630,735

Payment service obligations 5,437,999 7,762,470 8,209,789 8,159,309 7,640,581

Long-term debt 978,881 345,000 150,000 150,000 150,000

Mezzanine equity (4) 742,212 — — — —

Stockholders' (deficit) equity (781,736) (488,517) 669,063 624,129 565,191

Other Selected Data

Capital expenditures $ 40,357 $ 71,142 $ 81,033 $ 47,359 $ 29,589

Depreciation and amortization 56,672 51,979 38,978 32,465 29,567

Cash dividends declared per share (5) — 0.20 0.17 0.07 0.20

Average investable balances (6) 4,866,339 6,346,442 6,333,115 6,726,790 6,772,124

Net investment margin (7) 1.23% 2.28% 2.31% 1.91% 1.42%

Approximate number of countries and territories

served 189 180 170 170 170

Number of money order locations (8) 59,000 59,000 55,000 53,000 54,000

Number of money transfer locations (8) 176,000 143,000 110,000 89,000 77,000

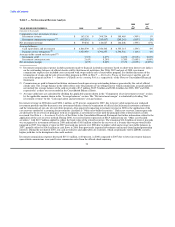

(1) Net revenue for 2008 includes net securities losses of $340.7 million from the realignment of the investment portfolio in the first

quarter of 2008, other-than-temporary impairments and declines in the value of our trading investments. Net losses for 2007 of

$1.2 billion relates to other-than-temporary impairments in the Company's investment portfolio.

28