MoneyGram 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

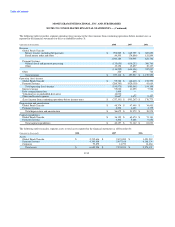

investment losses as of December 31, 2007, the Company determined that it was not "more likely than not" that the deferred tax assets

related to the losses will be realized.

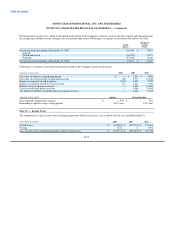

Deferred income taxes reflect temporary differences between amounts of assets and liabilities, including tax loss and tax credit carry-

forwards, for financial reporting purposes and such amounts as measured by tax laws at enacted tax rates expected to be in effect when

such differences reverse. The carrying value of the Company's deferred tax assets is dependent upon the Company's ability to generate

sufficient future taxable income in certain tax jurisdictions. If the Company determines that it is more likely than not that some portion of

all of its deferred assets will not be realized, a valuation allowance to the deferred tax assets would be established in the period such

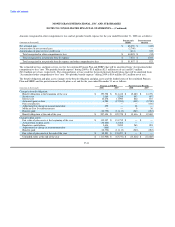

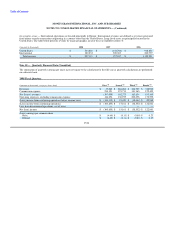

determination was made. The Company's deferred tax assets and liabilities at December 31 are comprised of the following:

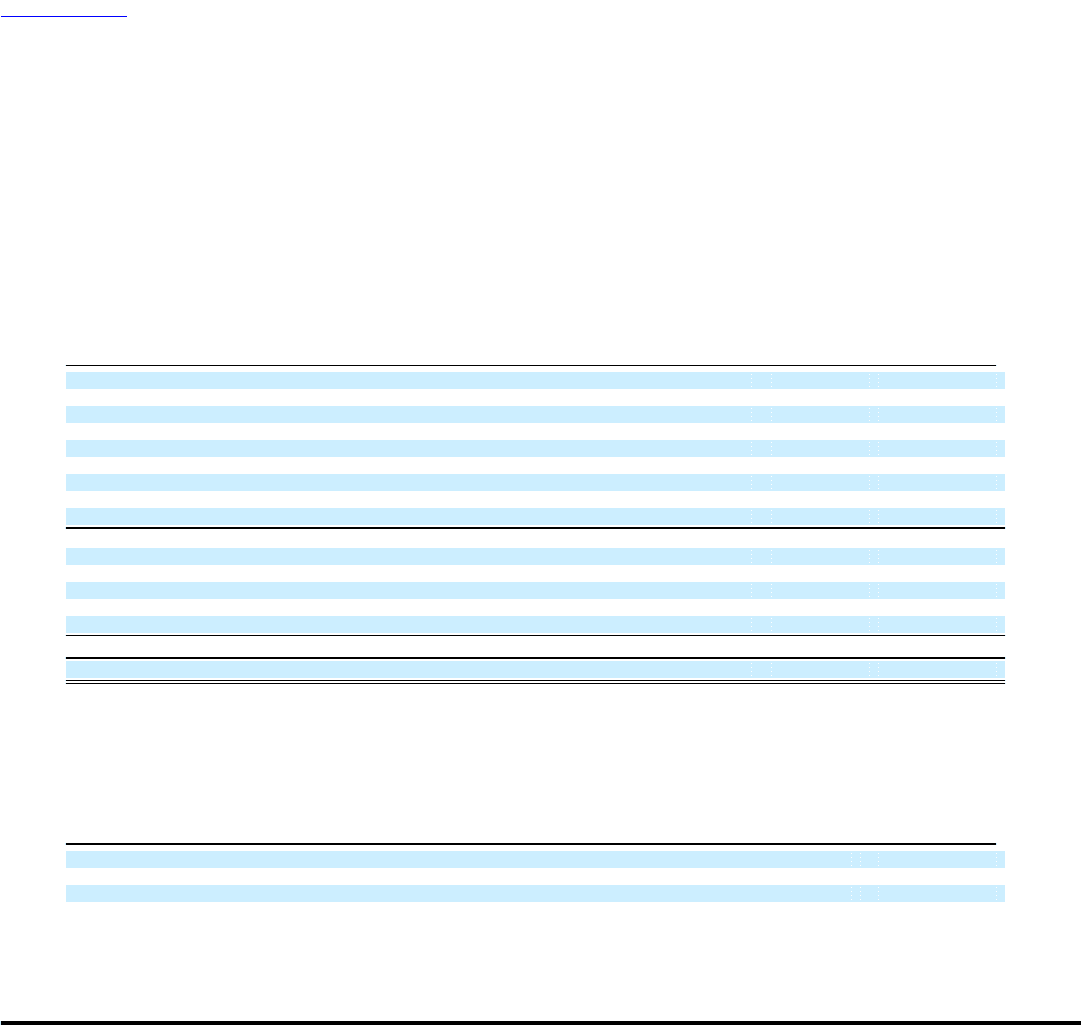

(Amounts in thousands) 2008 2007

Deferred tax assets:

Postretirement benefits and other employee benefits $ 52,133 $ 37,274

Tax loss carryovers 308,870 —

Tax credit carryovers 45,394 1,474

Unrealized loss on derivative financial investments — 11,857

Basis difference in revalued investments 126,341 442,442

Bad debt and other reserves 5,977 2,801

Other 7,126 14,194

Valuation allowance (494,310) (435,700)

Total deferred tax asset 51,531 74,342

Deferred tax liabilities:

Unrealized gain on securities classified as available-for-sale — (16,192)

Depreciation and amortization (63,507) (64,848)

Basis difference in investment income — (4,761)

Unrealized gain on derivative financial instruments (478) —

Gross deferred tax liability (63,985) (85,801)

Net deferred tax liability $ (12,454) $ (11,459)

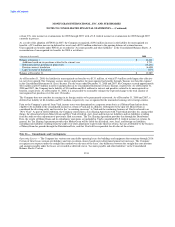

The increase in tax loss and tax credit carry-forwards and corresponding decrease in the basis difference in revalued investments in 2008

relate to tax positions taken on the Company's investment losses. The increase in the valuation allowance relates primarily to additional

investment losses in 2008. The deferred tax liability relating to unrealized gains on investments was recognized through earnings in the

first quarter of 2008 in connection with the sale of investments to realign the portfolio. The amount and expiration dates of tax loss and

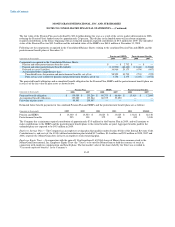

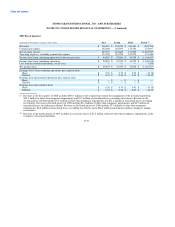

credit carryforwards (not tax effected) as of December 31, 2008 are as follows:

Expiration

(Amounts in thousands) Date Amount

U.S. federal and state loss carry-forwards 2012-2028 $ 838,000

U.S. federal tax credit carry-forwards 2012-2028 26,526

U.S. federal tax credit carry-forwards Indefinite 18,868

The Company, or one of its subsidiaries, files income tax returns in the U.S. federal jurisdiction and various states and foreign

jurisdictions. With a few exceptions, the Company is no longer subject to foreign or U.S. federal, state and local income tax examinations

for years prior to 2005. The Company is subject to foreign, U.S. federal and

F-50