MoneyGram 2008 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

International income consists of statutory income and losses from the Company's international subsidiaries. Most of the Company's

wholly owned subsidiaries recognize revenue based solely on services agreements with MPSI. Income tax (benefit) expense related to

continuing operations is as follows for the year ended December 31:

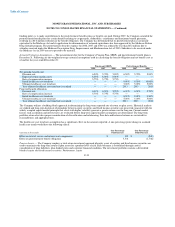

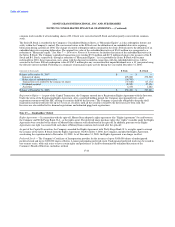

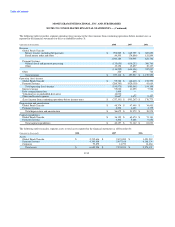

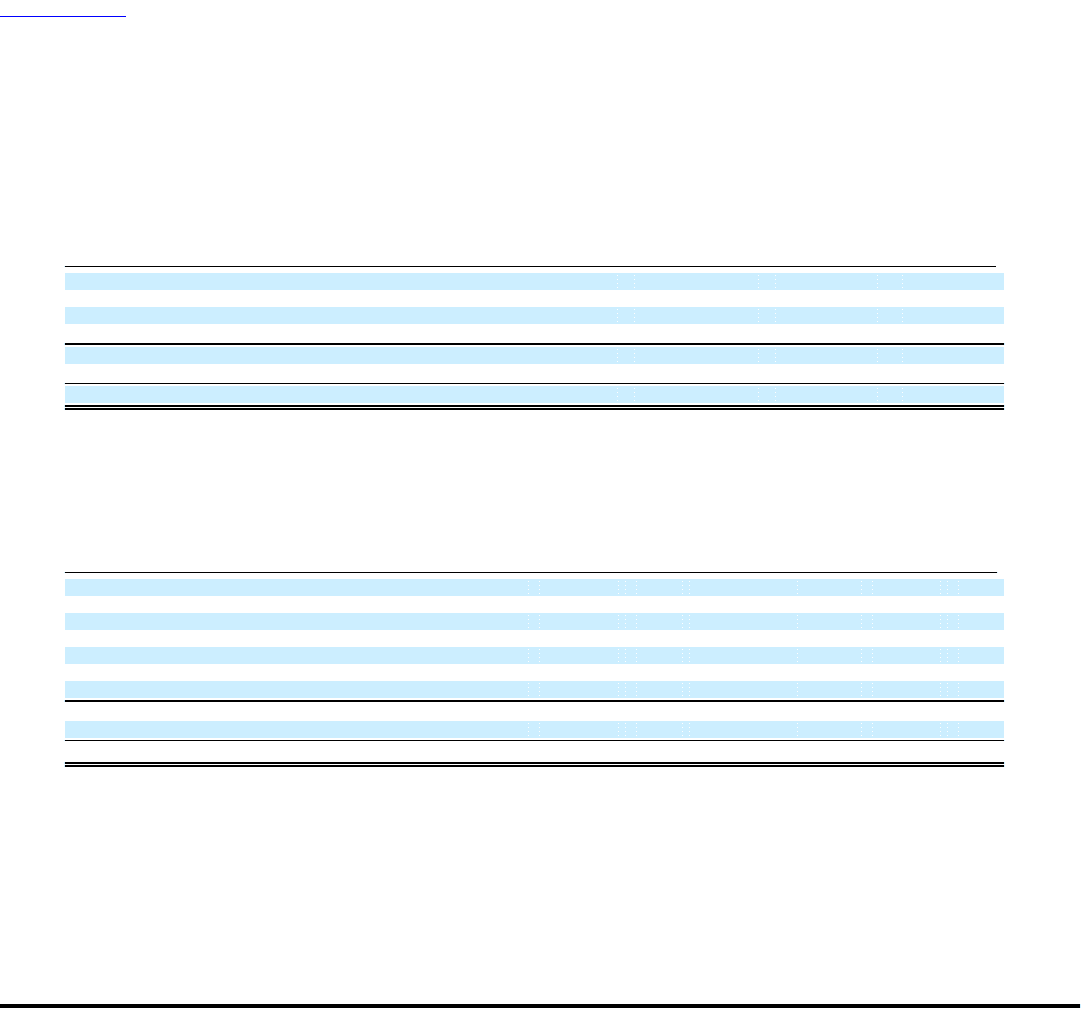

(Amounts in thousands) 2008 2007 2006

Current:

Federal $ (55,980) $ 35,445 $ 13,716

State (8,064) 3,999 2,968

Foreign (13,938) 1,400 2,880

Current income tax (benefit) expense (77,982) 40,844 19,564

Deferred income tax expense 2,176 37,637 33,155

Income tax (benefit) expense $ (75,806) $ 78,481 $ 52,719

Income tax expense totaling $1.9 million in 2007 is included in "(Loss) income from discontinued operations, net of tax" in the

Consolidated Statements of (Loss) Income. As of December 31, 2008, the Company had a net income tax receivable of $35.9 million

recorded in the "Other assets" line in the Consolidated Balance Sheets. The Company received a $24.7 million federal income tax refund

in 2008 and a federal income tax refund of $43.5 million in January 2009. Federal and state taxes paid were $1.7 million, $16.0 million

and $38.7 million for 2008, 2007 and 2006, respectively. A reconciliation of the expected federal income tax at statutory rates for year

ended to the actual taxes provided is as follows:

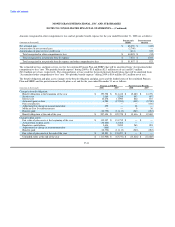

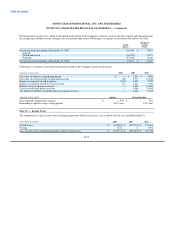

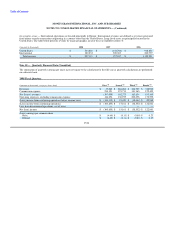

(Amounts in thousands) 2008 % 2007 % 2006 %

Income tax at statutory federal income tax rate $ (118,017) 35.0 $ (347,643) 35.0 $ 61,870 35.0

Tax effect of:

State income tax, net of federal income tax effect 1,634 (0.5) 3,606 (0.4) 2,647 1.5

Valuation allowance 44,639 (13.2) 434,446 (43.7) — —

Non-taxable loss on embedded derivatives 5,611 (1.7)

Decrease in tax reserve (7,761) 2.3 — — — —

Other (1,186) 0.4 (152) 0.0 1,445 0.8

(75,080) 22.3 90,257 (9.1) 65,962 37.3

Tax-exempt income (726) 0.2 (11,776) 1.2 (13,243) (7.5)

Income tax (benefit) expense $ (75,806) 22.5 $ 78,481 (7.9) $ 52,719 29.8

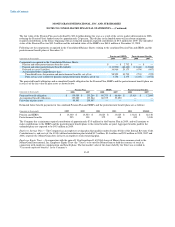

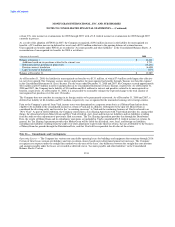

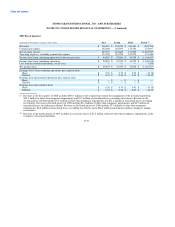

For 2008, the Company had an effective income tax rate of 22.5 percent. The effective tax rate is 12.5 basis points lower than the

statutory tax rate primarily due to the $44.6 million net increase in the deferred tax asset valuation allowance, which includes a

$90.5 million benefit recognized in the fourth quarter of 2008. In the fourth quarter of 2008, the Company completed the evaluation of

the technical merits of tax positions with respect to part of the net securities losses from 2008 and 2007 and recorded a $90.5 million tax

benefit from the release of deferred tax valuation allowances. As the Company assesses changes in facts and circumstances in the future,

it may record additional tax benefits as further deferred tax valuation allowances are released and carry-forwards are utilized. The

Company continues to evaluate additional available tax positions related to the net securities losses.

For 2007, the Company had a negative effective income tax rate of 7.9 percent from the $434.4 million deferred tax valuation allowance

relating primarily to investment losses. Due to the amount and characterization of the

F-49