MoneyGram 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We manage financial institution risk by entering into clearing and cash management agreements with only major financial institutions

and regularly monitoring the credit ratings of these financial institutions. Our financial institution risk is further mitigated as the majority

of our cash equivalents and investments held by these institutions are invested in securities issued by U.S. government agencies or money

market instruments collateralized by U.S. government agencies, which have the implicit or explicit guarantee of the U.S. government

depending upon the issuing agency. Our non-interest bearing cash held at our domestic clearing and cash management banks is covered

under the Temporary Liquidity Guarantee Program ("TLGP") as those banks opted in to the program. The Federal Deposit Insurance

Corporation ("FDIC") has created the TLGP program to strengthen confidence and encourage liquidity in the banking system by

guaranteeing newly issued senior unsecured debt of banks, thrifts and certain holding companies and providing full coverage of non-

interest bearing deposit transaction accounts, regardless of dollar amount. In addition, official checks issued by our financial institution

customers are treated as deposits under the TLGP. The TLGP is currently effective for all of calendar year 2009, at which point it will

expire unless renewed by the FDIC. With respect to our credit union customers, our credit exposure is partially mitigated by NCUA

insurance. However, as our credit union customers are not insured by a TLGP-equivalent program, we have required certain credit union

customers to provide us with larger balances on deposit and/or to issue cashier's checks only. While the value of these assets are not at

risk in a disruption or collapse of a counterparty financial institution, the delay in accessing our assets could adversely affect our liquidity

and potentially our earnings depending upon the severity of the delay and corrective actions we may need to take. Corrective actions

could include draws upon our Senior Facility to provide short-term liquidity until our assets are released, reimbursements of costs or

payment of penalties to our agents and higher banking fees to transition banking relationships in a short timeframe.

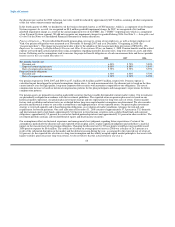

At December 31, 2008, we held $2.2 billion, or 49 percent of our investment portfolio, in cash accounts at seven financial institutions

with a rating of A or better and time deposits at two financial institutions with a rating of AA or better. We held another $1.6 billion of

cash equivalents collateralized by securities issued by U.S. government agencies, or 36 percent of our investment portfolio, at nine

financial institutions. Our trading and available-for-sale investments totaling $460.3 million, or 10 percent of our investment portfolio,

are held at three financial institutions with a rating of A or better. The remaining $231.8 million, or five percent, of our investment

portfolio is comprised of cash and cash equivalents held at foreign banks for use by our international subsidiaries and branches or to

comply with local requirements.

Receivables — Credit risk related to receivables is the risk that we are unable to collect the funds owed to us by our agents and financial

institution customers who have collected the face amount and fees associated with the sale of our payment instruments from the consumer

on our behalf. Substantially all of the business conducted by our Global Funds Transfer segment is conducted through independent

agents, while all of the business conducted by the Payment Systems segment is conducted through independent financial institution

customers. Our agents and financial institution customers receive the face amount and fees related to the sale of our payment instruments,

and we must then collect these funds from them. As a result, we have credit exposure to our agents and financial institution customers.

Agents typically have from one to three days to remit the funds, with longer remittance schedules granted to international agents and

certain domestic agents. For our Global Funds Transfer segment, the credit exposure averages approximately $670.8 million for all

products and is spread across more than 17,000 agents, of which three owe us in excess of $15.0 million each at any one time. For our

Payment Systems segment, the credit exposure averages approximately $449.0 million for all products and is spread across our 1,800

financial institution customers, of which five owe us in excess of $15.0 million each at any one time.

Our strategy in managing credit risk related to receivables is to ensure that the revenue generation from an agent or financial institution

customer is sufficient to provide for an appropriate level of credit risk and to reduce concentrations of risk through diversification,

termination of agents or financial institution customers with poor risk-reward ratios or other means. Management's decision during the

fourth quarter of 2008 to terminate its ACH business was based primarily on a review of the credit risk associated with that business.

Due to the larger average face amount of money orders and official checks, we consider our credit exposure from these products to be of

higher risk than exposure due to money transfers. However, in the current macroeconomic environment and as a result of our

international growth, credit risk related to our money transfer products is increasing. While the extent of credit risk may vary by product,

the process for mitigating risk is substantially the same. We assess the creditworthiness of each potential agent before accepting them into

our distribution network.

60