MoneyGram 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

capital base. Due to the continuous nature of the sales and settlement of our payment instruments described above, we are able to

maintain this capital base to provide for long-term capital needs. Our primary capital objective is to have unrestricted assets in an amount

which allows us to maintain compliance with all contractual and regulatory requirements during the normal fluctuations in the value of

our assets and liabilities. Assets restricted for regulatory or contractual reasons are not available to satisfy working capital or other

investing or financing needs.

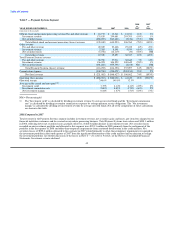

Our Senior Facility, Notes, one clearing bank contract and the SPEs contain certain financial covenants that require us to maintain pre-

defined ratios of certain assets to payment service obligations as presented in the Consolidated Balance Sheets. One clearing bank

contract has financial covenants that include the maintenance of total cash, cash equivalents, receivables and investments in an amount at

least equal to total outstanding payment service obligations (the "Total Company Ratio"), as well as the maintenance of a minimum

103 percent ratio of total assets held at that bank to instruments estimated to clear through that bank (the "Clearing Bank Ratio").

Financial covenants related to the SPEs include the maintenance of specified ratios, typically greater than 100 percent, of cash, cash

equivalents and investments held in the SPE to outstanding payment instruments issued by the related financial institution. In addition,

under limited circumstances, the financial institution customers who are beneficiaries of the SPEs have the right to either demand

liquidation of the assets in the SPEs or to replace us as the administrator of the SPE. Such limited circumstances consist of material, and

in most cases continued, failure to uphold our warranties and obligations pursuant to the underlying agreements with the financial

institutions.

In addition, through our wholly owned subsidiary and licensed entity, MPSI, we are regulated by various state agencies that generally

require us to maintain a pool of liquid assets and investments with a rating of A or higher in an amount generally equal to the regulatory

payment service obligation measure, as defined by the state, for our regulated payment instruments, namely teller checks, agent checks,

money orders and money transfers. The regulatory requirements are similar to, but less restrictive than, our internal unrestricted assets

measure set forth in Table 8 — Unrestricted Assets below. The regulatory payment service obligation measure varies by state, but in all

cases is substantially lower than our payment service obligations as disclosed in the Consolidated Balance Sheets as we are not regulated

by state agencies for payment service obligations resulting from outstanding cashier's checks or for amounts payable to agents and

brokers. All states require MPSI to maintain positive net worth, with one state also requiring MPSI to maintain positive tangible net

worth of $100.0 million. As of December 31, 2008, we had excess assets over the regulatory payment service obligations ("cushion")

under our most restrictive state of $1.4 billion; all other states had substantially higher cushions.

The regulatory and contractual requirements do not require us to specify individual assets held to meet our payment service obligations,

nor are we required to deposit specific assets into a trust, escrow or other special account. Rather, we must maintain a pool of liquid

assets. Provided we maintain a total pool of liquid assets sufficient to meet the regulatory and contractual requirements, we are able to

withdraw, deposit or sell our individual liquid assets at will, with no prior notice or penalty or limitations.

53