MoneyGram 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

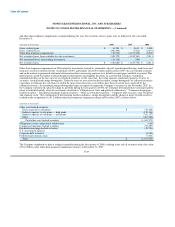

Commerce, a component of the Payment Systems segment. As a result of this decision, the Company recognized an impairment charge of

$8.8 million for the full amount of goodwill related to ACH Commerce. During the annual impairment test in 2007, it was determined

that the fair value of the FSMC reporting unit was less than the carrying value of that reporting unit. The fair value of the reporting unit

was calculated based on discounted expected future cash flows using a forecasted growth rate and weighted average cost of capital rate.

The impairment was calculated as the excess of the implied fair value over the carrying amount of goodwill and resulted in an impairment

charge of $6.4 million in the Payment Systems segment in 2007. Goodwill impairment charges are included in the "Transaction and

operations support" line of the Consolidated Statements of (Loss) Income.

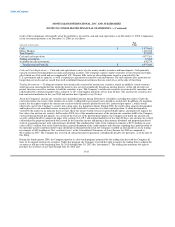

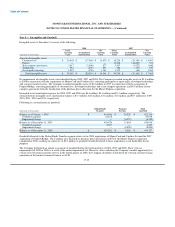

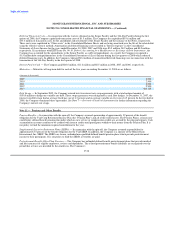

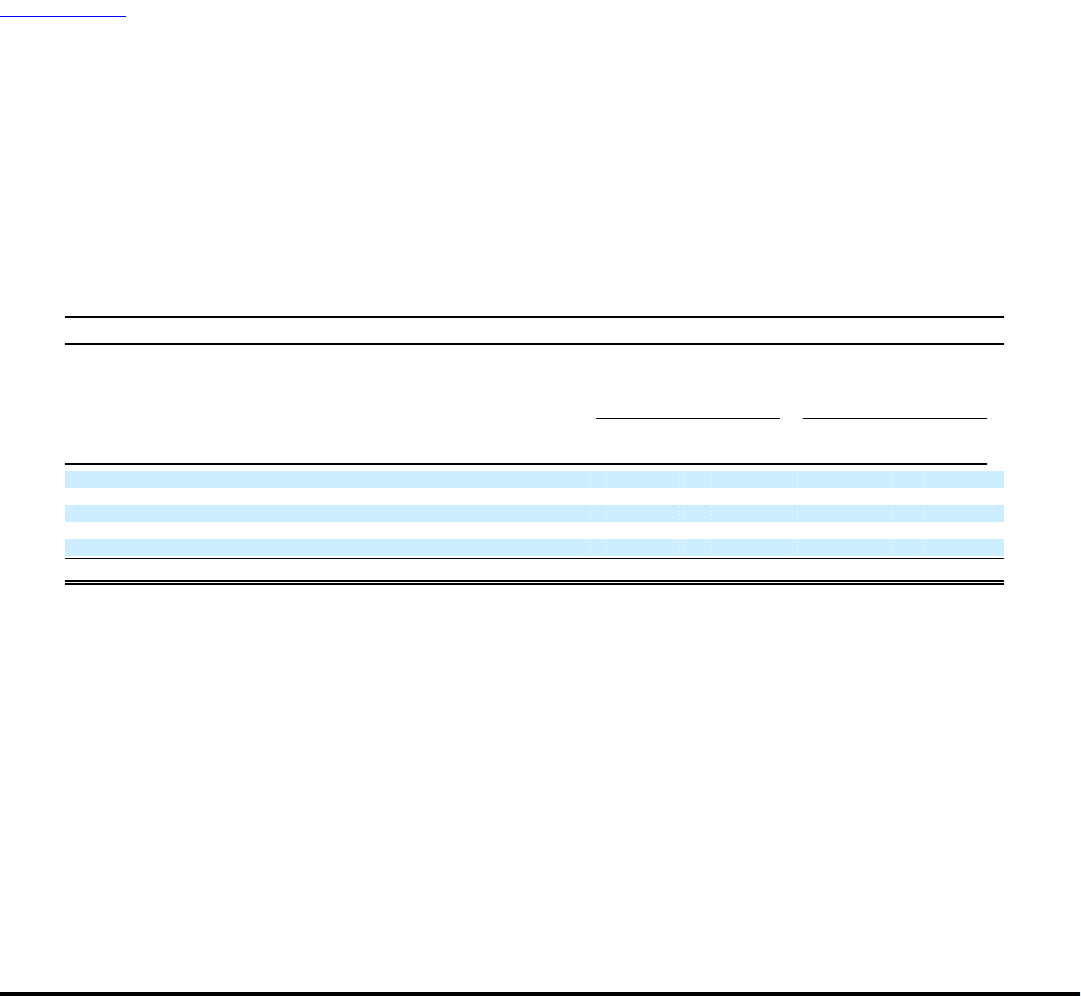

Note 10 — Debt

Following is a summary of the outstanding debt at December 31:

2008 2007

Weighted- Weighted-

Average Average

(Amounts in thousands) Amount Interest Rate Amount Interest Rate

Senior Tranche A Loan, due 2013 $ 100,000 6.33% $ —

Senior term loan — extinguished — 100,000 5.91%

Senior Tranche B Loan, net of unamortized discount, due 2013 233,881 7.78% —

Senior revolving credit facility, due 2013 145,000 6.27% 245,000 5.85%

Second lien notes, due 2018 500,000 13.25% —

Total debt $ 978,881 $ 345,000

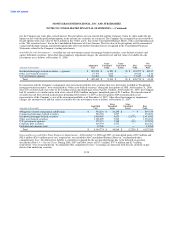

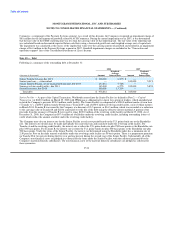

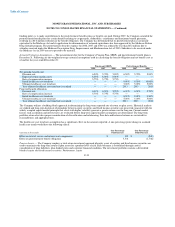

Senior Facility — As part of the Capital Transaction, Worldwide entered into the Senior Facility (as defined in Note 2 — Capital

Transaction ) of $600.0 million on March 25, 2008 with JPMorgan as Administrative Agent for a group of lenders, which amended and

restated the Company's previous $350.0 million credit facility. The Senior Facility is comprised of a $100.0 million tranche A term loan

("Tranche A"), a $250.0 million tranche B term loan ("Tranche B") and a $250.0 million revolving credit facility, each of which matures

in March 2013. Tranche B was issued by the Company at a discount of 93.5 percent, or $16.3 million, which was recorded as a reduction

to the carrying value of Tranche B and will be amortized over the life of the debt using the effective interest method. A portion of the

proceeds from the issuance of Tranche B were used to repay $100.0 million of the revolving credit facility on March 25, 2008. As of

December 31, 2008, the Company has $97.4 million of availability under the revolving credit facility, including outstanding letters of

credit which reduce the amount available under the revolving credit facility.

The Company may elect an interest rate for the Senior Facility at each reset period based on the U.S. prime bank rate or the Eurodollar

rate. The interest rate election may be made individually for each term loan and each draw under the revolving credit facility. For

Tranche A and the revolving credit facility, the interest rate is either the U.S. prime bank rate plus 250 basis points or the Eurodollar rate

plus 350 basis points. For Tranche B, the interest rate is either the U.S. prime bank rate plus 400 basis points or the Eurodollar rate plus

500 basis points. Under the terms of the Senior Facility, the interest rate determined using the Eurodollar index has a minimum rate of

2.50 percent. Fees on the daily unused availability under the revolving credit facility are 50 basis points. There is a prepayment premium

on Tranche B of two percent during the first year and one percent during the second year of the Senior Facility. Substantially all of the

Company's non-financial assets are pledged as collateral for the loans under the Senior Facility, with the collateral guaranteed by the

Company's material domestic subsidiaries. The non-financial assets of the material domestic subsidiaries are pledged as collateral for

these guarantees.

F-36