MoneyGram 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

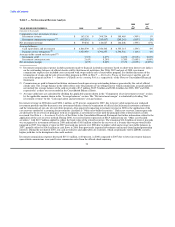

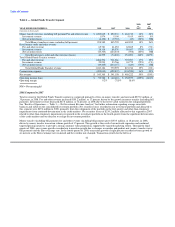

$168.0 million, or 55 percent, in 2008 from lower yields earned on our realigned portfolio and the decline in investable balances from the

departure of official check financial institution customers. Fee and other revenue increased $1.8 million, or 5 percent, in 2008, due to

recoveries of costs for forms related to terminated financial institution customers.

Commissions expense includes payments made to financial institution customers based on official check average investable balances and

short-term interest rate indices, as well as costs related to the sale of receivables program. For the Payment Systems segment,

commissions expense also includes costs associated with interest rate swaps used to hedge our variable rate commission payments.

Commissions expense decreased $129.3 million in 2008, primarily from lower investable balances from the departure of financial

institution customers, repricing initiatives and a steady decline in the effective federal funds rate during the year. These factors were

partially offset by a $27.7 million loss from the termination of the interest rate swaps in the first quarter of 2008. See Note 7 —

Derivative Financial Instruments of the Notes to Consolidated Financial Statements for further information regarding the termination of

the commission swaps.

Operating loss for 2008 was $286.8 million as compared to an operating loss of $920.1 million in 2007, reflecting the lower net securities

losses. The net investment margin of 0.84 percent in 2008 as compared to 1.47 percent in 2007 reflects the lower yields on our realigned

portfolio, partially offset by lower commission rates from the repricing initiatives and the declining federal funds rate. As the lower

commission rates did not go into effect until the second half of 2008, the lower yields on the portfolio offset the benefits of the repricing

initiatives.

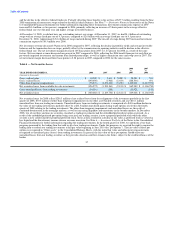

2007 Compared to 2006

Total Payment Systems losses of $614.4 million in 2007 reflects allocated net securities losses of $955.6 million relating to other-than-

temporary impairments recognized in the investment portfolio in the fourth quarter of 2007 from the significant deterioration of the credit

markets, ratings downgrades and growing uncertainty and illiquidity. See further discussion of the losses in Note 6 — Investment

Portfolio of the Notes to Consolidated Financial Statements. Investment revenue remained relatively stable from 2006, while fee and

other revenue declined slightly as 2006 benefited from $2.2 million of early termination fees.

Commissions expense increased two percent in 2007, primarily due to an increase in the average federal funds rate over 2006, as well as

the run-off of interest rate swaps through normal maturities.

Operating loss of $920.1 million in 2007 compared to operating income of $41.6 million in 2006 reflects the net securities losses from the

deterioration of the credit markets in late 2007 and a goodwill impairment charge of $6.4 million relating to one component of the

Payment Systems segment. After considering the net securities losses and goodwill impairment charge, the operating margin for 2007

declined 70 basis points from 2006 due primarily to the run-off of interest rate swaps. The operating margin in 2006 of 12.3 percent

included a 2.6 percentage point contribution from cash flows from previously impaired securities, income from limited partnership

interests and early termination fees.

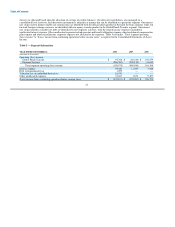

Outlook for 2009

Our outlook for 2009 is based on information presently available and contains certain assumptions regarding future economic conditions.

Differences in actual economic conditions during 2009 compared with our assumptions could have a material impact on our results. See

"Cautionary Statements Regarding Forward-Looking Statements" and Item 1A. Risk Factors of this Annual Report on Form 10-K for

additional factors that could cause results to differ materially from those contemplated by the following forward-looking statements.

Worldwide economic conditions began deteriorating significantly in 2008, with many countries, including the United States, formally

announcing that their economies were in a recession. The deterioration in the global economy is evidenced by many factors, including

increasing unemployment, substantial government assistance to citizens and certain industries, significant declines in asset values,

increasing rates of consumer defaults and corporate bankruptcies and decreased consumer confidence and spending. We cannot predict

the duration or extent of severity of this economic downturn, nor the extent to which these global economic developments could

negatively affect our business, operating results or financial condition.

46