MoneyGram 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

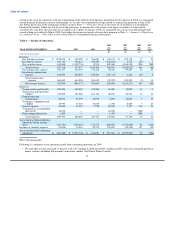

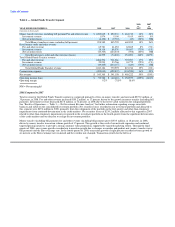

resulted in incremental fee and other revenue of $149.2 million in 2008, while changes in product and corridor mix resulted in

incremental revenue of $3.1 million in 2008. Our domestic originated transactions, which contribute lower revenue per transaction,

increased 16 percent in 2008. Internationally originated transactions (outside of North America) increased 17 percent in 2008.

Transaction volume to Mexico grew two percent in 2008 compared to eight percent in 2007, reflecting slowing growth from the

economic conditions in the U.S. housing market and immigration concerns. Mexico represented nine percent of our total transactions in

2008 compared to 10 percent in 2007.

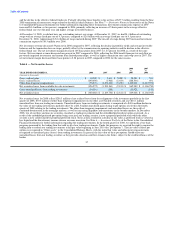

The money transfer agent base expanded 23 percent to approximately 176,000 locations in 2008, primarily due to the international

markets. At December 31, 2008, money transfer agents are located in the following geographic regions: 47,500 locations in Western

Europe and the Middle East; 44,000 locations in North America; 24,600 locations in Latin America (including 11,900 in Mexico); 22,700

locations in Eastern Europe; 15,900 locations in the Indian subcontinent; 14,800 locations in Asia Pacific; and 6,500 locations in Africa.

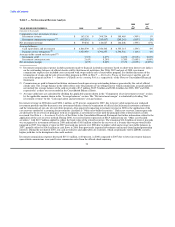

Our targeted pricing initiatives, which were initiated in the first half of 2005, included reducing the number of pricing tiers or bands,

allowing us to manage our price-volume dynamic while streamlining the point of sale process for our agents and customers. While

targeted pricing initiatives have contributed to a lower average per transaction fee, we believe that the initiatives have contributed to our

volume growth for money transfer as a simpler pricing process and lower overall fees attracts new customers. We continue to evaluate the

price-volume dynamic and will make further changes where deemed appropriate to support our consumer value proposition.

In January 2008, we launched our MoneyGram Rewards loyalty program in the United States, which provides tiered discounts on

transaction fees to our repeat consumers, less paperwork and notifications to the sender when the funds are received, among other

features. We believe this program contributed to the strong domestic transaction growth, attracting both new and repeat consumers. We

intend to roll-out a loyalty program in Canada and select European markets in 2009, as well as make revisions to the existing program to

further enhance its attractiveness to consumers.

Fee and other revenue for retail money order and other products increased eight percent in 2008 from the acquisition of PropertyBridge in

October 2007, partially offset by a decline in fee and other revenue for retail money order. While retail money order volumes declined

6 percent during 2008, retail money order fee and other revenue only declined two percent due to non-volume based revenue. In the

fourth quarter of 2008, we implemented the first phase of a repricing initiative and undertook a review of the risk versus reward for our

money order only agents. Although we expect fees to increase from the repricing initiatives, we expect fees to decline on lower volumes

from the attrition of money order agents as a result of these initiatives.

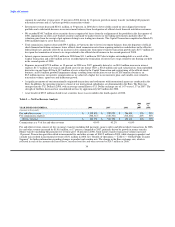

Commissions expense consists primarily of fees paid to our third-party agents for the money transfer service, as well as investment

commissions expense and costs related to the sale of receivables program. Commissions expense increased 16 percent in 2008, primarily

driven by higher money transfer transaction volume, higher commission rates, amortization of signing bonuses and increases in the Euro

exchange rate. Higher money transfer transaction volumes increased fee commissions expense by $59.7 million in 2008, while higher

average commissions per transaction, primarily from Walmart, increased commissions by $16.4 million. The extension of the term of the

current agreement with Walmart, our largest agent, through January 2013 includes certain commission increases over the term of the

contract. The Walmart commission rate increased one percent effective March 25, 2008, but is not scheduled to increase again until 2011.

Commissions expense in 2008 benefited from the termination of the sale of receivables program in the first quarter of 2008. For 2007,

commissions expense included $22.3 million of expense related to the sale of receivables program, while minimal expense was incurred

in 2008 prior to the termination of the program.

Operating income of $95.8 million and an operating margin of 9.2 percent in 2008 increased from an operating loss of $60.4 million and

an operating margin of (7.8) percent in 2007, reflecting substantially lower net securities losses and the growth of money transfer

(including bill payment) fee revenue at a faster pace than commissions expense growth and investment revenue declines.

43