MoneyGram 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

the discount rate used in the 2008 valuation, fair value would be reduced by approximately $45.9 million, assuming all other components

of the fair value estimate remain unchanged.

In the fourth quarter of 2008, we decided to exit the business formerly known as ACH Commerce, which is a component of our Payment

Systems segment. As a result, we recognized an $8.8 million goodwill impairment charge. In 2007, we recognized a $6.4 million

goodwill impairment charge as a result of the annual impairment test of the FSMC, Inc. ("FSMC") reporting unit, which is a component

of our Payment Systems segment. We did not recognize any impairment charges for goodwill during 2006. See Note 9 — Intangibles and

Goodwill of the Notes to Consolidated Financial Statements for further discussion.

Pension obligations — We provide defined benefit pension plan coverage to certain of our employees, as well as former employees of

Viad. Our pension obligations were measured as of November 30 through 2007 and as of December 31 beginning in 2008 (the

"measurement date"). The change in measurement date is due to the adoption of the measurement date provisions of SFAS No. 158,

Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans, on January 1, 2008. Pension benefits and the related

expense are based upon actuarial projections using assumptions regarding mortality, discount rates, long-term return on assets and other

factors. Following are the assumptions used to measure the projected benefit obligation as of each measurement date and the net periodic

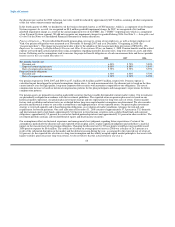

benefit cost for the year ended December 31:

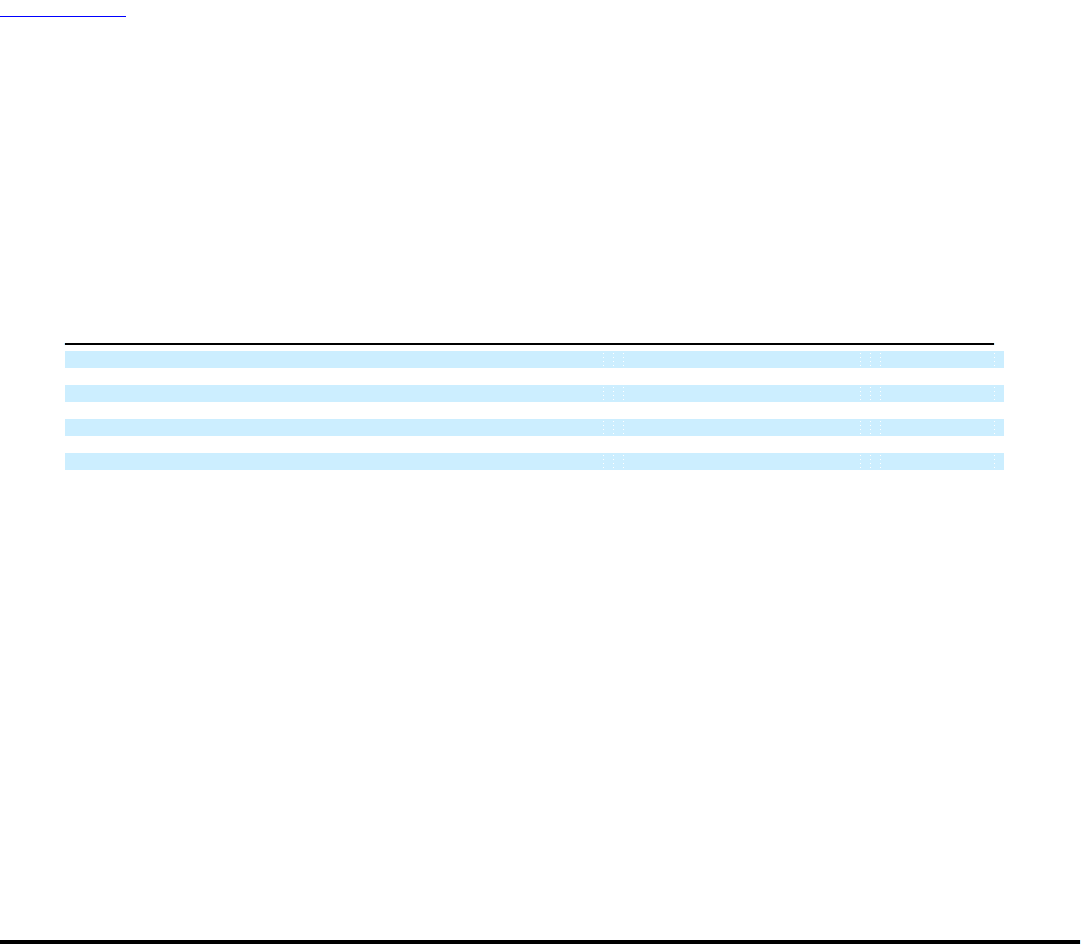

2008 2007 2006

Net periodic benefit cost:

Discount rate 6.50% 5.70% 5.90%

Expected return on plan assets 8.00% 8.00% 8.00%

Rate of compensation increase 5.75% 5.75% 5.75%

Projected benefit obligation:

Discount rate 6.30% 6.50% 5.70%

Rate of compensation increase 5.75% 5.75% 5.75%

Our pension expense for 2008, 2007 and 2006 was $7.1 million, $8.8 million and $9.5 million, respectively. Pension expense is

calculated in part based upon the actuarial assumptions shown above. At each measurement date, the discount rate is based on the then

current interest rates for high-quality, long-term corporate debt securities with maturities comparable to our obligations. The rate of

compensation increase is based on historical compensation patterns for the plan participants and management's expectations for future

compensation patterns.

Our pension assets are primarily invested in marketable securities that have readily determinable current market values. Our investments

are periodically realigned in accordance with the investment guidelines. The expected return on pension plan assets is based on our

historical market experience, our pension plan investment strategy and our expectations for long-term rates of return. Current market

factors such as inflation and interest rates are evaluated before long-term capital market assumptions are determined. We also consider

peer data and historical returns to assess the reasonableness and appropriateness of our expected return. Our pension plan investment

strategy is reviewed annually and is based upon plan obligations, an evaluation of market conditions, tolerance for risk and cash

requirements for benefit payments. Our asset allocation at December 31, 2008 consists of approximately 57.5 percent in U.S. domestic

and international equity stock funds, approximately 34.0 percent in fixed income securities such as global bond funds and corporate

obligations, approximately 5.5 percent in a real estate limited partnership interest and approximately 3.0 percent in other securities. The

investment portfolio contains a diversified blend of equity and fixed income securities.

Our assumptions reflect our historical experience and management's best judgment regarding future expectations. Certain of the

assumptions, particularly the discount rate and expected return on plan assets, require significant judgment and could have a material

impact on the measurement of our pension obligation. Changing the discount rate by 50 basis points would have increased/decreased

2008 pension expense by $0.6 million. The actual rate of return on average pension assets in 2008 was a decline of 26.3 percent as a

result of the substantial disruption in the market and the global recession during the year, as compared to the expected rate of return of

8.0 percent. As the expected rate of return is a long-term assumption and the widely accepted capital market principle is that assets with

higher volatility generate greater long-term returns, we do not believe that the actual return for one year is

68