MoneyGram 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

from the auction rate securities equal to the fair value of the put options received, with a corresponding gain in the Consolidated

Statements of (Loss) Income. Changes in the fair value of the put options are recognized in the "Net securities losses" line in the

Consolidated Statements of (Loss) Income.

In January 2008, Moody's Investor Service ("Moody's"), Standard & Poors ("S&P") and Fitch Ratings ("Fitch") downgraded our senior

unsecured debt rating to non-investment grade at Ba1, BB and BB-, respectively. In March 2008, S&P downgraded our senior unsecured

debt rating to B+. Moody's, S&P and Fitch have also placed us on watch for potential additional downgrades. It is possible that one or

more rating agencies will downgrade our debt rating in the future; however, there is no impact to our Senior Facility or Notes if such a

downgrade were to occur. Any change in our debt rating would not affect our regulatory status as state and federal regulatory authorities

do not consider such ratings as criteria in determining licensing or regulatory compliance.

Other Funding Sources and Requirements

At December 31, 2008, we had overdraft facilities consisting of $7.6 million of letters of credit to assist in the management of our

investments and the clearing of our payment service obligations. All of these letters of credit were outstanding as of December 31, 2008,

but no amounts have been drawn under the letters of credit. These overdraft facilities reduce the amounts available under the Senior

Facility described in Note 10 — Debt of the Notes to Consolidated Financial Statements; accordingly, disclosures of amounts available

under the Senior Facility include the outstanding letters of credit.

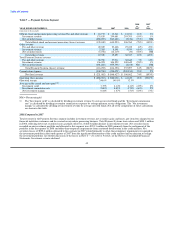

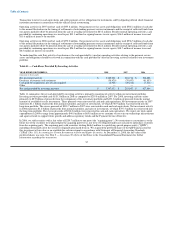

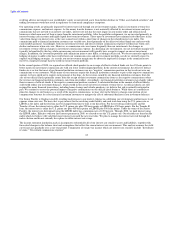

Contractual Obligations — The following table includes aggregated information about the Company's contractual obligations that impact

its liquidity and capital needs. The table includes information about payments due under specified contractual obligations, aggregated by

type of contractual obligation.

Table 9 — Contractual Obligations

Payments due by period

Less than More than

(Amounts in thousands) Total 1 year 1-3 years 4-5 years 5 years

Debt, including interest payments $ 1,742,573 $ 101,694 $ 202,576 $ 657,661 $ 780,642

Operating leases 44,510 10,536 17,375 9,025 7,574

Other obligations $ 636 636 — — —

Total contractual cash obligations $ 1,787,719 $ 112,866 $ 219,951 $ 666,686 $ 788,216

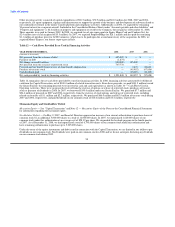

Debt consists of amounts outstanding under the term loan and revolving credit facility at December 31, 2008, as described in Note 10 —

Debt of the Notes to Consolidated Financial Statements, as well as related interest payments, facility fees and annual commitment fees.

Included in our Consolidated Balance Sheet at December 31, 2008 is $978.9 million of debt, net of unamortized discounts of

$14.2 million, and $0.1 million of accrued interest on the debt. The above table reflects the principal and interest that will be paid through

the maturity of the debt using the rates in effect on December 31, 2008. At December 31, 2008, we had outstanding borrowings under the

Senior Facility of $493.1 million. Our outstanding debt has a floating interest rate indexed to either the U.S. prime bank rate or LIBOR

based on our election. For disclosure purposes, the interest rate for future periods has been assumed to be 5.75 to 7.25 percent, which are

the rates in effect on December 31, 2008 based on the U.S. prime bank rate. At December 31, 2008, we had outstanding borrowings

under the Notes of $500.0 million. The interest expense on the Notes is payable quarterly at a rate of 13.25 percent. Prior to March 25,

2011, the Company can elect to capitalize the interest when due, but if so elected, the interest rate increases to 15.25 percent. The

Company has paid the interest payments due on the Notes and Table 9 assumes that the Company will continue to pay interest as due.

Operating leases consist of various leases for buildings and equipment used in our business. Other obligations are unfunded capital

commitments related to our limited partnership interests included in our investment portfolio. We have other commitments as described

further below that are not included in Table 9.

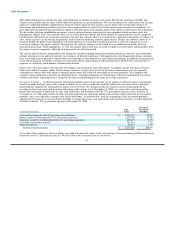

The Series B Stock has a cash dividend rate of 10 percent. At the Company's option, dividends may be accrued through March 25, 2013

at a rate of 12.5 percent in lieu of paying a cash dividend. Due to restrictions in our debt agreements, we elected to accrue the dividends

in 2008 and expect that dividends will be accrued and not paid in

55