MoneyGram 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

resulting adverse movement in our stockholders' equity or unrestricted assets from further declines in "Other asset-backed securities" and

trading investments would not result in regulatory or contractual compliance exceptions.

Our operating results are primarily impacted by interest rate risk through our net investment margin, which is investment revenue less

commissions expense, and interest expense. As the money transfer business is not materially affected by investment revenue and pays

commissions that are not tied to an interest rate index, interest rate risk has the most impact on our money order and official check

businesses which earn most of their revenue from the investment portfolio. After the portfolio realignment, we are invested primarily in

interest-bearing cash accounts and highly liquid short-term investments. These types of investment have minimal risk of declines in fair

value from changes in interest rates as the rates earned reset within a short time of changes in the related interest rate index. Our

commissions paid to financial institution customers are variable rate, based primarily on the effective federal funds rate and reset with

each monthly payment. Accordingly, both our investment revenue and our investment commissions expense will decrease when rates

decline and increase when rates rise. However, as commission rates reset more frequently than our investments, the changes in

investment revenue will lag changes in investment commissions expense. In a declining rate environment, our net investment margin will

typically be benefited by this lag, while an increasing rate environment will typically have a negative impact on our net investment

margin. In addition, the investment portfolio and commission interest rates differ, resulting in basis risk. We do not currently employ any

hedging strategies to address the basis risk between our commission rates and our investment portfolio, nor do we currently expect to

employ such hedging strategies. As a result, our net investment margin may be adversely impacted if changes in the commission rate

move by a larger percentage than the yield on our investment portfolio.

In the second quarter of 2008, we repriced our official check product to an average of effective federal funds rate less 85 basis points to

better match our investment commission rate with our lower yield realigned portfolio. In the current environment, the effective federal

funds rate is so low that most of our financial institution customers are in a "negative" commission position, in that we do not owe any

commissions to our customers. While many of our contracts require the financial institution customers to pay us the negative commission

amount, we have opted not to require such payment at this time. As the revenue earned by our financial institution customers from the

sale of our official checks primarily comes from the receipt of their investment commissions from us, the negative commissions reduce

the revenue our financial insitution customers earn from our product. Accordingly, our financial institution customers may sharply reduce

their issuances of official checks if the negative commission positions continue. A substantial decline in the amount of official checks

sold would reduce our investment balances, which would in turn result in lower investment revenue for us. As official checks are still

required for many financial transactions, including home closings and vehicle purchases, we believe that risk is naturally mitigated in

part. We continue to assess the potential impact of negative commissions on our official check business. While there are currently no

plans for changes to our business as a result of the negative commissions, we may elect in the future to change some portion of our

compensation structure for select financial institution customers to mitigate the risk of substantial declines in our investment balances.

Our Senior Facility is floating rate debt, resulting in decreases to our interest expense in a declining rate environment and increases to our

expense when rates rise. We may elect to pay interest for the revolving credit facility and each term loan using the U.S. prime rate or

LIBOR as the index and the election may be changed from time to time at our discretion. For the revolving credit facility and the

Tranche A loan, the interest rate is either the U.S. prime rate plus 250 basis points or LIBOR plus 350 basis points. For the Tranche B

loan, the interest rate is either the U.S. prime rate plus 400 basis points or LIBOR plus 500 basis points. Under the terms of the Senior

Facility, the interest rate determined using the LIBOR index has a minimum rate of 2.50 percent. Through 2008, we paid interest using

the LIBOR index. Effective with our first interest payment in 2009, we elected to use the U.S. prime rate. Our elections are based on the

index which we believe will yield the lowest interest rate until the next reset date. We plan to manage the interest rate risk through the

index election and do not currently have plans to utilize interest rate swaps.

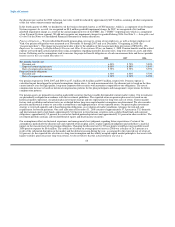

The income statement simulation analysis incorporates substantially all of our interest rate sensitive assets and liabilities, together with

forecasted changes in the balance sheet and assumptions that reflect the current interest rate environment. This analysis assumes the yield

curve increases gradually over a one-year period. Components of our pre-tax income which are interest rate sensitive include "Investment

revenue," "Investment commissions expense"

63