MoneyGram 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

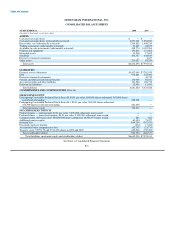

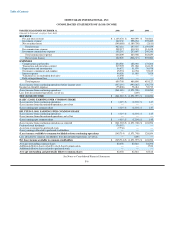

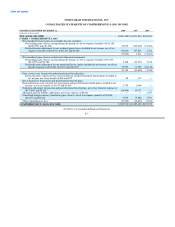

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

available to satisfy working capital or other financing requirements. Consequently, we consider a significant amount of cash and cash

equivalents, receivables and investments to be restricted to satisfy the liability to pay the face amount of regulated payment service

obligations upon presentment. The Company has unrestricted cash and cash equivalents, receivables and investments to the extent those

assets exceed all payment service obligations. These amounts are generally available; however, management considers a portion of these

amounts as providing additional assurance that regulatory requirements are maintained during the normal fluctuations in the value of

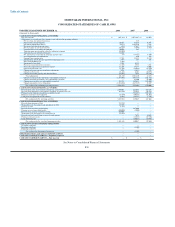

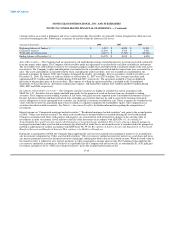

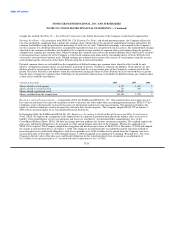

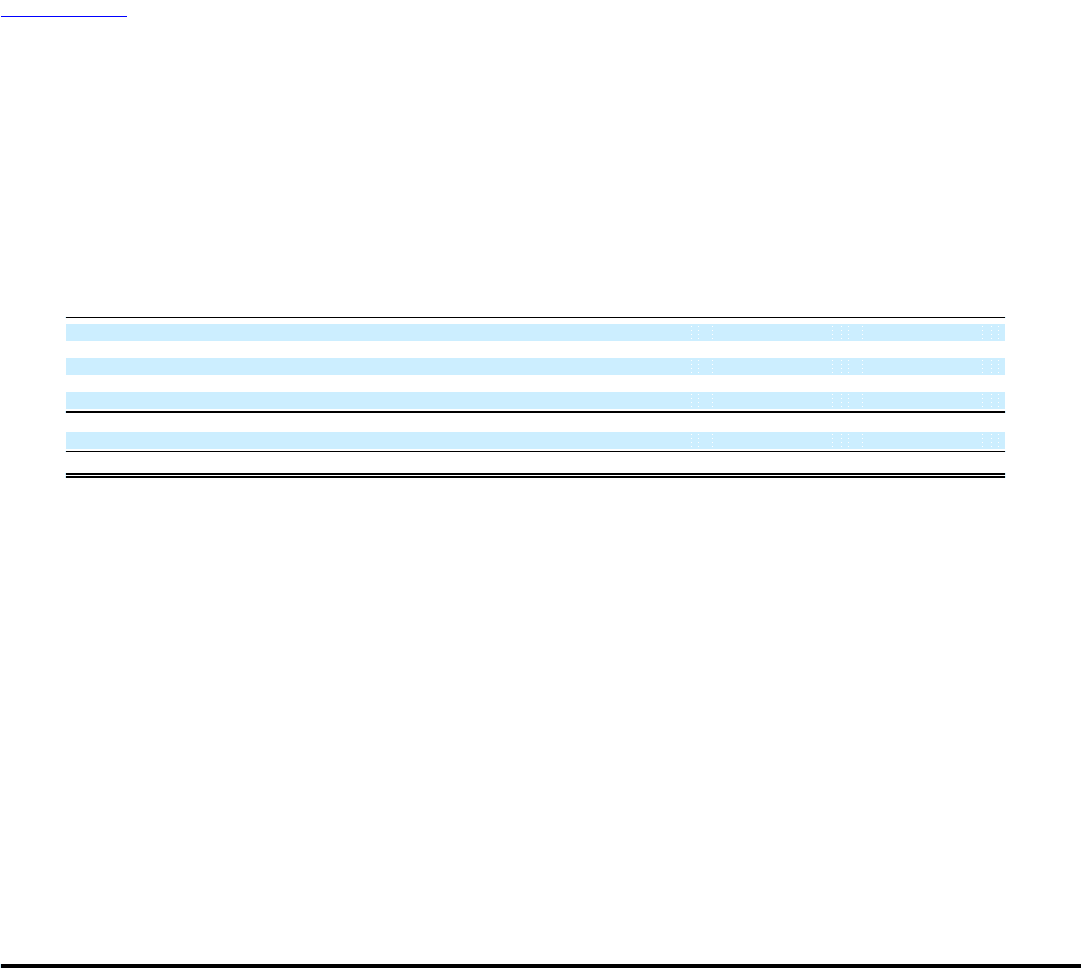

investments. The following table shows the total amount of unrestricted assets at December 31:

(Amounts in thousands) 2008 2007

Cash and cash equivalents (substantially restricted) $ 4,077,381 $ 1,552,949

Receivables, net (substantially restricted) 1,264,885 1,408,220

Trading investments (substantially restricted) 21,485 62,105

Put options related to trading investments 26,505 —

Available-for-sale investments (substantially restricted) 438,774 4,187,384

5,829,030 7,210,658

Amounts restricted to cover payment service obligations (5,437,999) (7,762,470)

Excess (shortfall) in unrestricted assets $ 391,031 $ (551,812)

The Company had a shortfall in its unrestricted assets at December 31, 2007 due to the decline in the fair value of its investment

portfolio. Regulatory requirements also require MPSI, the licensed entity and wholly owned operating subsidiary of the Company, to

maintain positive net worth, with one state also requiring that MPSI maintain positive tangible net worth. From the period of

December 31, 2007 through March 24, 2008, the Company was not in compliance with the tangible net worth requirement as a result of

declines in the investment portfolio. In July 2008, MPSI was informed by the applicable state that it was contemplating the assessment of

a fine for the period of non-compliance. As of December 31, 2008, no such fine has been assessed and the Company believes any such

fine would not be material to the Company's Consolidated Financial Statements. Since March 25, 2008, the Company has been in

compliance with regulatory requirements for all states. In our most restrictive state, the Company had excess permissible investments

over the state's payment service obligations measure of $1.4 billion at December 31, 2008; all other states had substantially higher excess

permissible investments. The Company is also in compliance with all contractual requirements as of December 31, 2008.

Cash and Cash Equivalents (substantially restricted) — The Company defines cash and cash equivalents as cash on hand and all highly

liquid debt instruments with original maturities of three months or less at the purchase date which the Company does not intend to

rollover.

Receivables, net (substantially restricted) — The Company has receivables due from financial institutions and agents for payment

instruments sold. These receivables are outstanding from the day of the sale of the payment instrument until the financial institution or

agent remits the funds to the Company. The Company provides an allowance for the portion of the receivable estimated to become

uncollectible.

Allowance for Losses on Receivables — The Company provides an allowance for potential losses from receivables from agents and

financial institution customers. The allowance is determined based on known delinquent accounts and historical trends. Receivables are

generally considered past due two days after the contractual remittance schedule, which is typically one to three days after the sale of the

underlying payment instrument. Receivables are evaluated for collectibility and possible write-off by examining the facts and

circumstances surrounding each

F-14