MoneyGram 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

cash for the foreseeable future. While no dividends have been declared as of December 31, 2008, we have accrued dividends of

$76.6 million in our Consolidated Balance Sheets as accumulated and unpaid dividends are included in the redemption price of the

Series B Stock regardless of whether dividends have been declared.

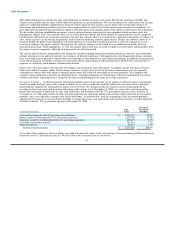

We have a funded, noncontributory pension plan that is frozen to both future benefit accruals and new participants. Our funding policy

has historically been to contribute at least the minimum contribution required by applicable regulations. We were not required to and did

not make a contribution to the funded pension plan during 2008. The fair value of the pension plan assets declined by $30.6 million

during the year as a result of the severe market deterioration in 2008, reducing the pension plan's funded status by approximately

20 percent. This decline in the funded status will accelerate minimum required contributions in the future, beginning with an estimated

minimum required contribution of $3.0 million for 2009. We also have certain unfunded pension and postretirement plans that require

benefit payments over extended periods of time. During 2008, we paid benefits totaling $4.5 million related to these unfunded plans.

Benefit payments under these unfunded plans are expected to be $4.5 million in 2009. Expected contributions and benefit payments under

these plans are not included in the table above. See "Critical Accounting Policies — Pension Obligations" for further discussion of these

plans.

As of December 31, 2008, the liability for unrecognized tax benefits is $13.1 million. As there is a high degree of uncertainty regarding

the timing of potential future cash outflows associated with liabilities relating to FIN 48, Accounting for Uncertainty in Income Taxes, we

are unable to make a reasonably reliable estimate of the amount and period in which these liabilities might be paid.

In limited circumstances, we may grant minimum commission guarantees as an incentive to new or renewing agents, for a specified

period of time at a contractually specified amount. Under the guarantees, we will pay to the agent the difference between the

contractually specified minimum commission and the actual commissions earned by the agent. As of December 31, 2008, the minimum

commission guarantees had a maximum payment of $16.3 million over a weighted average remaining term of 1.8 years. The maximum

payment is calculated as the contractually guaranteed minimum commission times the remaining term of the contract and, therefore,

assumes that the agent generates no money transfer transactions during the remainder of its contract. As of December 31, 2008, the

liability for minimum commission guarantees is $2.7 million. Minimum commission guarantees are not reflected in the table above.

Analysis of Cash Flows

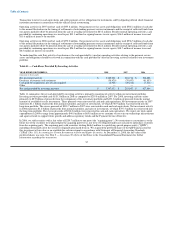

Table 10 — Cash Flows Used In Operating Activities

YEAR ENDED DECEMBER 31, 2008 2007 2006

(Amounts in thousands)

Net (loss) income $ (261,385) $(1,071,997) $ 124,054

Total adjustments to reconcile net income 341,740 1,301,410 42,485

Net cash provided by continuing operating activities before changes in payment service assets

and obligations 80,355 229,413 166,539

Change in cash and cash equivalents (substantially restricted) (2,524,402) (563,779) (261,725)

Change in trading investments, net (substantially restricted) — 83,200 22,200

Change in receivables, net (substantially restricted) 128,752 342,681 (335,509)

Change in payment service obligations (2,324,486) (447,319) 38,489

Net change in payment service assets and obligations (4,720,136) (585,217) (536,545)

Net cash used in continuing operating activities $(4,639,781) $ (355,804) $(370,006)

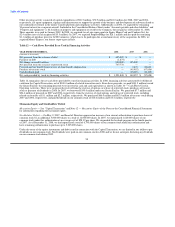

Table 10 summarizes the net cash flows used in operating activities, with the primary operating cash flows related to our payment service

assets and obligations. Operating activities used net cash of $4.6 billion in 2008. Besides normal operating activities, cash provided by

continuing operations was used to pay $84.0 million of interest on our debt, $57.7 million for signing bonuses to new agents and

$29.7 million to terminate our interest rate swaps. We also received an income tax refund of $24.7 million during 2008 and did not make

any tax payments. During 2008, we used $4.7 billion of proceeds from the sale and normal maturity of available-for-sale securities and

the Capital

56