MoneyGram 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

In June 2008, the FASB issued FSP EITF 03-6-1, Determining Whether Instruments Granted in Share-Based Payment Transactions Are

Participating Securities. FSP EITF 03-6-1 addresses whether instruments granted in share-based payment transactions are participating

securities prior to vesting and, therefore, need to be included in computing earnings per share under the two-class method described in

SFAS No. 128. FSP EITF 03-6-1 requires companies to treat unvested share-based payment awards that have non-forfeitable rights to

dividend or dividend equivalents as a separate class of securities in calculating earnings per share. FSP EITF 03-6-1 will be effective for

the Company's fiscal year beginning January 1, 2009, with early adoption prohibited. The Company is currently evaluating the impact of

FSP EITF 03-6-1 on its Consolidated Financial Statements.

In October 2008, the FASB issued FSP FAS 157-3, Determining the Fair Value of a Financial Asset When the Market for That Asset Is

Not Active. FSP FAS 157-3 clarifies the application of SFAS 157 in a market that is not active and provides an example to illustrate key

considerations in determining the fair value of a financial asset when the market for that financial asset is not active. The Company

determines the fair value of certain of its cash equivalents, trading investments, available-for-sale investments and derivative financial

instruments based on the guidance set forth in SFAS 157 as described in Note 5 — Fair Value Measurement. The Company adopted FSP

SFAS No. 157-3 in October 2008 with no material impact on its Consolidated Financial Statements.

In December 2008, the FASB issued FSP FAS 140-4 and FIN 46(R)-8, Disclosures by Public Entities (Enterprises) about Transfers of

Financial Assets and Interests in Variable Interest Entities. FSP FAS 140-4 and FIN 46(R)-8 increases disclosures for public companies

about securitizations, asset-backed financings and variable interest entities. The Company adopted FSP FAS 140-4 and FIN 46(R)-8 with

no material impact on its Consolidated Financial Statements.

Note 4 — Acquisitions and Discontinued Operations

Raphael's Bank France — On February 2, 2009, MoneyGram acquired the French assets of R. Raphael's & Sons PLC ("Raphael's Bank")

for a purchase price of $3.2 million. The acquisition of Raphael's Bank provides us with five highly productive money transfer stores in

and around Paris, France that will be integrated into our French retail operations. We incurred $0.2 million of transaction costs related to

this acquisition in 2008 which are included in the "Transaction and operations" expense line in the Consolidated Income Statements. The

acquired net assets and operating results of Raphael's Bank are not included in the Company's Consolidated Financial Statements as of

December 31, 2008 as the acquisition occurred subsequent to that date.

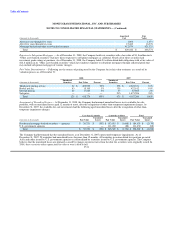

MoneyCard World Express, S.A. and Cambios Sol S.A. — On July 10, 2008 and July 31, 2008, MoneyGram acquired MoneyCard World

Express, S.A. ("MoneyCard") and Cambios Sol S.A. ("Cambios Sol"), two of its former super-agents in Spain, for purchase prices of

$3.4 million and $4.5 million, respectively, including cash acquired of $1.4 million and $4.1 million, respectively. The acquisition of

these money transfer entities provide the Company with a money transfer license in Spain, as well as the opportunity for further network

expansion and more control over marketing and promotional activities in the region.

The purchase price allocation as of December 31, 2008 includes $4.3 million of goodwill assigned to the Company's Global Funds

Transfer segment and $1.4 million of intangible assets. The intangible assets consist primarily of agent rights and developed technology

and will be amortized over useful lives ranging from three to five years. In addition, we recognized an indefinite life intangible asset of

$0.6 million relating to the money transfer license. The purchase price allocation includes $0.5 million of transaction costs. The operating

results of MoneyCard and Cambios Sol subsequent to the acquisition dates are included in the Company's Consolidated Statements of

(Loss) Income. The financial impact of the acquisitions is not material to the Consolidated Balance Sheets or Consolidated Statements of

(Loss) Income.

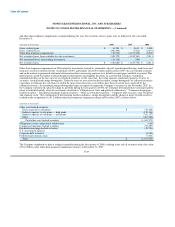

PropertyBridge, Inc. — On October 1, 2007, the Company acquired PropertyBridge, Inc. ("PropertyBridge") for $28.1 million.

PropertyBridge is a provider of electronic payment processing services for the real estate

F-22