MoneyGram 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Item 1B. UNRESOLVED SEC COMMENTS

None.

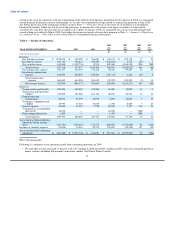

Item 2. PROPERTIES

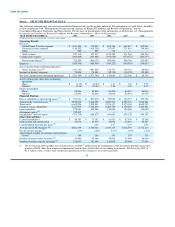

Location Use Segment(s) Using Space Square Feet Lease Expiration

Minneapolis, MN Global Headquarters Both 168,211 12/31/2015

Brooklyn Center, MN Global Operations Center Both 75,000 1/31/2012

Brooklyn Center, MN Global Operations Center Both 44,026 1/31/2012

Lakewood, CO Call Center Global Funds Transfer 113,735 3/31/2012

Information concerning our material properties, all of which are leased, including location, use, approximate area in square feet and lease

terms, is set forth above. We also have a number of other smaller office locations in California, Florida, New York, Tennessee, France,

Germany, Italy and the United Kingdom, as well as small sales and marketing offices in Australia, China, Greece, Hong Kong, India,

Nigeria, Russia, South Africa, Spain, Ukraine and United Arab Emirates. We believe that our properties are sufficient to meet our current

and projected needs.

Item 3. LEGAL PROCEEDINGS

Legal proceedings — We are party to a variety of legal proceedings, including those that arise in the normal course of our business. All

legal proceedings are subject to uncertainties and outcomes that are not predictable with assurance. We accrue for legal proceedings as

losses become probable and can be reasonably estimated. Significant legal proceedings arising outside the normal course of our business

are described below. While the results of these proceedings cannot be predicted with certainty, management believes that after final

disposition, any monetary liability will not be material to our financial position. Further, the Company maintains insurance coverage for

many of the claims alleged.

Federal Securities Class Actions — The Company and certain of its officers and directors are parties to a consolidated class action case in

the United States District Court for the District of Minnesota captioned In re MoneyGram International, Inc. Securities Litigation. The

Consolidated Complaint was filed on October 3, 2008, and alleges against each defendant violations of Section 10(b) of the Securities

Exchange Act of 1934, as amended (the "Exchange Act") and Rule 10b-5 under the Exchange Act and alleges against Company officers

violations of Section 20(a) of the Exchange Act. The Consolidated Complaint alleges failure to adequately disclose, in a timely manner,

the nature and risks of the Company's investments, as well as unrealized losses and other-than-temporary impairments related to certain

of the Company's investments. The complainant seeks recovery of losses incurred by stockholder class members in connection with their

purchases of the Company's securities.

ERISA Class Action — On April 22, 2008, Delilah Morrison, on behalf of herself and all other MoneyGram 401(k) Plan participants,

brought an action in the United States District Court for the District of Minnesota. The complaint alleges claims under the Employee

Retirement Income Security Act of 1974, as amended ("ERISA"), including claims that the defendants breached fiduciary duties by

failing to manage the plan's investment in Company stock, and by continuing to offer Company stock as an investment option when the

stock was no longer a prudent investment. The complaint also alleges that defendants failed to provide complete and accurate information

regarding Company stock sufficient to advise plan participants of the risks involved with investing in Company stock and breached

fiduciary duties by failing to avoid conflicts of interests and to properly monitor the performance of plan fiduciaries and fiduciary

appointees. Finally, the complaint alleges that to the extent that the Company is not a fiduciary, it is liable for knowingly participating in

the fiduciary breaches as alleged. On August 7, 2008, plaintiff amended the complaint to add an additional plaintiff, name additional

defendants and additional allegations. For relief, the complaint seeks damages based on what the most profitable alternatives to Company

stock would have yielded, unspecified equitable relief, costs and attorneys' fees.

24