MoneyGram 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

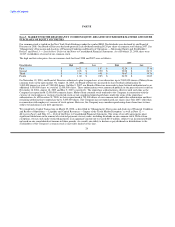

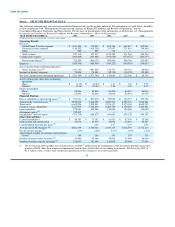

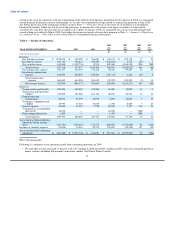

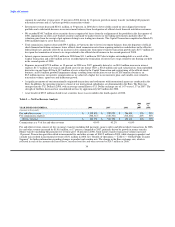

(2) Loss (income) from continuing operations before income taxes for 2008 includes a $29.7 million net loss on the termination of

swaps, a $26.5 million gain from put options on our trading investments, a $16.0 million non-cash valuation loss from changes in

the fair value of embedded derivatives on our Series B Stock and a goodwill impairment of $8.8 million related to a component of

our Global Funds Transfer segment. Net loss from continuing operations for 2007 includes a goodwill impairment of $6.4 million

related to a component of our Payment Systems segment.

(3) Unrestricted assets are substantially restricted assets less payment service obligations as calculated in Note 3 — Summary of

Significant Accounting Policies of the Notes to Consolidated Financial Statements. Substantially restricted assets are comprised of

cash and cash equivalents, receivables and investments. Substantially restricted assets for 2008 include $26.5 million for the

valuation of put options on our trading investments.

(4) Mezzanine Equity relates to our Series B Stock issued in the Capital Transaction described in Note 2 — Capital Transaction of the

Notes to Consolidated Financial Statements. See Note 12 — Mezzanine Equity of the Notes to Consolidated Financial Statements for

the terms of the Series B Stock.

(5) Cash dividends declared per share for 2004 is based on Viad declared dividends of $0.18 per share during the first half of 2004 and

MoneyGram declared dividends of $0.02 per share during the second half of 2004.

(6) Investable balances are comprised of cash and cash equivalents and investments.

(7) Net investment margin is determined as net investment revenue (investment revenue less investment commissions) divided by daily

average investable balances.

(8) Includes 30,000, 18,000, 16,000, 16,000 and 15,000 locations in 2008, 2007, 2006, 2005 and 2004, respectively, that issue both

money orders and offer money transfers.

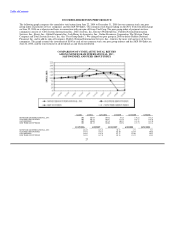

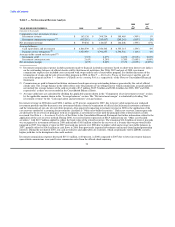

Item 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The following discussion should be read in conjunction with our Consolidated Financial Statements and related Notes. This discussion

contains forward-looking statements that involve risks and uncertainties. MoneyGram's actual results could differ materially from those

anticipated due to various factors discussed under "Cautionary Statements Regarding Forward-Looking Statements" and elsewhere in this

Annual Report on Form 10-K.

Basis of Presentation

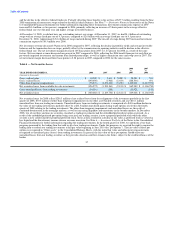

On December 18, 2003, MoneyGram International, Inc. ("MoneyGram") was incorporated in the state of Delaware as a subsidiary of

Viad Corp ("Viad") to effect the spin-off of Viad's payment services business (the "spin-off") operated by Travelers Express Company,

Inc. ("Travelers"). On June 30, 2004, Travelers was merged with a subsidiary of MoneyGram and Viad then distributed

88,556,077 shares of MoneyGram common stock to Viad's stockholders in a tax-free distribution. Effective December 31, 2005, the

entity that was formerly Travelers was merged into MoneyGram Payment Systems, Inc. ("MPSI"), with MPSI remaining as the surviving

corporation. The financial statements in this Annual Report on Form 10-K are presented on a consolidated basis and include the accounts

of the Company and our subsidiaries. See Note 3 — Summary of Significant Accounting Policies of the Notes to the Consolidated

Financial Statements for further information regarding consolidation. References to "MoneyGram," the "Company," "we," "us" and "our"

are to MoneyGram International, Inc. and its subsidiaries and consolidated entities. Our Consolidated Financial Statements are prepared

in conformity with accounting principles generally accepted in the United States of America ("GAAP").

During 2007, we paid $3.3 million in connection with the settlement of a contingency arising from the Sale and Purchase Agreement

related to the continued operations of Game Financial Corporation with one casino. We recognized a loss from discontinued operations of

$0.3 million in the Consolidated Statements of (Loss) Income in 2007, representing the recognition of a deferred tax asset valuation

allowance partially offset by the reversal of the remaining liability for contingencies which expired. The following discussion of our

results of operations is focused on our continuing businesses.

29