MoneyGram 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Money Order Repricing and Review — In the fourth quarter of 2008, we initiated the first phase of a repricing initiative for our money

order product sold through retail agent locations. This initiative increases the per-item fee we receive for our money orders and reflects

the impact of the realigned investment portfolio on the profitability of this product. We are assessing the impact of this first phase and

may roll out additional pricing initiatives in 2009 on a targeted basis. In addition, we continue to review our credit exposure to our agents

and may terminate or otherwise revise our relationship with certain agents. We expect volumes to decline from the attrition of money

order customers as a result of these initiatives.

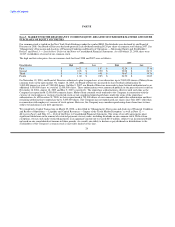

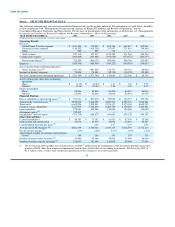

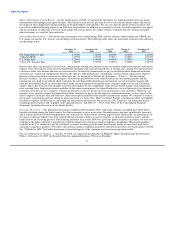

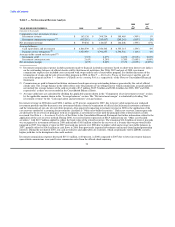

Interest Rate Environment — The interest rate environment was volatile during 2008, with the effective federal funds rate, LIBOR, the

U.S. prime rate and the U.S. treasury rate declining to historical lows. The following table shows the movement in interest rates affecting

our operating results:

December 31, September 30, June 30, March 31, December 31,

2008 2008 2008 2008 2007

Fed Funds Effective Rate 0.14000 1.81000 2.00000 2.61000 4.24000

3 Month LIBOR 1.42500 4.05250 2.78313 2.68813 4.07250

U.S. Prime Rate 3.25000 5.00000 5.00000 5.25000 7.25000

5 Year U.S. Treasury Rate 1.54890 2.97930 3.32710 2.43650 3.43970

Interest rates affect our business in several ways, but primarily through investment revenue, investment commission expense and interest

expense. First, the majority of our investment portfolio (including cash and cash equivalents) is floating rate, causing investment revenue

to decrease when rates decline and increase when rates rise. Second, the commissions we pay to our official check financial institution

customers are variable rate and primarily based on the effective federal funds rate. Accordingly, our investment commissions expense

decreases when rates decline and increases when rates rise. As discussed in "Results of Operations — Table 3 — Net Investment

Revenue Analysis," our net investment margin is based on the spread between the yield earned on our investment portfolio and the

commission rates paid to our official check customers. In a declining federal funds rate environment, our net investment margin will

typically be benefited, while an increasing federal funds rate environment will typically have a negative impact on our net investment

margin. This is due to lag in when changes in interest rates impact the two components of the net investment margin, with commission

rates resetting faster than our investment portfolio. In the current environment, the federal funds rate is so low that most of our financial

institution customers are in a "negative" commission position, in that we do not owe any commissions to our customers. While the vast

majority of our contracts require the financial institution customers to pay us for the negative commission amount, we have opted at this

time to impose certain per-item and other fees rather than require payment of the negative commissions amount. We continue to monitor

the negative commissions and may decide to pursue payment at a future date. Third, our Senior Facility is floating rate debt. Accordingly,

our interest expense will decrease in a declining rate environment and increase when rates rise. See "Expenses" for further discussion

regarding interest expense and "Liquidity and Capital Resources" and Note 10 — Debt of the Notes to the Consolidated Financial

Statements for further discussion of our Senior Facility.

Economic Recession — The global macroeconomic conditions deteriorated in 2008, with many countries, including the United States,

formally declaring during the fourth quarter that their economies were in a recession. Unemployment rates have significantly increased

and it is generally believed that unemployment rates will increase further before showing improvement. Historically, the performance of

the money remittance industry has been resilient during economic softness as money transfers are deemed essential to many, with the

funds used by the receiving party for food, housing and other basic needs. However, given the global economic uncertainty, we have less

visibility to the future and believe growth rates could be impacted by slowing economic conditions. In addition, bill payment products

available in the U.S. market may not be as resilient as money transfers given the more discretionary nature of some items paid for by

consumers using these products. We believe the current economic conditions negatively affected our growth in the fourth quarter of 2008.

See "Outlook for 2009" for further discussion of expected impacts of the economic recession on our operating results.

Executive Management Changes — On June 19, 2008, we announced the departure of Philip W. Milne, President and Chief Executive

Officer. On January 21, 2009, the Board of Directors appointed Anthony P. Ryan as President

31