MoneyGram 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

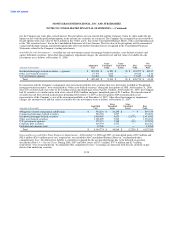

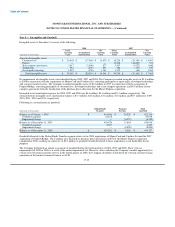

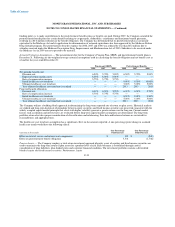

2008, the Company recognized a $6.8 million loss in "Transaction and operations support" in the Consolidated Statements of (Loss)

Income related to its forward contracts, including $2.2 million of losses reclassified from "Accumulated other comprehensive income"

upon the final settlement of the related forward contracts.

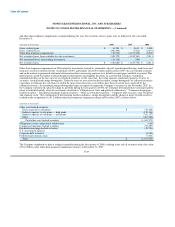

The Company is exposed to credit loss in the event of non-performance by counterparties to its derivative contracts. Collateral generally

is not required of the counterparties or of the Company. In the unlikely event a counterparty fails to meet the contractual terms of the

derivative contract, the Company's risk is limited to the fair value of the instrument. The Company actively monitors its exposure to

credit risk through the use of credit approvals and credit limits, and by selecting major international banks and financial institutions as

counterparties. The Company has not had any historical instances of non-performance by any counterparties, nor does it anticipate any

future instances of non-performance.

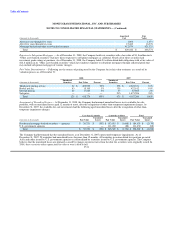

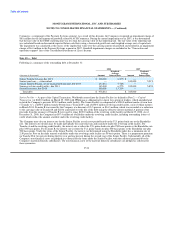

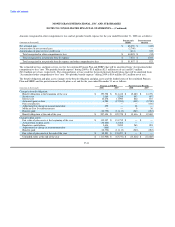

As described in Note 12 — Mezzanine Equity, the B Stock contains a conversion option allowing the stockholder to convert the B Stock

into shares of common stock. As the Certificate of Designation for the B Stock does not explicitly state that a net-cash settlement is not

required in the event the Company has insufficient shares of common stock to effect a conversion, guidance from the Securities and

Exchange Commission (the "SEC") requires the Company to presume a net-cash settlement would be required. As a result, the

conversion option met the definition of an embedded derivative requiring bifurcation and liability accounting treatment under

SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities and related interpretative guidance to the extent the

Company did not have sufficient shares to effect a full conversion. As of March 31, 2008 and June 30, 2008, the Company had a shortfall

of committed and authorized common stock, requiring the Company to recognize an embedded derivative. On August 11, 2008, the

Investors and the Company formally clarified that the provisions of the B Stock do not allow the Investors to require the Company to net-

cash settle the conversion option if the Company does not have sufficient shares of common stock to effect a conversion. Effective with

this agreement, the B Stock conversion option no longer meets the criteria for an embedded derivative requiring bifurcation and liability

accounting treatment. Accordingly, the Company remeasured the liability through August 11, 2008 and then recorded the liability to

"Additional paid-in capital" in the third quarter of 2008. The increase in the fair value of the liability from the issuance of the B Stock

through August 11, 2008 of $16.0 million was recognized in the "Valuation loss on embedded derivatives" line in the Consolidated

Statements of (Loss) Income. There will be no further impact to the Company's Consolidated Statements of (Loss) Income as no further

remeasurement of the conversion option is required.

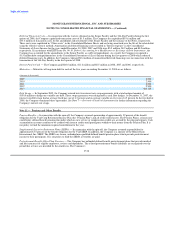

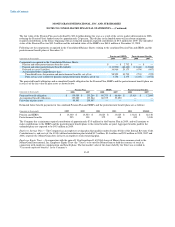

The Series B Stock also contain a change of control redemption option which, upon exercise, requires the Company to cash settle the par

value of the Series B Stock and any accumulated unpaid dividends at a one percent premium. As the cash settlement is made at a

premium, the change of control redemption option meets the definition of an embedded derivative requiring bifurcation and liability

accounting treatment under SFAS No. 133. The fair value of the change of control redemption option is de minimus as of December 31,

2008.

F-33