Experian 2016 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

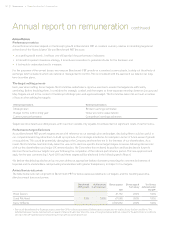

Payments made to former directors

Chris Callero

Chris Callero stepped down from the Board on 16 July 2014, and remained an employee of the Group until 31 March 2015. On 18 May 2015,

a number of CIP and PSP awards made to him in 2012 vested, based on performance over the three years ended 31 March 2015.

In accordance with the prescribed methodology, we originally estimated the value of these shares as US$5.107m, using the average

share price from 1 January 2015 to 31 March 2015 of £11.54. The actual share price on the vesting date of 18 May 2015 was £12.25,

and the updated value is US$5.606m based on the exchange rate at the date of vesting of £1:US$1.5692.

Chris Callero was granted awards under the CIP and PSP in June 2013, which are due to vest in June 2016, subject to performance.

Details are shown in the table below. As these awards had not vested at the date this Report was finalised, the value of the awards is

based on the average share price during the last three months of the financial year, which was £11.67.

CIP PSP Value of

shares vesting2

’000

Value of dividend

equivalent payments

’000

Total value of

shares vesting

’000

Shares

awarded 1

Shares

vesting

Shares

awarded1

Shares

vesting

107,294 51,071 73,336 8,305 US$991 US$67 US$1,058

1 Chris Callero was originally awarded 160,942 shares under the CIP and 110,004 shares under the PSP. In line with the Plans’ rules, these were adjusted on

a pro-rata basis to 107,294 and 73,336 shares respectively when he ceased to be an executive director. The CIP and PSP awards vested at 47.6% and 11.3%

respectively, based on the same performance outcomes which applied to the awards made to the executive directors, as described in the Share-based

incentives section of this Report.

2 The value of the shares has been converted into US dollars at a rate of £1:US$1.4304, which was the average rate during the last three months

of the financial year.

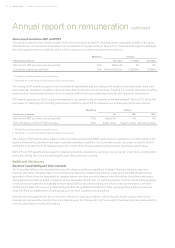

Pensions

Three former directors of Experian Finance plc (formerly GUS plc) receive unfunded pensions from the Group. Two of the former

directors are now paid under the Secured Unfunded Retirement Benefit Scheme, which provides security for the unfunded pensions

of executives affected by the HMRC earnings cap. The total unfunded pensions paid to the former directors was £418,144 in the year

ended 31 March 2016.

Payments for loss of office

No payments for loss of office were made in the year (2015: nil).

Executive directors’ non-executive directorships (not audited)

Experian recognises that external non-executive directorships are beneficial for both the executive director concerned and the

Company. In line with the recommendations of the Code, each serving executive director may accept one external non-executive

directorship, although they may not serve as the chairman of a FTSE 100 company. Executive directors are permitted to retain fees

received in respect of any such non-executive directorship.

None of our executive directors held any external non-executive director positions during the year. Brian Cassin was appointed as a

non-executive director of J Sainsbury plc on 1 April 2016.

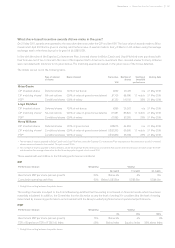

Relative importance of spend on pay (not audited)

The table below illustrates the relative importance of remuneration spend for all employees, compared to the financial distributions

to shareholders, through dividends and earnings-enhancing share repurchases:

2016

US$m

2015

US$m

%

change

Employee remuneration costs 1,712 1,799 (4.8%)

Dividends paid on ordinary shares 380 374 1.6%

Estimated value of earnings-enhancing share repurchases 487 66 638%

The employee remuneration costs figure shown in the table above has decreased since 2015, primarily as a result of movements

in exchange rates over the year. The increase in the estimated value of earnings-enhancing share repurchases from 2015 to 2016

results from the execution of the Group’s share repurchase programme.

Annual report on remuneration continued

96 Governance •Report on directors’ remuneration