Experian 2016 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

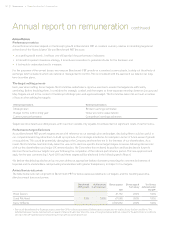

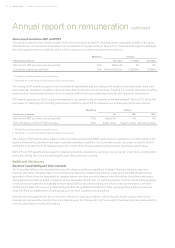

Share-based incentives (CIP and PSP)

The executive directors have elected to defer 100% of their bonuses into the CIP. Matching shares, equivalent to 200% of the gross

deferred bonus, are expected to be granted in the first quarter of the year ending 31 March 2017. These will vest subject to satisfying

the following performance conditions, which will be measured over a three-year performance period:

Performance measure

Weighting Vesting1

No match 1:1 match 2:1 match

Benchmark PBT per share (annual growth)250% Below 4% 4% 8%

Cumulative operating cash flow250% Below US$3.6bn US$3.6bn US$4bn

1 Straight-line vesting between the points shown.

2 Measured on a continuing activities and constant currency basis.

The vesting of CIP awards is subject to the Committee being satisfied that the vesting is not based on financial results which have

been materially misstated. In addition, the Committee has the discretion to vary the level of vesting if it considers the level of vesting

determined by measuring performance to be inconsistent with the Group’s underlying financial and operational performance.

PSP awards equivalent to 200% of salary are expected to be granted in the first quarter of the year ending 31 March 2017. These will

vest subject to satisfying the following performance conditions, which will be measured over a three-year performance period:

Performance measure

Weighting Vesting1

0% 25% 100%

Benchmark PBT per share (annual growth)275% Below 4% 4% 8%

TSR of Experian vs TSR of FTSE 100 Index 25% Below Index Equal to Index 25% above Index

1 Straight-line vesting between the points shown.

2 Measured on a continuing activities and constant currency basis.

The vesting of PSP awards will be subject to the Committee agreeing that ROCE performance is satisfactory and that vesting is not

based on financial results which have been materially misstated. In addition, the Committee has the discretion to vary the level of

vesting if it considers this to be inappropriate in the context of the Group’s underlying financial and operational performance.

Both CIP and PSP awards will be subject to clawback provisions, whereby the Company may recover all or part of any vested award,

at any time during the 12 months following the end of the performance period.

Additional disclosures

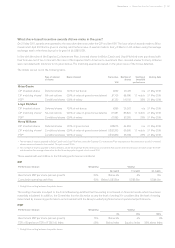

Directors’ shareholding and share interests

The Committee believes it is important that executive directors build up a significant holding in Experian shares to align their

interests with those of shareholders. The Committee has therefore established guidelines under which the CEO should hold the

equivalent of three times his base salary in Experian shares and other executive directors should hold two times their base salary.

These guidelines include invested or deferred shares held under the CIP (but not matching shares). Until the shareholding guideline

is met, an executive director is expected to retain at least 50% of any shares vesting (net of tax) under a share award. Unvested

shares are not taken into account in determining whether the guideline has been met. After joining the Board, Brian Cassin and

Lloyd Pitchford are building their shareholdings up to the level required by the guidelines.

Experian also has guidelines for its non-executive directors to build up a holding in the Company’s shares equal to their annual

Experian plc non-executive director’s fee. Each financial year, the first quarter’s net fee is used to purchase Experian shares until the

non-executive director reaches this holding.

Annual report on remuneration continued

94 Governance •Report on directors’ remuneration