Experian 2016 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188

|

|

37

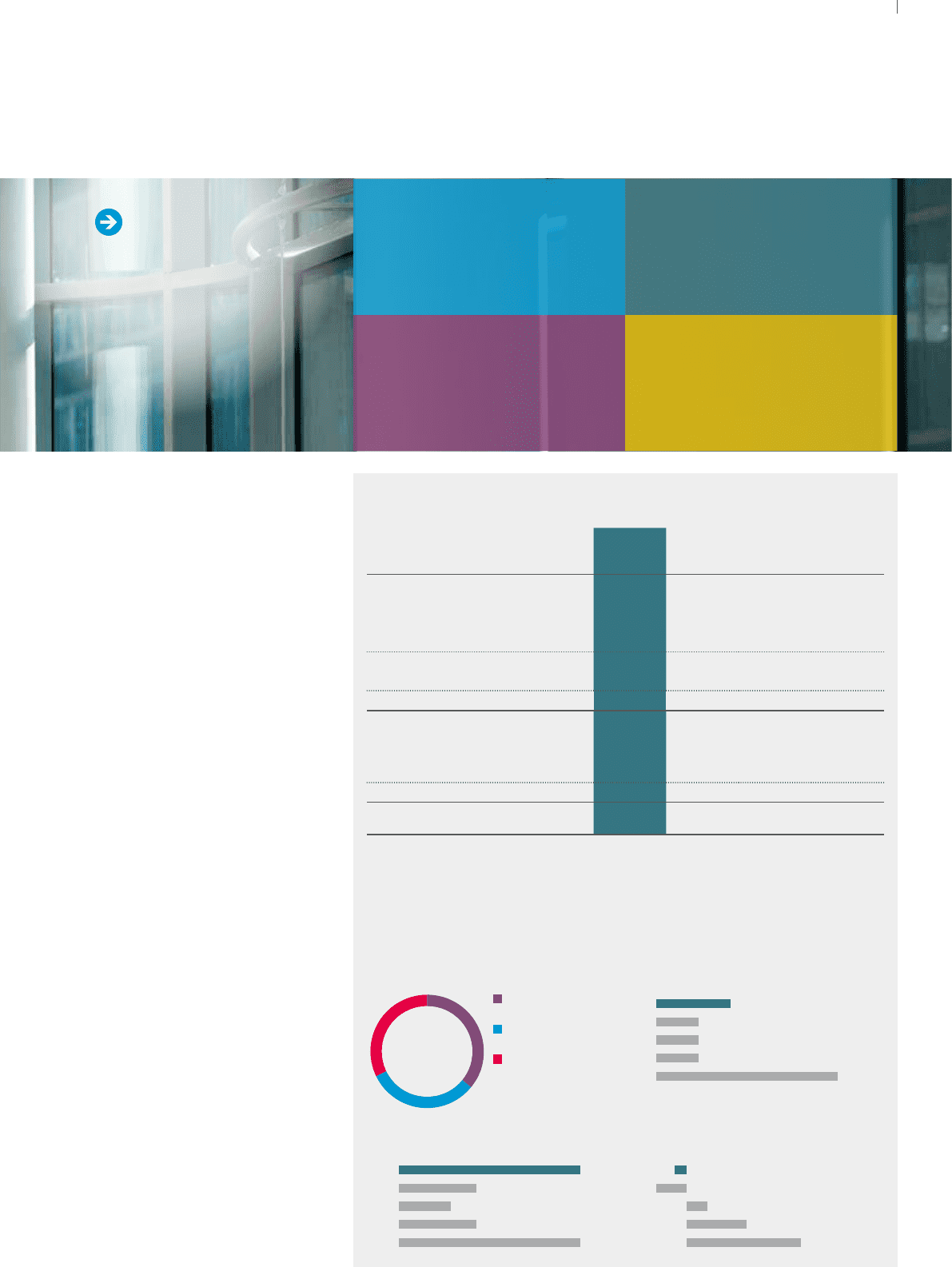

Marketing Services

Total and organic revenue growth at

constant exchange rates were both 10%

as we benefited from new client wins

for integrated data and cross-channel

marketing capabilities.

EBIT and EBIT margin

Losses in EMEA/Asia Pacific were

significantly reduced to US$4m (2015:

US$10m). EBIT margin improved to (1.0)%

from (2.3)% at actual exchange rates, as

operating efficiencies were partially offset

by foreign exchange headwinds.

Year ended 31 March

2016

US$m

20151

US$m

Total

growth2

%

Organic

growth2

%

Revenue

Credit Services 149 176 (3) (3)

Decision Analytics 135 130 18 18

Marketing Services 133 135 10 10

Total – continuing activities 417 441 7 7

Discontinuing activities315 45

Total EMEA/Asia Pacific 432 486

EBIT

Continuing activities (4) (10)

Discontinuing activities319

Total EMEA/Asia Pacific (3) (1) n/a

EBIT margin4(1.0)% (2.3)%

1 2015 restated for discontinuing activities (see note 3 below for details).

2 Growth at constant exchange rates.

3 Discontinuing activities includes the divestments of FootFall, Consumer Insights

and other smaller businesses.

4 EBIT margin is for continuing activities only.

Credit

Services 36%

Decision

Analytics 32%

Marketing

Services 32%

2%

3%

7%

7%

3%

7%

4%

4%

4%

17%

(1.0)%

1.4%

(2.3)%

4.1%

6.6%

(4)m

(10)m

7m

20m

38m

9% 7%

Contribution to

Group revenue

Organic

revenue growth

(4)m

EBIT (US$)

with (1.0)% margin

0.4bn

Revenue

(US$)

Revenue by activity Total revenue growth

Organic revenue growth EBIT (US$m) and EBIT margin (%)

2016

2016

15

15

14

14

13

13

12

12

2016

15

14

13

12

Revenue, EBIT and EBIT margin

Highlights 2016

Strategic report •EMEA/Asia Pacic