Experian 2016 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188

|

|

149•Notes to the Group nancial statementsFinancial statements

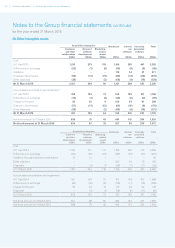

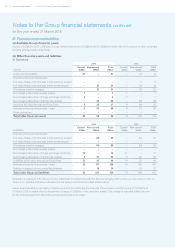

25. Borrowings

(a) Analysis by carrying amounts and fair value

Carrying amount Fair value

2016

US$m

2015

US$m

2016

US$m

2015

US$m

Current:

Bank loans –100 –100

Commercial paper 44 40 44 40

Bank overdrafts 5 25 2

Finance lease obligations 3 43 4

52 146 52 146

Non-current:

US$600m 2.375% notes 2017 603 601 601 608

£400m 4.75% Euronotes 2018 622 647 622 657

€500m 4.75% Euronotes 2020 646 617 660 640

£400m 3.50% Euronotes 2021 596 608 614 635

Bank loans 600 669 600 669

Finance lease obligations 1 41 4

3,068 3,146 3,098 3,213

Total borrowings 3,120 3,292 3,150 3,359

The effective interest rates for bonds approximate to the coupon rates indicated above. Other than finance lease obligations, the

borrowings are unsecured. Further information on the methodology used in determining fair values is given in note 28.

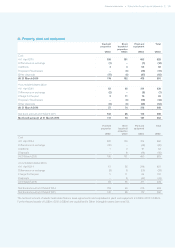

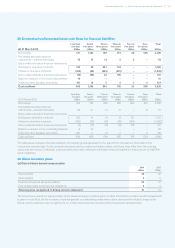

(b) Analysis by maturity

2016

US$m

2015

US$m

Less than one year 52 146

One to two years 1,104 672

Two to three years 722 602

Three to four years 646 647

Four to five years –617

Over five years 596 608

3,120 3,292

(c) Analysis by currency

2016

US$m

2015

US$m

US dollar 2,514 2,530

Sterling 443 620

Euro 100 83

Other 63 59

3,120 3,292

The above analysis takes account of the effect of cross currency swaps and forward foreign exchange contracts and reflects the way

in which the Group manages exposures.