Experian 2016 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

155•Notes to the Group nancial statementsFinancial statements

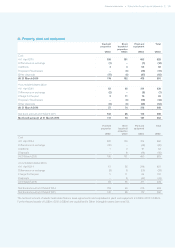

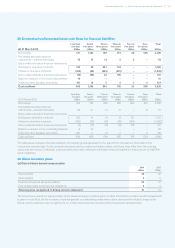

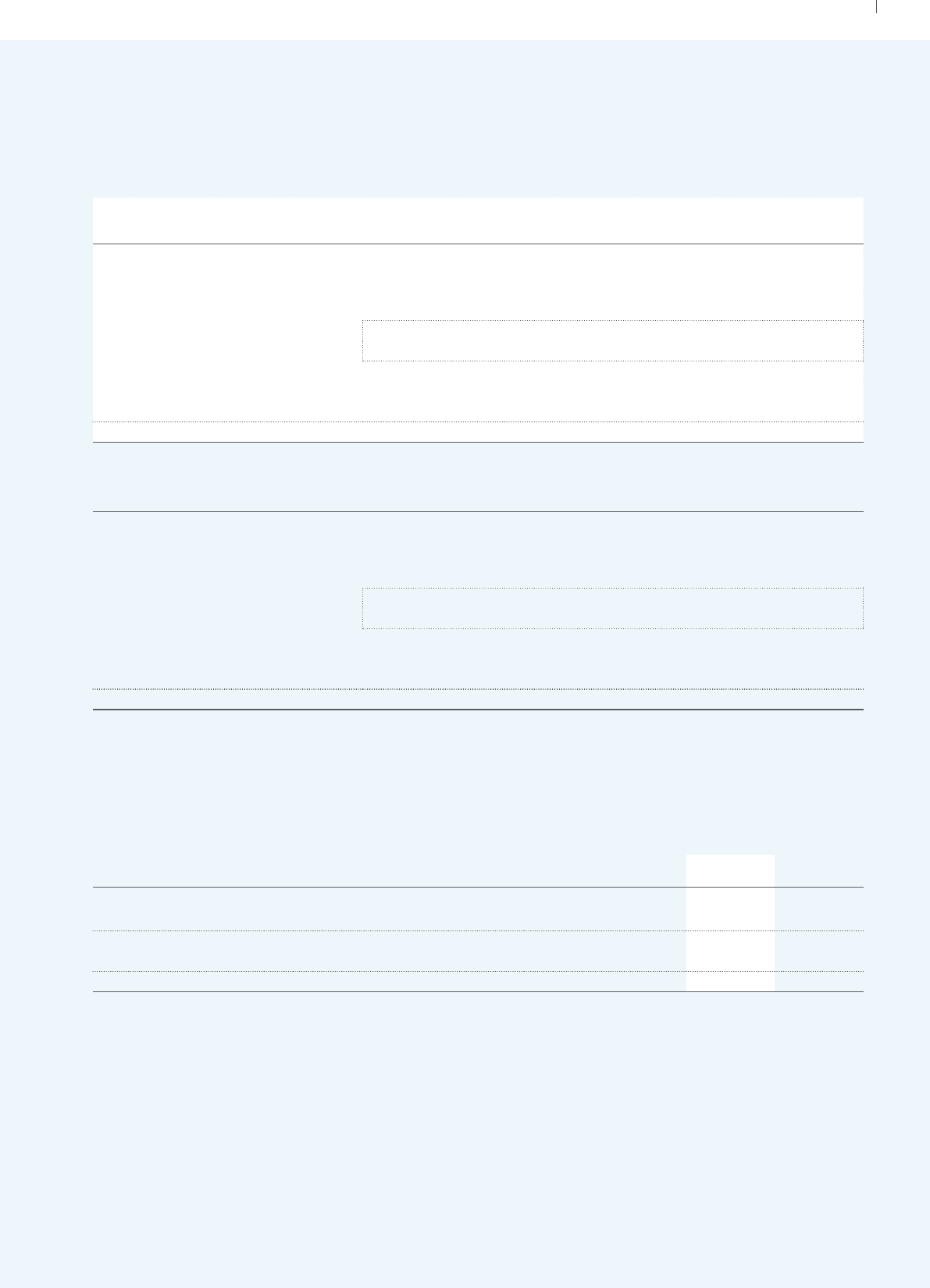

29. Contractual undiscounted future cash flows for financial liabilities

At 31 March 2016

Less than

one year

US$m

One to

two years

US$m

Two to

three years

US$m

Three to

four years

US$m

Four to

five years

US$m

Over

five years

US$m

Total

US$m

Borrowings 141 1,183 749 617 20 595 3,305

Net settled derivative financial

instruments – interest rate swaps 18 15 14 5 2 – 54

Gross settled derivative financial instruments:

Outflows for derivative contracts 340 30 667 723 – – 1,760

Inflows for derivative contracts (355) (54) (629) (597) – – (1,635)

Gross settled derivative financial instruments (15) (24) 38 126 – – 125

Options in respect of non-controlling interests 10 – – – – – 10

Trade and other payables (note 24(b)) 411 10 3 2 1 4 431

Cash outflows 565 1,184 804 750 23 599 3,925

At 31 March 2015

Less than

one year

US$m

One to

two years

US$m

Two to

three years

US$m

Three to

four years

US$m

Four to

five years

US$m

Over

five years

US$m

Total

US$m

Borrowings 234 760 682 665 583 632 3,556

Net settled derivative financial

instruments – interest rate swaps 23 21 14 10 –(1) 67

Gross settled derivative financial instruments:

Outflows for derivative contracts 450 14 14 14 721 – 1,213

Inflows for derivative contracts (452) (26) (26) (26) (563) – (1,093)

Gross settled derivative financial instruments (2) (12) (12) (12) 158 – 120

Options in respect of non-controlling interests 8 20 – – – – 28

Trade and other payables (note 24(b)) 391 11 10 2 1 3 418

Cash outflows 654 800 694 665 742 634 4,18 9

The table above analyses financial liabilities into maturity groupings based on the period from the balance sheet date to the

contractual maturity date. As the amounts disclosed are the contractual undiscounted cash flows, they differ from the carrying

values and fair values. Contractual undiscounted future cash outflows for derivative financial liabilities in total amount to US$179m

(2015: US$187m).

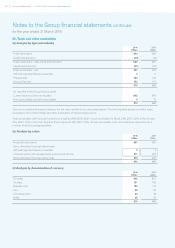

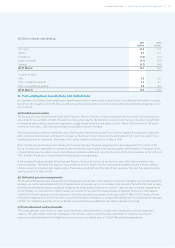

30. Share incentive plans

(a) Cost of share-based compensation

2016

US$m

2015

US$m

Share awards 49 42

Share options 5 5

Expense recognised (all equity settled) 54 47

Cost of associated social security obligations 3 4

Total expense recognised in Group income statement 57 51

The Group has a number of equity-settled, share-based employee incentive plans. Further information on share award arrangements

is given in note 30(b). As the numbers of options granted or outstanding under share option plans and the related charge to the

Group income statement are not significant, no further disclosures are included within these financial statements.