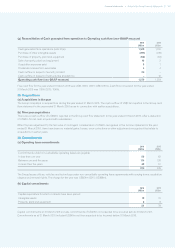

Experian 2016 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

157•Notes to the Group nancial statementsFinancial statements

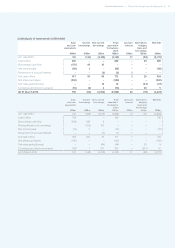

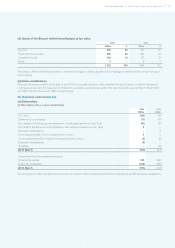

(iii) Share awards outstanding

2016

million

2015

million

At 1 April 14.8 17.4

Grants 4.5 4.7

Forfeitures (1.2) (1.5)

Lapse of awards (1.7) (0.2)

Vesting (4.2) (5.6)

At 31 March 12.2 14.8

Analysis by plan:

CIPs 3.8 5.2

PSP – conditional awards 3.4 4.1

PSP – unconditional awards 5.0 5.5

At 31 March 12.2 14.8

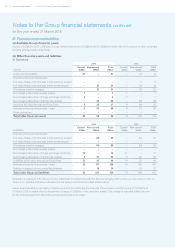

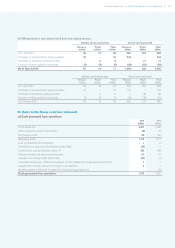

31. Post-employment benefit plans and related risks

An overview of the Group’s post-employment benefit plans and the related risks is given below. The additional information required

by IAS 19, which relates only to the Group’s defined benefit pension plans and post-employment medical benefits obligations, is set

out in note 32.

(a) Funded pension plans

The Group’s principal defined benefit plan is the Experian Pension Scheme, which provides benefits for certain UK employees but

was closed to new entrants in 2009. This plan has rules which specify the benefits to be paid, with the level of pension benet that

an employee will receive on retirement dependent on age, length of service and salary. As at 31 March 2016 there were 178 active

members of this plan, 1,630 deferred members and 2,938 pensioner members.

The Group provides a defined contribution plan, the Experian Retirement Savings Plan, to other eligible UK employees. Under this

plan, employee and employer contributions are paid by the Group into an independently administered fund, which is used to fund

member pensions at retirement. There were 3,441 active members of this plan at 31 March 2016.

Both UK plans are governed by trust deeds, which ensure that their finances and governance are independent from those of the

Group. Trustees are responsible for overseeing the investments and funding of the plans and plan administration. Employees in the

USA and Brazil have the option to join local defined contribution plans and currently there are 4,109 active members in the USA and

1,421 in Brazil. There are no other material funded pension arrangements.

A full actuarial funding valuation of the Experian Pension Scheme is carried out every three years, with interim reviews in the

intervening years. The latest full valuation was carried out as at 31 March 2013 by independent qualified actuaries Towers Watson

Limited, using the projected unit credit method. There was a small deficit at the date of that valuation. The next full valuation will be

carried out as at 31 March 2016.

(b) Unfunded pension arrangements

The Group’s unfunded pension arrangements are designed to ensure that certain directors and senior managers who are affected by the

earnings cap, which was introduced by the UK government some years ago to set a ceiling on the amount of benefits that could be paid

by defined benefit pension plans, are placed in broadly the same position as those who are not. There are also unfunded arrangements

for Don Robert, a current director of the Company, and certain former directors and employees of Experian Finance plc and Experian

Limited. Don Robert began to receive his pension under this unfunded arrangement in the year ended 31 March 2015. Certain of these

unfunded arrangements in the UK have been secured by the grant of charges to an independent trustee over an independently managed

portfolio of marketable securities owned by the Group and reported as available-for-sale financial assets (note 27(a)).

(c) Post-retirement medical benefits

The Group operates a plan which provides post-retirement medical benefits to certain retired employees and their dependant

relatives. This plan relates to former employees in the UK and, under it, the Group has undertaken to meet the cost of post-

retirement medical benefits for all eligible former employees who retired prior to 1 April 1994 and their dependants.