Experian 2016 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

169•Notes to the Group nancial statementsFinancial statements

(b) Transactions with associates

A full list of associate undertakings is given in note S(iii) to the Company financial statements. There were no individually material

associates during the current or prior year and accordingly no related party transactions are reported with such entities.

(c) Transactions with other related undertakings

The Group transacts with a number of related undertakings in connection with the operation of its share incentive plans, pension

arrangements in the UK, USA and Brazil, and the provision of medical cover in the UK and these undertakings are listed in note S(iv)

to the Company financial statements. Transactional relationships can be summarised as follows:

• The assets, liabilities and expenses of the Experian UK Approved All-Employee Share Plan and the Experian plc Employee Share

Trust are included in the financial statements.

• During the year ended 31 March 2016, US$52m (2015: US$50m) was paid by the Group to related undertakings in connection with

the provision of post-employment pensions benefits in the UK, USA and Brazil.

• During the year ended 31 March 2016, US$3m (2015: US$3m) was paid by the Group to Experian Medical Plan Limited in

connection with the provision of healthcare benefits.

• There were no other material transactions or balances with these related undertakings during the current or prior year.

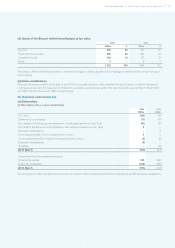

(d) Remuneration of key management personnel

2016

US$m

2015

US$m

Salaries and short-term employee benefits 10 6

Retirement benefits – –

Share incentive plans 610

16 16

Key management personnel comprises the Company’s executive directors and further details of their remuneration packages are

given in the audited parts of the Report on directors’ remuneration. There were no other material transactions with the Group in

which the key management personnel had a personal interest in either the current or prior year.

42. Events occurring after the end of the reporting period

Details of the second interim dividend announced since the end of the reporting period are given in note 18.

On 19 April 2016 the Group announced that it had signed a definitive agreement to acquire CSIdentity Corporation, a leading

provider of consumer identity management and fraud detection services, for a cash consideration of US$360m, payable in full at

closing. The transaction is subject to Hart-Scott-Rodino regulatory approval in the USA and other customary closing conditions. The

fair value of goodwill, software development, customer relationships and other assets and liabilities will be reported in the Group’s

half-yearly financial statements for the six months ending 30 September 2016 and in the 2017 annual report.