Experian 2016 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127•Notes to the Group nancial statementsFinancial statements

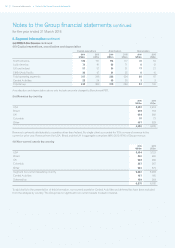

(h) Benchmark earnings and Total benchmark earnings

Benchmark earnings comprise Benchmark PBT less attributable tax and non-controlling interests. The attributable tax for this

purpose excludes significant tax credits and charges arising in the year which, in view of their size or nature, are not comparable

with previous years, together with tax arising on exceptional items and on total adjustments made to derive Benchmark PBT.

Benchmark PBT less attributable tax is designated as Total benchmark earnings.

(i) Benchmark earnings per share (‘Benchmark EPS’)

Benchmark EPS comprises Benchmark earnings divided by the weighted average number of issued ordinary shares, as adjusted

for own shares held.

(j) Benchmark PBT per share

Benchmark PBT per share comprises Benchmark PBT divided by the weighted average number of issued ordinary shares, as

adjusted for own shares held.

(k) Benchmark tax charge and rate

The Benchmark tax charge is the tax charge applicable to Benchmark PBT. It differs from the Group tax charge by tax attributable

to exceptional items and other adjustments made to derive Benchmark PBT, and exceptional tax charges. A reconciliation is

provided in note 15(b)(ii) to these financial statements. The related effective rate of tax is calculated by dividing the Benchmark

tax charge by Benchmark PBT.

(l) Exceptional items

The separate reporting of non-recurring exceptional items gives an indication of the Group’s underlying performance. Exceptional

items include those arising from the profit or loss on disposal of businesses, closure costs of major business units, costs of

significant restructuring programmes and other significant one-off items. All other restructuring costs are charged against Total

EBIT, in the segments in which they are incurred.

(m) Full year dividend per share

Full year dividend per share comprises the total of dividends per share announced in respect of the financial year.

(n) Operating and free cash flow

Operating cash flow is Total EBIT plus amortisation, depreciation and charges in respect of share-based incentive plans, less

capital expenditure net of disposal proceeds and adjusted for changes in working capital and the profit or loss retained in

continuing associates. Free cash flow is derived from operating cash flow by excluding net interest, tax paid in respect of

continuing operations and dividends paid to non-controlling interests.

(o) Cash flow conversion

Cash flow conversion is operating cash flow expressed as a percentage of Total EBIT.

(p) Net debt and net funding

Net debt is borrowings (and the fair value of derivatives hedging borrowings) excluding accrued interest, less cash and cash

equivalents reported in the Group balance sheet and other highly liquid bank deposits with original maturities greater than

three months. Net funding is total funding less cash held in Group Treasury.

(q) Return on capital employed (‘ROCE’)

ROCE is defined as Total EBIT less tax at the Benchmark rate divided by a three-point average of capital employed over the year.

Capital employed is net assets less non-controlling interests, further adjusted to add or deduct the net tax liability or asset and

to add net debt.