Experian 2016 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Generating value

The table opposite provides a

reconciliation of our underlying

profitability, as measured by Total EBIT,

to our statutory profit before tax.

Our net interest expense and the related

cash flows have benefited from the

strong cash generation and from low

interest rates globally. At 31 March 2016,

the interest on 91% of our net funding

was at fixed rates (2015: 83%).

Our effective tax rate on Benchmark PBT

was 24.9%, reflecting the mix of profits

and prevailing tax rates by territory.

The equivalent cash tax rate remains

below our Benchmark tax rate and a

reconciliation is provided in the table

opposite. It is currently anticipated that

our cash tax rate will increase and move

closer to our Benchmark tax rate over

the course of the next six years,

as tax amortisation of goodwill on

earlier acquisitions and prior tax

losses are utilised.

Basic EPS was 78.6 US cents (2015:

79.0 US cents). Basic EPS for the year

ended 31 March 2016 included a loss

of 1.3 (2015: earnings of 2.1) US cents

per share in respect of discontinued

operations. Benchmark EPS was 89.1 US

cents (2015: 95.2 US cents), a decrease

of 6% at actual exchange rates but an

increase of 5% at constant currency.

Further information is given in note 17 to

the Group financial statements.

The total dividend per share for the year

is covered 2.2 times by Benchmark EPS

(2015: 2.4 times) in accordance with

our previously declared policy. Ordinary

dividends paid in the year amounted to

US$380m (2015: US$374m).

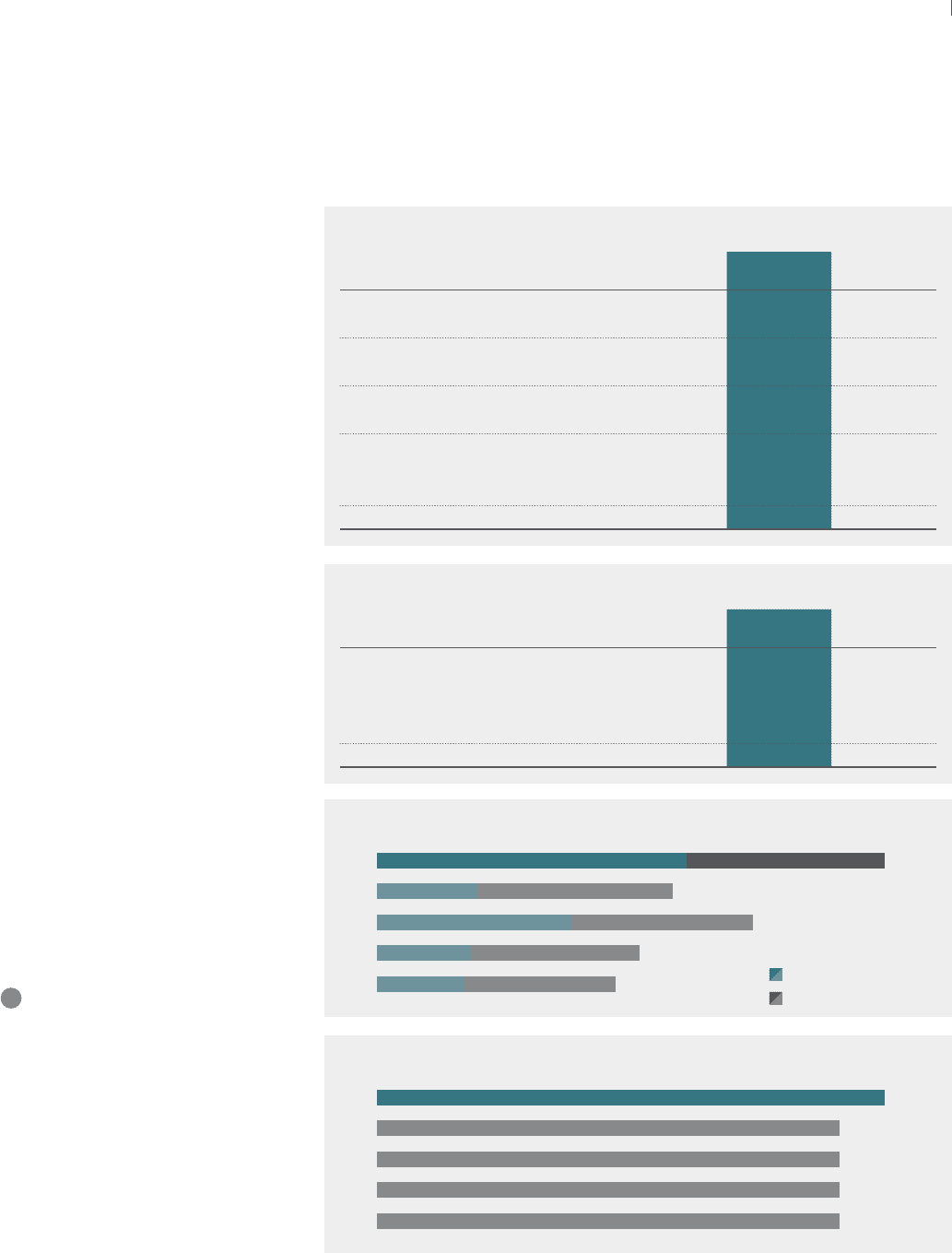

The table above summarises returns

to our shareholders by way of share

purchases and dividends over a

five-year period.

Reconciliation of Total EBIT to statutory profit before tax

Year ended 31 March

2016

US$m

2015

US$m

EBIT at constant currency 1,332 1,271

Currency impact (137) –

EBIT 1,195 1,271

Discontinuing activities 15 35

Total EBIT 1,210 1,306

Net interest expense (74) (75)

Benchmark PBT 1,136 1,231

Exceptional items 37 (2)

Other adjustments made to derive Benchmark PBT (146) (223)

Profit before tax 1,027 1,006

Cash tax reconciliation

Year ended 31 March

2016

%

2015

%

Tax charge on Benchmark PBT 24.9 24.4

Tax relief on intangible assets (6.5) (7.9)

Benefit of brought forward tax losses (4.6) (3.8)

Other (1.8) (0.9)

Tax paid as a percentage of Benchmark PBT 12.0 11.8

Total shareholder returns (US$m)

Dividend payout ratio (%)

592

2016

2016

14

14

15

15

13

13

12

12

192

41%

41%

41%

41%

374 566

592

45%

972380

371 349 720

Net share purchases

Dividends

180 322 502

167 290 457

p141

Strategic report •Financial review