Experian 2016 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

154

Notes to the Group financial statements continued

for the year ended 31 March 2016

Financial statements •Notes to the Group nancial statements

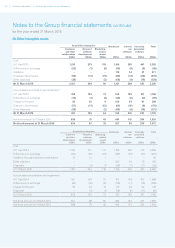

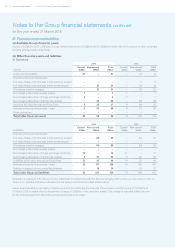

27. Financial assets and liabilities continued

(d) Analysis of movements in Level 3 assets/(liabilities)

Year ended 31 March 2016 Year ended 31 March 2015

Available-

for-sale

US$m

Contingent

consideration

US$m

Other

US$m

Total

US$m

Available-

for-sale

US$m

Contingent

consideration

US$m

Other

US$m

Total

US$m

At 1 April 5(11) (22) (28) 3(2) (44) (43)

Additions 2 – – 2 2(2) – –

Settlement of contingent

consideration – 2 – 2 – – – –

Adjustment to the fair value of

contingent consideration – 2 – 2 –(7) –(7)

Valuation gains recognised in

Group income statement – – 13 13 – – 1 1

Currency translation gains/(losses)

recognised directly in other

comprehensive income 1 – (1) –– – 5 5

Exercise of option in connection with

an acquisition – – – – – – 16 16

Other 2 – – 2 – – – –

At 31 March 10 (7) (10) (7) 5(11) (22) (28)

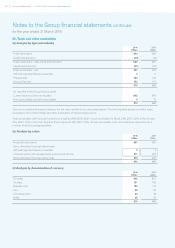

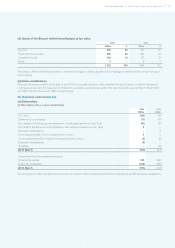

28. Fair value methodology

Information in respect of the fair value of borrowings is included in note 25(a). There are no material differences between the

carrying value of the Group’s other financial assets and liabilities not measured at fair value and their estimated fair values. The

following assumptions and methods are used to estimate the fair values:

• the fair values of receivables, payables and cash and cash equivalents are considered to approximate to the carrying amounts;

• the fair values of short-term borrowings, other than bonds, are considered to approximate to the carrying amounts due to the

short maturity terms of such instruments;

• the fair value of that portion of bonds carried at amortised cost is based on quoted market prices, employing a valuation falling

within Level 1 of the IFRS 13 fair value hierarchy;

• the fair values of long-term floating rate bank loans and finance lease obligations are considered to approximate to the carrying

amount; and

• the fair values of other financial assets and liabilities are calculated based on a discounted cash flow analysis, using a valuation

methodology falling within Level 2 of the IFRS 13 fair value hierarchy.