Experian 2016 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

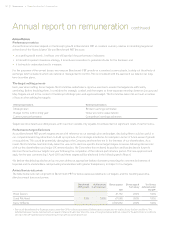

Annual bonus

Performance metrics

Annual bonus outcomes depend on the Group’s growth in Benchmark PBT at constant currency relative to stretching targets set

at the start of the financial year. We use Benchmark PBT because:

• as a profit growth metric, it reflects one of Experian’s key performance indicators;

• in line with Experian’s business strategy, it incentivises executives to generate returns for the business; and

• it is simple to understand and to measure.

For the purposes of the annual bonus, we measure Benchmark PBT growth on a constant currency basis, to strip out the effects of

exchange rate fluctuations which are outside of management’s control. This is consistent with the approach we take for our long-

term incentive plans.

The target setting process

Each year when setting bonus targets, the Committee undertakes a rigorous exercise to ensure the targets are sufficiently

stretching. Before finalising them, it considers the strategic context and the targets at three separate meetings between January and

May. Targets are set in the context of the Group’s strategic plan and approved budget. The Committee takes into account a number

of factors when setting the targets:

Internal expectations External expectations

Strategic plan

Budget for the forthcoming year

Current year performance

Brokers’ earnings estimates

Wider economic expectations

Competitors’ earnings estimates

Targets are structured as a sliding scale, with maximum awards only payable for achievement of significant levels of performance.

Performance target disclosure

As our Benchmark PBT growth targets are set with reference to our strategic plan and budget, disclosing them could be useful to

our competitors and may allow them to build up a picture of our strategic intentions, for example in terms of future areas of growth

or acquisitions. This could be potentially damaging to the Company and therefore not in the interests of our shareholders. As a

result, the Committee has historically taken the view not to disclose specific bonus target ranges. However, following discussions

with our key shareholders and major UK investor bodies, the Committee has reviewed its position and has decided in future to

disclose the annual bonus targets one year following the completion of the relevant performance period. This new approach will

apply for the year commencing 1 April 2016 and these targets will be disclosed in the following year’s Report.

We believe that delaying disclosure by one year strikes an appropriate balance between protecting the commercial interests of

Experian and its shareholders, and providing shareholders with greater transparency in respect of our targets.

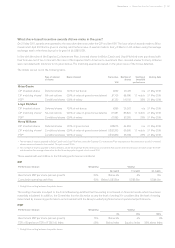

Annual bonus outcomes

The table below sets out our growth in Benchmark PBT for bonus purposes relative to our targets, and the resulting executive

director annual bonus outcomes:

Benchmark

PBT growth

Achievement

% of maximum

Bonus payout

’000

Bonus payout

% of salary

% of bonus

deferred under

the CIP1

Brian Cassin £1,750 200% 100%

Lloyd Pitchford 5.3% 100% £1,080 200% 100%

Kerry Williams US$1,850 200% 100%

1 Bonus will be deferred into Experian shares under the CIP for a three-year period. Deferred bonus shares are not subject to any further conditions. The

deferred bonuses may be matched with an award of shares of up to two times the value of the gross bonus deferred, subject to the performance conditions

set out in the CIP awards section below being met as well as continued service.

Annual report on remuneration continued

86 Governance •Report on directors’ remuneration