Experian 2016 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

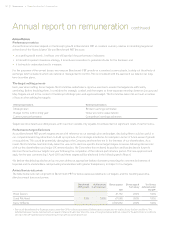

Percentage change from 2015 to 2016

Base salary Taxable

benefits

Annual bonus

CEO 2.9% 0% 175%

UK and Ireland employees 2.7% (3.2%) 12.8%

The increase in annual bonus paid to the CEO reflects the higher bonus achieved in 2016. There has been no change to the bonus

opportunity. Further information can be found in the What did we pay our executive directors during the year? section of this Report.

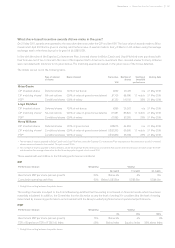

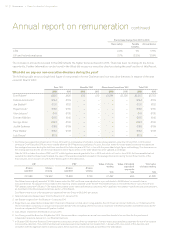

What did we pay our non-executive directors during the year?

The following table shows a single total figure of remuneration for the Chairman and non-executive directors in respect of the year

ended 31 March 2016:

Fees ’000 Benefits ’0007Share-based incentives ’000 Total ’000

2016 2015 2016 2015 2016 2015 2016 2015

Don Robert1£600 £425 £16 £12 £1,594 £5,326 £2,210 £5,763

Fabiola Arredondo2€144 €163 – – – – €144 €163

Jan Babiak3€131 €152 – – – – €131 €152

Roger Davis4€192 €165 – – – – €192 €165

Alan Jebson5€47 €195 – – – – €47 €195

Deirdre Mahlan €197 €140 – – – – €197 €140

George Rose €233 €190 – – – – €233 €190

Judith Sprieser €168 €169 – – – – €168 €169

Paul Walker €150 €133 – – – – €150 €133

Luiz Fleury6€119 – – – – – €119 –

1 Don Robert was appointed Chairman on 16 July 2014 and his comparative information includes shares granted under the CIP and PSP in 2012 (whilst

serving as Chief Executive Officer), which vested after the 2015 Report was published. As such, the value shown for share-based incentives was based on

the average share price during the last three months of the financial year of £11.54, in line with the prescribed single figure methodology. The share price on

the vesting date was £12.25, and the share-based incentive figure shown in the table above has been updated accordingly.

Data for 2016 includes the value of PSP and CIP matching share awards granted to him in 2013 and which will vest in June 2016. As these awards had not

vested at the date this Report was finalised, the value of the awards presented is based on the average share price during the last three months of the

financial year, which was £11.67, with further details given in the table below:

CIP PSP Value of shares

vesting

’000

Value of dividend

equivalent

payments

’000

Total value

of shares vesting

’000

Shares

awarded

Shares

vesting

Shares

awarded

Shares

vesting

251,980 119,942 76,828 8,700 £1,492 £93 £1,585

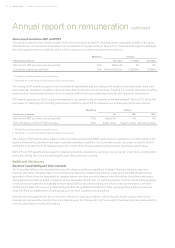

Don Robert was originally awarded 172,864 shares under the PSP and these were adjusted on a pro-rata basis to 76,828 when he ceased to be an

executive director. No adjustment was made to the matching shares awarded under the CIP. This treatment was in line with the Plans’ rules. The CIP and

PSP awards vested at 47.6% and 11.3% respectively, based on the same performance outcomes which applied to the awards made to the executive directors,

as described in the Share-based incentives section of this Report.

Don Robert receives an unfunded pension payment from the Group of £420,945 per annum.

2 Fabiola Arredondo stepped down from the Board on 31 January 2016.

3 Jan Babiak resigned from the Board on 13 January 2016.

4 Roger Davis was appointed as independent Chairman of Experian Limited, which is regulated by the UK Financial Conduct Authority, on 15 February 2016.

His remuneration comprises an annual non-executive director’s fee (including a fee for his role as Chairman of the Remuneration Committee) and a fee for

his role as independent Chairman of Experian Limited.

5 Alan Jebson retired from the Board on 22 July 2015.

6 Luiz Fleury joined the Board on 8 September 2015. His remuneration comprises an annual non-executive director’s fee and fees for the provision of

independent advice to Seresa S.A., our Brazilian business.

7 In October 2015 the Irish Revenue Commissioners concluded a review of the tax treatment of certain travel and subsistence expenses for non-Irish resident

non-executive directors. They confirmed that such expenses were to be treated as non-taxable from 1 January 2016. As a result of this decision, and

consistent with the approach taken in previous years, these expenses are not disclosed as benefits in the table above.

Annual report on remuneration continued

92 Governance •Report on directors’ remuneration