Experian 2016 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

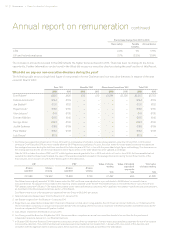

Element and link

to strategy

Operation Maximum potential

value and payment at target

Performance metrics,

weightings, relevant time

period and clawback

Share Option Plan (‘SOP’)

Provides focus

on increasing

Experian’s share

price over the

medium to

longer term.

Options are granted with an exercise

price equivalent to the market value of

an Experian share at the date of

grant. These vest subject to achieving

performance targets that are tested over

a three-year period and are exercisable

for a seven-year period thereafter.

No option grants have been made since

2009 and the Committee has agreed that

no further awards will be made, unless

warranted by exceptional circumstances

such as recruitment.

Normal maximum awards are

200% of salary. However, the rules

of the SOP allow awards of up to

400% of salary.

Minimum vesting of awards is zero.

Nothing vests for below-target

performance.

For target performance,

25% of the options vest.

For maximum performance,

100% of the options vest.

The vesting of options

is based on financial

performance targets.

Clawback provisions apply.

Chairman and non-executive director (‘NED’) fees

Attract

individuals with

a broad range

of experience

and skills, to

oversee the

implementation

of our strategy.

The Chairman is paid a fee in equal

instalments. The Group may provide the

Chairman with a limited range of benefits

such as a company car or allowance,

healthcare and tax advice.

The NEDs are paid a basic fee plus

additional fees for chairing a Board

Committee and for the role of Deputy

Chairman / Senior Independent Director.

NED fees are paid in equal instalments

during the year.

NEDs receive an additional fee where

attendance at Board meetings involves

intercontinental travel from their home

location. The Company may settle any tax

due on travel expenses incurred by the

Chairman and NEDs.

The Committee sets the

Chairman’s fees and benefits at

a level it considers appropriate,

against comparable roles in

similar companies.

NED fees are set by the Board

as a whole.

Fees are normally reviewed

every two years, against those of

Chairmen and NEDs in companies

of similar size, international reach

and complexity.

No performance-related

arrangements are in

place for the Chairman

or the NEDs.

Notes

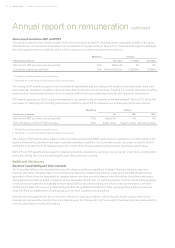

The remuneration policy for executive directors, and for around 800 members of our senior management, is more heavily weighted

towards variable pay than for other employees. This makes the greater part of their remuneration conditional on successfully

delivering our business strategy and, in turn, high levels of corporate performance and shareholder returns. This underpins the

link between creating value for shareholders and the pay of our most senior leaders.

The performance measures used in the annual bonus and the long-term incentive plans are all financial or share-based. The

performance-management process, which we use throughout Experian, assesses executives against both financial and non-

financial objectives. Performance against these individual objectives ultimately supports our financial performance, so the

Committee believes it is appropriate that financial metrics remain the key measures. These seek to ensure the underlying

financial performance of the business, while clearly aligning the interests of shareholders and executive directors.

On behalf of the Remuneration Committee

Charles Brown

Company Secretary

10 May 2016

Directors’ remuneration policy continued

102 Governance •Report on directors’ remuneration