Experian 2016 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

173•Notes to the Company nancial statementsFinancial statements

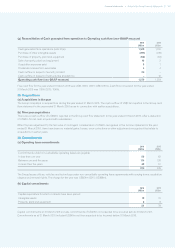

C. FRS 101 transitional arrangements

As it has not previously presented financial statements under FRS 101, the Company is required under FRS 100 and FRS 101 to apply

the transitional arrangements set out in IFRS 1 ‘First-time adoption of International Financial Reporting Standards’ in its financial

statements for the year ended 31 March 2016. The key transitional arrangements are:

• an explanation of how the transition has affected the Company’s reported financial position and financial performance;

• a reconciliation of the equity reported at 31 March 2014 and 31 March 2015; and

• a reconciliation of the profit and loss and other recognised gains and losses to the total comprehensive income reported for the

year ended 31 March 2015.

The transition had no effect on the Company’s financial position and financial performance in the current or prior year and

accordingly no such explanation or reconciliations are required in these financial statements.

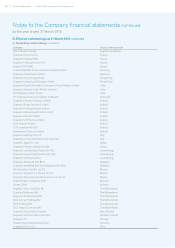

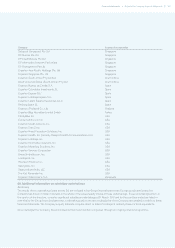

D. Significant accounting policies

The significant accounting policies applied are summarised below. They have been consistently applied to both years presented.

The explanations of these policies focus on areas where judgment is applied or which are particularly important in the financial

statements. Content from accounting standards, amendments and interpretations is excluded where there is simply no policy choice

under IFRS.

(i) Foreign currency

The Company follows IAS 21 ‘The effects of changes in foreign exchange rates’.

(ii) Investments – shares in Group undertakings

Investments in Group undertakings are stated at cost less any provisions for impairment. The Company follows IAS 36 ‘Impairment

of assets’. The fair value of share incentives issued by the Company to employees of Group undertakings is accounted for as a capital

contribution and recognised as an increase in the Company’s investment in Group undertakings, with a corresponding increase in

total equity.

(iii) Debtors and creditors

Debtors are initially recognised at fair value and subsequently measured at this value. Where the time value of money is material,

they are then carried at amortised cost using the effective interest rate method. Creditors are initially recognised at fair value. Where

the time value of money is material, they are then carried at amortised cost using the effective interest rate method.

(iv) Ta x

Current tax is calculated on the basis of the tax laws enacted or substantively enacted at the balance sheet date in Ireland, where the

Company is resident.

Deferred tax is provided in respect of temporary differences that have originated but not reversed at the balance sheet date and

is determined using the tax rates that are expected to apply when the temporary differences reverse. Deferred tax assets are

recognised only to the extent that they are expected to be recoverable.

(v) Own shares

The Group has a number of equity-settled, share-based employee incentive plans. In connection with these, shares in the Company

are held by the Experian plc Employee Share Trust and the Experian UK Approved All-Employee Share Plan. The assets, liabilities

and expenses of these separately administered trusts are included in the financial statements as if they were the Company’s own.

The trusts’ assets mainly comprise Experian shares, which are shown as a deduction from total shareholders’ funds at cost.

Experian shares purchased and held as treasury shares, in connection with the above plans and any share purchase programme,

are also shown as a deduction from total shareholders’ funds at cost. The par value of shares that are purchased and cancelled, in

connection with any share purchase programme, is accounted for as a reduction in called up share capital with any cost in excess of

that amount being deducted from the profit and loss account.

Contractual obligations to purchase own shares are recognised at the net present value of expected future payments. Gains and

losses in connection with such obligations are recognised in the profit and loss account.

(vi) Profit and loss account format

Income and charges, which are recognised on an accruals basis, are reported by nature in the profit and loss account, as this

reflects the composition of the Company’s income and cost base.