Experian 2016 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Risk management is an essential element of how we run Experian,

to help us deliver long-term shareholder value and to protect our

business, people, assets, capital and reputation.

Introduction

Principal risks – identifying

and managing risk

Successful management of existing

and emerging risks is critical to the

long-term success of our business and

to achieving our strategic objectives.

To seize the opportunities in front

of us, we must accept risk to a

reasonable degree and manage that

risk appropriately. Risk management is

therefore an integral component of our

corporate governance.

Our risk and control governance

Board – The Board has overall

responsibility for determining, and

keeping under review throughout

the year, the nature and extent of the

principal risks it is willing to take within

our strategy, setting our overarching

risk appetite and ensuring that risks

are appropriately managed across the

Group. The Board delegates oversight

of certain risk management activities

to the Audit Committee.

Audit Committee – The Audit

Committee regularly monitors the

principal risks and uncertainties

identified by the Group’s risk assessment

processes, along with strategies

developed and actions taken, where

possible, to mitigate them. It also

reviews the effectiveness of the Group’s

system of risk management and internal

controls that supports the identification,

assessment and reporting of risk.

Executive committees

The Executive Risk Management

Committee comprises senior Group

executives, including the executive

directors and the Company Secretary.

Its primary responsibility is to oversee

the management of global risks. The

regional risk management committees

oversee the management of regional

risks. The Tax and Treasury Committee

oversees the management of financial

risks, including tax, credit, liquidity,

funding, market and currency risks.

Each committee is responsible for

ensuring these risks remain consistent

with Experian’s risk appetite, strategies

and objectives.

The Group Operating Committee

comprises the Group’s most senior

executives. Its remit includes identifying,

debating and achieving consensus on

issues involving strategy, risk, growth,

people and culture, and operational

efficiency. It also focuses on ensuring

strong communication and co-operative

working relationships among the

executive team. Its meetings tend to be

issues oriented and focus on selected

Group issues worthy of discussion.

The global and regional strategic

project committees comprise the most

senior global and regional executives.

Their remit is to oversee a process to

ensure that all strategic projects are

appropriately resourced, risk assessed

and commercially, financially and

technically appraised. Depending on

the outcome of their discussions, the

committees’ conclusions are then

considered by the Board or relevant

Group Principal Operating Subsidiary

for approval.

Executive management

Executive management implements

and takes day-to-day responsibility for

Board policies on risk management

and internal control. In doing so,

management designates internal

responsibilities and accountabilities

through the design and implementation

of necessary systems of internal control.

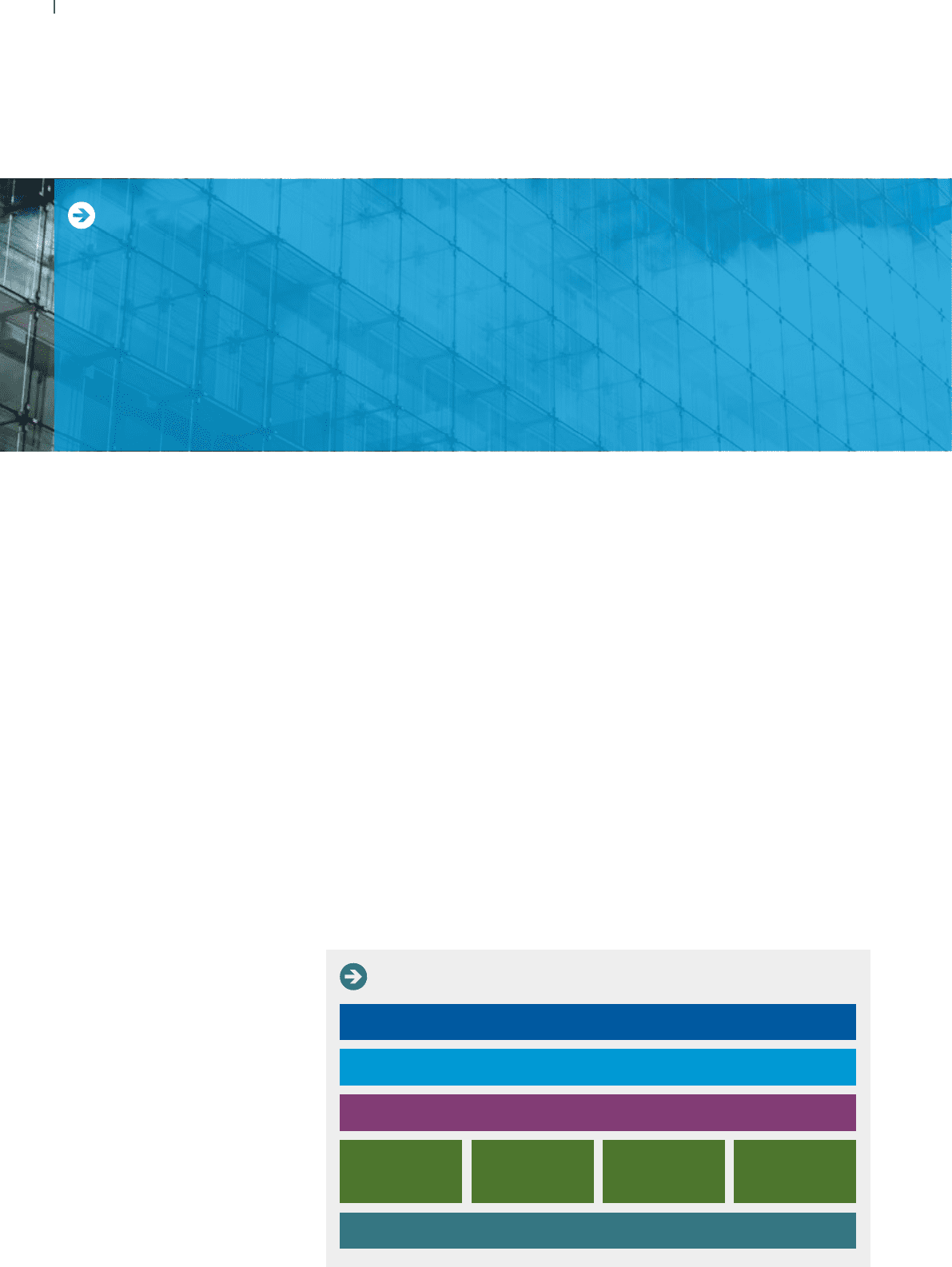

Risk and control governance structure

Board

Audit Committee

Executive Risk Management Committee

Executive management

Tax and

Treasury

Committee

Group Operating

Committee

Regional risk

management

committees

Strategic

project

committees

Strategic report •Principal risks – identifying and managing risk