Experian 2016 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

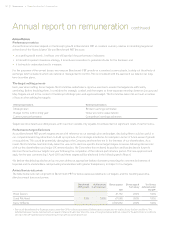

As these awards had not vested at the date this Report was finalised, the reported value of the awards is based on the average share

price in the last three months of the financial year to 31 March 2016, which was £11.67. The value of the awards, included in the

single total figure of remuneration, is as follows:

CIP PSP Value of

shares

vesting1

’000

Value of

dividend

equivalent

payments2

’000

Total

value of

shares

vesting

’000

Shares

awarded

Shares

vesting

Shares

awarded

Shares

vesting

Brian Cassin 113,0 08 53,791 76,827 8,700 £729 £45 £774

Kerry Williams 105,278 50,112 58,606 6,636 US$947 US$64 US$1,011

1 The value of the shares has been converted into US dollars for Kerry Williams at a rate of £1:US$1.4304, which is the average rate during the last three

months of the financial year.

2 Dividend equivalents of 113.25 US cents per share will be paid on vested shares. These represent the value of the dividends that would have been paid to the

owner of one share between the date of grant and the date of vesting.

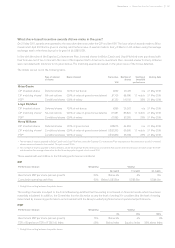

Buyout awards for Lloyd Pitchford

As previously disclosed, Lloyd Pitchford was granted a number of replacement share incentive awards (‘buyout awards’) on joining

Experian in 2014 to compensate him for the long-term incentive awards he forfeited upon leaving his previous employer.

Whilst the Committee aimed to replicate as closely as possible the structure and vesting dates of the share awards forfeited, it was

also mindful of shareholders’ views that vesting periods should be a minimum of 12 months and that performance conditions should

be applied to awards. Full details of the awards granted are disclosed in the 2015 Report on directors’ remuneration. As disclosed in

the table below, two tranches of these awards vested during the year:

Shares awarded Shares vesting Vesting date Share price

on vesting

Value on vesting

£’000

Value of dividend

equivalent

payments

£’0001

Total value of

shares vesting

£‘000

38,394 38,394 1 October 2015 £10.69 410 10 420

29,123 29,123 5 March 2016 £12.14 354 10 364

764 20 784

1 Dividend equivalents of 39.25 US cents per share and 51.75 US cents per share were payable on the awards vesting in October 2015 and March 2016

respectively. These represent the value of the dividends that would have been paid to the owner of one share between the date of grant and the date

of vesting.

The vesting of these awards was subject to satisfactory financial and business performance over the vesting period and the

achievement of personal objectives. Prior to approving the vesting of these awards, the Committee considered Lloyd Pitchford’s

performance in relation to his personal objectives since appointment, as well as the Group’s general financial and business

performance (which is summarised in the Remuneration at a glance section of this Report), and determined that both of these

conditions had been achieved. Full vesting of these awards was therefore considered appropriate.

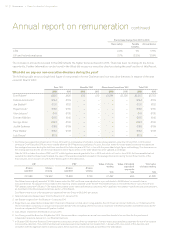

Update to 2015 disclosure

The value of the share awards realised by Brian Cassin and Kerry Williams in 2015 was originally calculated using the average

share price from 1 January 2015 to 31 March 2015, in accordance with the prescribed single figure methodology. This has now

been revised to reflect the actual share price on vesting, as follows:

Three-month

average share price to

31 March 2015

Estimated value of long-

term incentive awards

Share price on vesting Actual value of long-term

incentive awards

Brian Cassin £11.5 4 £0.498m £12.25 £0.527m

Kerry Williams US$2.458m US$2.698m

Annual report on remuneration continued

88 Governance •Report on directors’ remuneration