Experian 2016 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188

|

|

139•Notes to the Group nancial statementsFinancial statements

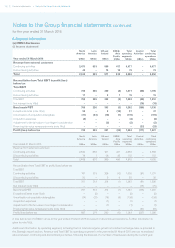

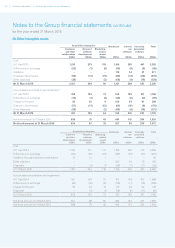

15. Group tax charge

(a) Analysis of tax charge in the Group income statement

2016

US$m

2015

US$m

Current tax:

Tax on income for the year 228 160

Adjustments in respect of prior years (26) 4

Total current tax charge 202 164

Deferred tax:

Origination and reversal of temporary differences 56 99

Adjustments in respect of prior years 5 (8)

Total deferred tax charge 61 91

Group tax charge 263 255

The Group tax charge comprises:

UK tax 116 67

Non-UK tax 147 188

263 255

(b) Tax reconciliations

(i) Reconciliation of the Group tax charge

As the Group is not subject to the tax rate of only one country, it has chosen to present its tax reconciliation using the local tax

rate of the UK, the country in which its shares are listed. The effective tax rate for each year is higher than the main rate of UK

corporation tax, with the differences explained in note (c) below.

2016

US$m

2015

US$m

Profit before tax 1,027 1,006

Profit before tax multiplied by the main rate of UK corporation tax of 20% (2015: 21%) 205 211

Effects of:

Adjustments in respect of prior years (21) (4)

Tax on exceptional items 18 –

Other income not taxable (7) (34)

Losses not recognised 16 15

Expenses not deductible 87 92

Adjustment in respect of previously unrecognised tax losses –(1)

Different effective tax rates in non-UK businesses (35) (24)

Group tax charge 263 255

Effective rate of tax based on profit before tax 25.6% 25.3%

(ii) Reconciliation of the Group tax charge to the Benchmark tax charge

2016

US$m

2015

US$m

Group tax charge 263 255

Tax charge on disposal of businesses (34) –

Tax relief on other exceptional items 8 –

Tax relief on other adjustments made to derive Benchmark PBT 46 45

Benchmark tax charge 283 300

Benchmark PBT 1,136 1,231

Benchmark tax rate 24.9% 24.4%