Experian 2016 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140

Notes to the Group financial statements continued

for the year ended 31 March 2016

Financial statements •Notes to the Group nancial statements

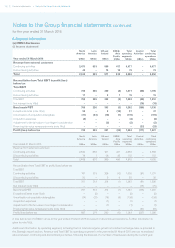

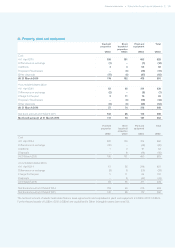

15. Group tax charge continued

(c) Factors that affect the tax charge

Prior year adjustments reflect the net movement on historical tax positions, including adjustments for matters that have been

substantively agreed with local tax authorities, and adjustments to deferred tax assets based on latest estimates and assumptions.

Tax on exceptional items principally relates to the disposal of businesses, with the higher effective tax rate reflecting the different

locations of the disposals and the fact that the cost for tax purposes was lower than that for accounting purposes.

Expenses not deductible include charges in respect of uncertain tax positions affecting the current year, financing fair value

remeasurements not allowable for tax purposes, and losses on the disposal of businesses which are not subject to tax.

In the normal course of business, the Group has a number of open tax returns with various tax authorities including those in the

UK, USA and Brazil, with whom it is in active dialogue. Liabilities relating to these open and judgmental matters are based on an

assessment as to whether additional taxes will be due, after taking into account external advice where appropriate.

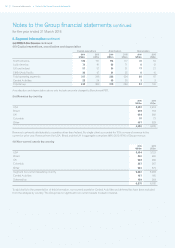

(d) Other factors that affect the future tax charge

The Group’s tax charge will continue to be influenced by the profile of profits earned in the different countries in which the Group’s

subsidiaries operate. The Group could be affected by changes in tax law in the future as we expect countries to amend legislation in

respect of international tax.

In the UK, the main rate of corporation tax was reduced to 20% from 1 April 2015. Further reductions will reduce the rate to 19% from

1 April 2017 and 18% from 1 April 2020. These further reductions had been substantively enacted at 31 March 2016 and their effects

are recognised in these financial statements. A further reduction will reduce the rate to 17% from 1 April 2020 but, as it had not been

substantively enacted by 31 March 2016, its effect is not recognised.

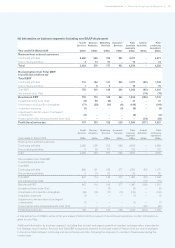

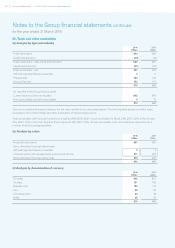

16. Discontinued operations

(a) Comparison shopping and lead generation businesses

Experian completed a transaction to divest these businesses in October 2012 and their results and cash flows are classified

as discontinued.

The loss for the financial year from discontinued operations of US$12m for the year ended 31 March 2016 comprised a charge

of US$20m, net of a US$8m tax credit, arising from the reduction in the carrying value of the loan note receivable issued as

part of the disposal. The profit for the financial year from discontinued operations of US$21m for the year ended 31 March 2015

comprised a current tax credit for tax losses arising in respect of the disposal.

The cash inflow from operating activities of US$32m for the year ended 31 March 2015 comprised a tax recovery on the

disposal transaction.

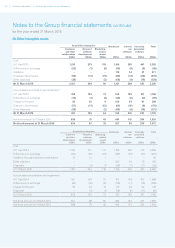

(b) Cash inflow/(outflow) on disposal of discontinued operations

2016

US$m

2015

US$m

Comparison shopping and lead generation businesses:

Partial redemption of loan note issued at disposal 13 –

Transaction costs paid –(1)

Comparison shopping and lead generation businesses 13 (1)

Cash flow for earlier disposal –(8)

Net cash inflow/(outflow) 13 (9)

The net cash inflow of US$13m on the disposal of the discontinued businesses (2015: outflow of US$9m) is disclosed in the Group

cash flow statement within net cash flows used in investing activities. Contingent consideration is available to Experian, in respect

of the comparison shopping and lead generation businesses, if defined profit targets are achieved over time, and in certain other

circumstances, up to US$25m. This is in addition to the amount of US$61m receivable, of which US$41m is recognised, in respect of

the loan note.