Experian 2016 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

162

Notes to the Group financial statements continued

for the year ended 31 March 2016

Financial statements •Notes to the Group nancial statements

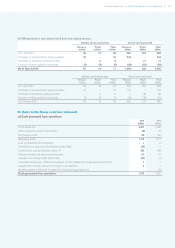

33. Deferred and current tax continued

(a) Deferred tax continued

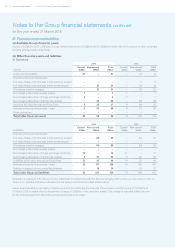

(ii) Movements in gross deferred tax assets and liabilities

Assets

Intangibles

US$m

Tax lo sses

US$m

Share

incentive

plans

US$m

Accelerated

depreciation

US$m

Other

US$m

Total

US$m

At 1 April 2015 390 139 34 20 190 773

Differences on exchange (39) (1) – – (4) (44)

Tax recognised in the Group income statement

– Continuing operations (18) (47) (6) (6) 18 (59)

– Discontinued operations – – – – 8 8

Tax recognised within other

comprehensive income – – – – 6 6

Tax recognised directly in equity

on transactions with owners – – (3) – – (3)

Disposal of subsidiaries (3) – – – (2) (5)

Transfers (1) – – – 13 12

At 31 March 2016 329 91 25 14 229 688

Assets

Intangibles

US$m

Tax losses

US$m

Share

incentive

plans

US$m

Accelerated

depreciation

US$m

Other

US$m

Total

US$m

At 1 April 2014 559 227 37 27 155 1,005

Differences on exchange (157) (3) – (4) (12) (176)

Tax recognised in the Group income statement

– continuing operations (16) (63) (12) (3) 53 (41)

Business combinations – – 14 – – 14

Tax recognised within other

comprehensive income – – – – 3 3

Tax recognised directly in equity

on transactions with owners – – (5) – – (5)

Transfers 4 (22) – – (9) (27)

At 31 March 2015 390 139 34 20 190 773

Liabilities

Intangibles

US$m

Accelerated

depreciation

US$m

Other

US$m

Total

US$m

At 1 April 2015 842 28 24 894

Differences on exchange (29) – 2 (27)

Tax recognised in the Group income statement – continuing operations 16 (7) (7) 2

Transfers (1) –13 12

At 31 March 2016 828 21 32 881

Liabilities

Intangibles

US$m

Accelerated

depreciation

US$m

Other

US$m

Total

US$m

At 1 April 2014 894 38 25 957

Differences on exchange (112) – (3) (115)

Tax recognised in the Group income statement – continuing operations 60 (10) – 50

Business combinations 5 – – 5

Transfers (5) – 2 (3)

At 31 March 2015 842 28 24 894

These movements do not take into consideration the offsetting of assets and liabilities within the same tax jurisdiction. Items

classified as Other assets in the above analyses predominantly relate to future tax benefits deferred in line with local tax laws.