Experian 2016 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

174

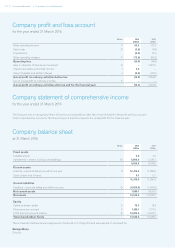

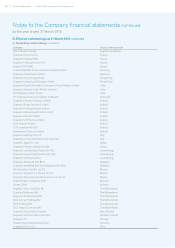

Notes to the Company financial statements continued

for the year ended 31 March 2016

Financial statements •Notes to the Company nancial statements

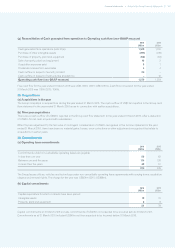

E. Critical accounting estimates, assumptions and judgments

(i) Critical accounting estimates and assumptions

In preparing the financial statements, management is required to make estimates and assumptions that affect the reported amount

of income, costs and charges, assets and liabilities and the disclosure of contingent liabilities. The resulting accounting estimates,

which are based on management’s best judgment at the date of the financial statements, will, by definition, seldom equal the related

actual results.

The most significant of these estimates and assumptions for the Company that has a signicant risk of causing a material

adjustment to the carrying amounts of assets and liabilities within the next nancial year is in respect of the carrying value of

investments in subsidiary undertakings.

(ii) Critical judgments

In applying the Company’s accounting policies, management may make judgments that have a significant effect on the amounts

recognised in the Company financial statements. These judgments may include the classification of transactions between the

Company income statement and the Company balance sheet.

The most significant of these judgments for the Company is in respect of contingencies where, in the case of pending and

threatened litigation claims, management has formed a judgment as to the likelihood of ultimate liability. No liability has been

recognised where the likelihood of any loss arising is possible rather than probable.

F. Other operating income and charges

Other operating income and charges principally comprise charges to and from other Group undertakings in respect of Group

management services provided during the year. Other operating charges include a fee of US$0.4m (2015: US$0.4m) payable to the

Company’s auditor and its associates for the audit of the Group financial statements.

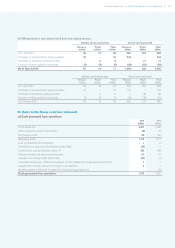

G. Staff costs

2016

US$m

2015

US$m

Directors’ fees 2.4 2.7

Wages and salaries 1.0 1.0

Social security costs 0.1 0.1

Other pension costs 0.1 0.1

3.6 3.9

Executive directors of the Company are employed by other Group undertakings and details of their remuneration, together with

that of the non-executive directors, are given in the audited part of the Report on directors’ remuneration. The Company had two

employees throughout both years.

H. Gain on disposal of fixed asset investment

During the year ended 31 March 2015, a gain of US$7,967.9m arose on the disposal of the Company’s holding in the ordinary shares

of Experian Investments Holdings Limited to a fellow subsidiary undertaking, in connection with a Group reorganisation (see note M).

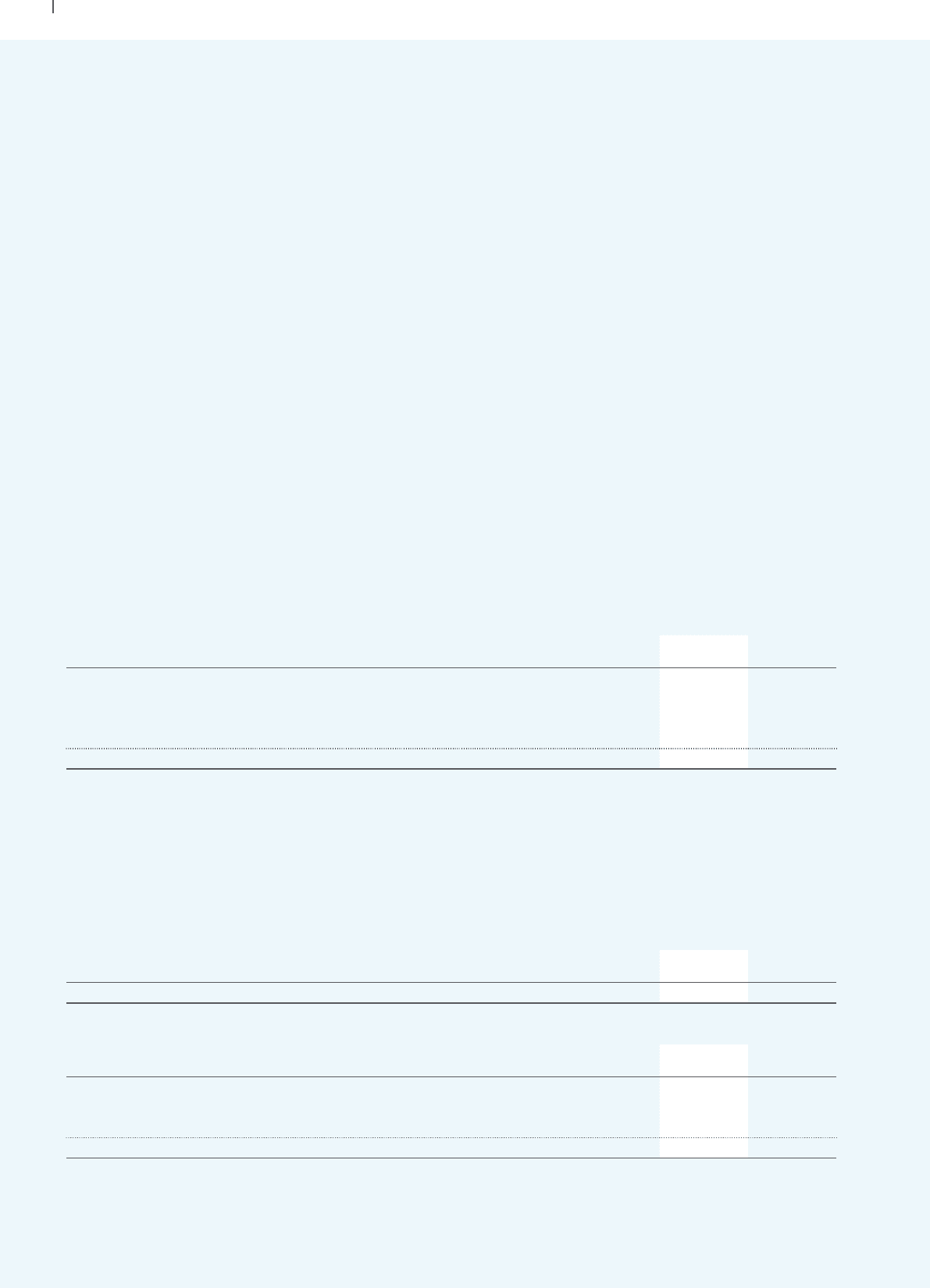

I. Interest receivable and similar income

2016

US$m

2015

US$m

Gain in connection with commitments to purchase own shares 2.5 –

J. Interest payable and similar charges

2016

US$m

2015

US$m

Interest on amounts owed to Group undertakings –0.3

Foreign exchange losses 0.5 43.2

Loss in connection with commitments to purchase own shares 0.3 –

0.8 43.5