Experian 2016 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2016 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

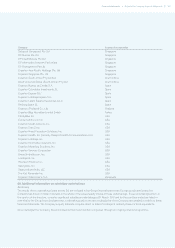

172 Financial statements •Notes to the Company nancial statements

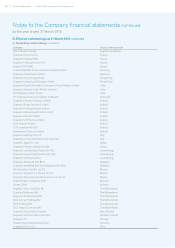

Notes to the Company financial statements

for the year ended 31 March 2016

A. Corporate information

Corporate information for Experian plc (the ‘Company’) is set out in note 1 to the Group financial statements, with further

information given in the Strategic report and the Corporate governance report.

B. Basis of preparation

The separate financial statements of the Company are presented voluntarily and are:

• prepared on a going concern basis under the historical cost convention and in accordance with UK accounting standards;

• presented in US dollars, the Company’s functional currency; and

• designed to include disclosures in line with those required by those parts of the UK Companies Act 2006 applicable to companies

reporting under UK accounting standards even though the Company is incorporated and registered in Jersey.

The Company’s previous financial statements were prepared in accordance with applicable UK accounting standards. Following

the requirements of Financial Reporting Standard (‘FRS’) 100 ‘Application of financial reporting requirements’ coming into effect,

the directors have opted to prepare these financial statements in accordance with FRS 101 ‘Reduced disclosure framework’.

That intention was communicated to the Company’s shareholders in June 2015. FRS 101 will also be used where appropriate by

the Company’s subsidiary undertakings. This will simplify external reporting requirements for the Company and its subsidiary

undertakings in the UK and Ireland.

FRS 101 allows certain exemptions from the requirements of International Financial Reporting Standards (‘IFRS’) to avoid the

duplication of information provided in the Group financial statements and to provide more concise financial reporting in entity

financial statements. The following exemptions have therefore been applied in the preparation of these financial statements:

• Paragraphs 45(b) and 46 to 52 of IFRS 2 ‘Share-based payment’, so exempting the Company from providing details of share

options and of how the fair value of services received was determined.

• IFRS 7 ‘Financial instruments: disclosures’.

• Paragraphs 91 to 99 of IFRS 13 ‘Fair value measurement’, so exempting the Company from disclosing valuation techniques and

inputs used for the measurement of assets and liabilities.

• Paragraph 38 of IAS 1 ‘Presentation of financial statements’, so exempting the Company from disclosing comparative information

required by:

– paragraph 79(a)(iv) of IAS 1 – shares outstanding at the beginning and at the end of that period; and

– paragraph 73(e) of IAS 16 ‘Property, plant and equipment’ – reconciliations between the carrying amount at the beginning and

end of that period.

• The following paragraphs of IAS 1:

– paragraphs 10(d) and 111, so exempting the Company from providing a cash flow statement and information;

– paragraph 16, so exempting the Company from providing a statement of compliance with all IFRS;

– paragraph 38A, so exempting the Company from the requirement for a minimum of two of each primary statement and the

related notes;

– paragraphs 38B to D, so exempting the Company from the requirement to provide additional comparative information;

– paragraphs 40A to D, so exempting the Company from the requirement to provide a third statement of financial position; and

– paragraphs 134 to 136, so exempting the Company from presenting capital management disclosures.

• IAS 7 ‘Statement of cash flows’.

• Paragraphs 30 and 31 of IAS 8 ‘Accounting policies, changes in accounting estimates and errors’, so exempting the Company

from disclosing information where it has not applied a new IFRS which has been issued but is not yet effective.

• Paragraph 17 of IAS 24 ‘Related party disclosures’, so exempting the Company from disclosing details of key management

compensation; and

• the requirements in IAS 24 ‘Related party disclosures’ to disclose related party transactions with wholly-owned members of

the Group.

The use of critical accounting estimates and management judgment is required in applying the accounting policies. Areas

involving a higher degree of judgment or complexity, or where assumptions and estimates are significant to the Company financial

statements, are highlighted in note E.