United Airlines 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

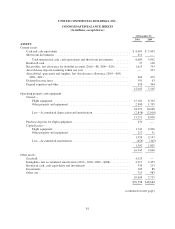

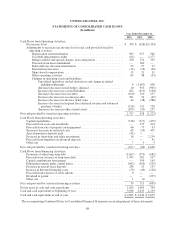

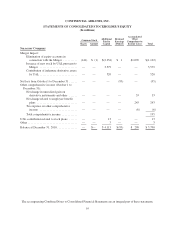

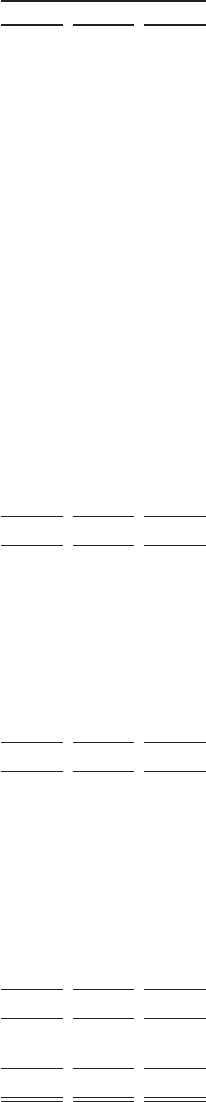

UNITED AIR LINES, INC.

STATEMENTS OF CONSOLIDATED CASH FLOWS

(In millions)

Year Ended December 31,

2010 2009 2008

Cash Flows from Operating Activities:

Net income (loss) ................................................... $ 399 $ (628) $(5,354)

Adjustments to reconcile net income (loss) to net cash provided (used) by

operating activities -

Depreciation and amortization ..................................... 903 917 946

Goodwill impairment (credit) ..................................... (64) — 2,277

Merger-related and special charges, non-cash portion ................... 230 374 339

Proceeds from lease amendment ................................... — 160 —

Debt and lease discount amortization ............................... 93 97 97

Deferred income taxes ........................................... (12) (16) (26)

Share-based compensation ........................................ 13 21 31

Other operating activities ......................................... 83 48 (53)

Changes in operating assets and liabilities -

Unrealized (gain)/loss on fuel derivatives and change in related

pending settlements ....................................... 4 (1,007) 858

(Increase) decrease in fuel hedge collateral ....................... 10 955 (965)

Increase (decrease) in accrued liabilities ......................... 262 (213) (128)

(Increase) decrease in receivables .............................. (160) 110 197

Increase (decrease) in accounts payable ......................... 221 94 (49)

Increase (decrease) in advance ticket sales ....................... 44 (38) (388)

Increase (decrease) in frequent flyer deferred revenue and advanced

purchase of miles ......................................... (126) 123 738

(Increase) decrease in other current assets ........................ (103) (19) 257

Net cash provided by (used in) operating activities ............................. 1,797 978 (1,223)

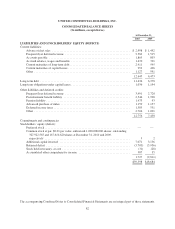

Cash Flows from Investing Activities:

Capital expenditures ................................................. (318) (317) (475)

Proceeds from asset sale-leasebacks .................................... — 175 274

Proceeds from sale of property and equipment ............................ 40 77 93

(Increase) decrease in restricted cash .................................... 68 (24) 455

Aircraft purchase deposits paid ........................................ (42) — —

Decrease in short-term and other investments ............................. 18 — 2,259

Proceeds from litigation on advanced deposits ............................ — — 41

Other, net .........................................................739

Net cash provided by (used in) investing activities ............................. (227) (86) 2,656

Cash Flows from Financing Activities:

Payments of other long-term debt ...................................... (1,667) (793) (682)

Proceeds from issuance of long-term debt ................................ 1,995 562 337

Capital contributions from parent ...................................... — 559 163

Principal payments under capital leases .................................. (482) (190) (235)

Decrease in aircraft lease deposits ...................................... 236 23 155

Increase in deferred financing costs ..................................... (33) (49) (120)

Proceeds from exercise of stock options ................................. 9 — —

Dividend to parent .................................................. — — (257)

Other, net ......................................................... 1 (1) —

Net cash provided by (used in) financing activities ............................. 59 111 (639)

Net increase in cash and cash equivalents .................................... 1,629 1,003 794

Cash and cash equivalents at beginning of year ................................ 3,036 2,033 1,239

Cash and cash equivalents at end of year ..................................... $4,665 $ 3,036 $ 2,033

The accompanying Combined Notes to Consolidated Financial Statements are an integral part of these statements.

88