United Airlines 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

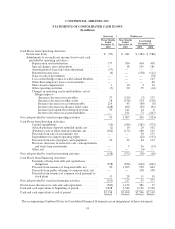

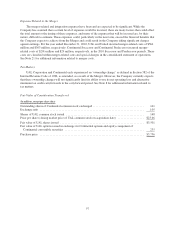

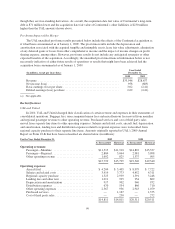

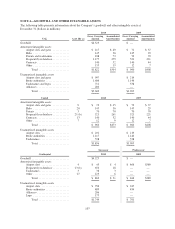

Allocation of Consideration Transferred

The Merger was accounted for using the acquisition method of accounting under applicable accounting

principles. The acquisition method of accounting requires, among other things, that assets acquired and liabilities

assumed be recognized on the balance sheet at their fair values as of the acquisition date. The table below

represents the allocation of the total consideration to Continental’s tangible and intangible assets and liabilities as

of October 1, 2010 based upon management’s estimate of their respective fair values. The goodwill resulting

from the Merger is primarily due to expected synergies to be gained from an enhanced route network and other

operating efficiencies. These acquisition accounting adjustments have also been pushed down to Continental for

its separate-entity financial reporting. None of the goodwill is deductible for tax purposes.

(In millions)

Cash and cash equivalents ............................................................ $3,698

Other current assets .................................................................. 1,811

Property and equipment .............................................................. 7,480

Goodwill .......................................................................... 4,523

Identified intangibles ................................................................ 2,594

Other noncurrent assets ............................................................... 237

Long-term debt and capital leases, including current portion ................................. (7,000)

Advance ticket sales ................................................................. (1,724)

Frequent flyer liability ............................................................... (1,978)

Pension and postretirement benefits ..................................................... (1,872)

Deferred income taxes ............................................................... (735)

Other liabilities ..................................................................... (3,298)

Total purchase price ............................................................. $3,736

The fair values of the assets acquired and liabilities assumed were determined using the market, income and

cost approaches. The fair value measurements were primarily based on significant inputs that are not observable

in the market other than for derivative financial instruments and certain long-term debt assumed in the Merger.

The market approach, which indicates value for a subject asset based on available market pricing for comparable

assets, was utilized to estimate the fair value of Continental’s aircraft and operating leases. The market approach

used by the Company included prices and other relevant information generated by market transactions involving

comparable assets, as well as pricing guides and other sources. The Company considered the current market for

the aircraft, the maintenance condition of the aircraft and the expected proceeds from the sale of the assets,

among other factors. The Company also utilized the market approach to value certain intangible assets such as

airport take-off and landing slots when sufficient market information was available. The income approach was

primarily used to value intangible assets, including the frequent flyer database, international route authorities,

alliances, the Continental logo and tradename, and certain airport take-off and landing slots. The income

approach indicates value for a subject asset based on the present value of cash flows projected to be generated by

the asset. Projected cash flows are discounted at a required market rate of return that reflects the relative risk of

achieving the cash flows and the time value of money. The cost approach, which estimates value by determining

the current cost of replacing an asset with another of equivalent economic utility, was used, as appropriate, for

certain assets for which the market and income approaches could not be applied due to the nature of the asset.

The cost to replace a given asset reflects the estimated reproduction or replacement cost for the asset, less an

allowance for loss in value due to depreciation. The fair value of Continental’s OnePass frequent flyer program

liability was determined based on the weighted average equivalent ticket value of outstanding miles which were

expected to be redeemed at October 1, 2010. The weighted average equivalent ticket value contemplates differing

classes of service, domestic and international itineraries and the carrier providing the award travel.

As more fully discussed in Note 14, and only for purposes of the Continental separate-entity reporting, the

embedded conversion options in Continental’s convertible debt are required to be separated and accounted for as

98