United Airlines 2010 Annual Report Download - page 55

Download and view the complete annual report

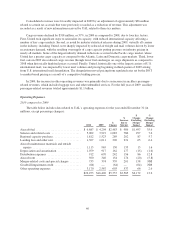

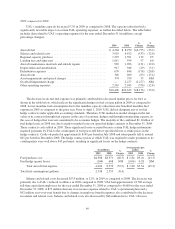

Please find page 55 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United had a net income of $399 million in 2010 as compared to a net loss of $628 million in 2009.

Excluding the impact of the Merger on UAL’s results of operations, United’s results of operations were

consistent with the UAL results discussed above. Prior to the Merger, United was UAL’s only significant

operating subsidiary. As compared to 2009, United’s consolidated revenue increased $3.3 billion, or 20%, to

$19.7 billion for the year ended December 31, 2010. This increase was primarily due to improved economic

conditions in 2010 which drove higher fares. As discussed above, in 2010, United increased consolidated

capacity only by approximately 1% due to the weak economic conditions in 2009 and 2008. United’s increase in

consolidated passenger volume was consistent with this increase in capacity.

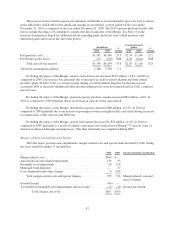

United’s operating expenses increased approximately $2.2 billion in 2010 as compared to 2009, which was

primarily due to the following:

• An increase of approximately $1.5 billion in aircraft fuel expense, which was primarily driven by

increased market prices for aircraft fuel, as highlighted in the fuel table in Operating Expenses—2010

compared to 2009, above;

• An increase of $293 million in salaries and related costs, which was primarily due to increased accruals

for profit sharing and other annual incentive plans. In 2010, United’s profit sharing expense was $165

million. Expense for the plan was not accrued in 2009 as the profit sharing and other incentive plan

payout expenses were not earned based on UAL’s adjusted pre-tax losses;

• An $86 million, or 13%, increase in distribution expenses due to increased passenger volumes and

higher ticket fares;

• A $158 million increase in merger-related costs and special charges, primarily due to $363 million of

costs associated with the Merger and the integration of United and Continental, as discussed above. In

2009, United incurred significant special charges associated with its fleet reduction plan. See Note 21

to the financial statements in Item 8 for additional details regarding merger-related costs and special

charges; and

• Other operating expenses included a $65 million payment due to the revenue sharing obligations

related to the trans-Atlantic joint venture with Lufthansa and Air Canada.

United’s nonoperating expense increased $123 million, or 24%, in 2010 as compared to 2009, which was

primarily due to the increased cost of debt financing as a result of distressed capital markets during 2008 and

2009. United’s interest expense is consistent with UAL’s interest expense, excluding the Merger impact

discussed above, except for approximately $21 million of interest expense in 2010 from UAL’s $345 million of

6% Senior Convertible Notes due 2029 that were not issued by United.

53