United Airlines 2010 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2010 United Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

fails to maintain (1) a minimum level of unrestricted cash, cash equivalents and short-term investments, (2) a

minimum ratio of unrestricted cash, cash equivalents and short-term investments to current liabilities of 0.25 to

1.0 or (3) a minimum senior unsecured debt rating of at least Caa3 and CCC- from Moody’s and Standard &

Poor’s, respectively. If the minimum debt ratings are not maintained, Continental’s required reserve will be 30%

of relevant advance ticket sales. Additional reserve requirements are summarized in the table below.

If Continental’s unrestricted cash balance is at, or more than, $2.0 billion as of any calendar month-end

measurement date, its required reserve will remain at $25 million. However, if Continental’s unrestricted cash

balance is less than $2.0 billion or certain lower minimum cash amounts, its required reserve will increase to

stated percentages of relevant advance ticket sales that could be significant. Based on Continental’s

December 31, 2010 unrestricted cash balance, Continental was not required to provide cash collateral above the

current $25 million reserve balance.

Under the terms of Continental’s credit card processing agreement with American Express, if a covenant

trigger under the JPMorgan Chase processing agreement requires them to post additional collateral under that

agreement, they would be required to post additional collateral under the American Express processing

agreement. The amount of additional collateral required under the American Express processing agreement

would be based on a percentage of the value of unused tickets (for travel at a future date) purchased by customers

using the American Express card. The percentage for purposes of this calculation is the same as the percentage

applied under the JPMorgan Chase processing agreement, after taking into account certain other risk protection

maintained by American Express.

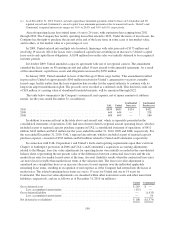

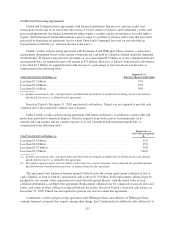

The following table summarizes required reserves if the minimum thresholds in Continental’s JPMorgan

Chase and American Express agreements are not maintained:

Unrestricted cash, cash equivalents, and short-term investments

balance

Minimum ratio of unrestricted cash, cash

equivalents and short-

term investments to current liabilities

Required% of

Relevant Advance

Ticket Sales

Less than $2.0 billion ............................. N/A 15%

Less than $1.75 billion ............................ N/A 25%

Less than $1.4 billion ............................. Less than 0.25 to 1.0 50% (a)

Less than $1.0 billion ............................. Less than 0.22 to 1.0 100% (a)

(a) Reserve percentage applies if either of the minimum thresholds is not maintained.

An increase in the future reserve requirements and the posting of a significant amount of cash collateral as

provided by the terms of any of the Company’s material credit card processing agreements could materially

reduce the Company’s liquidity.

Guarantees and Off-Balance Sheet Financing.

Fuel Consortia. The Company participates in numerous fuel consortia with other air carriers at major

airports to reduce the costs of fuel distribution and storage. Interline agreements govern the rights and

responsibilities of the consortia members and provide for the allocation of the overall costs to operate the

consortia based on usage. The consortium (and in limited cases, the participating carriers) have entered into long-

term agreements to lease certain airport fuel storage and distribution facilities that are typically financed through

tax-exempt bonds (either special facilities lease revenue bonds or general airport revenue bonds), issued by

various local municipalities. In general, each consortium lease agreement requires the consortium to make lease

payments in amounts sufficient to pay the maturing principal and interest payments on the bonds. As of

December 31, 2010, approximately $1.2 billion principal amount of such bonds were secured by significant fuel

facility leases in which UAL participates, as to which UAL and each of the signatory airlines has provided

indirect guarantees of the debt. As of December 31, 2010, UAL’s contingent exposure was approximately

$276 million principal amount of such bonds based on its recent consortia participation. As of December 31,

2010, United’s and Continental’s contingent exposure related to these bonds, based on its recent consortia

156